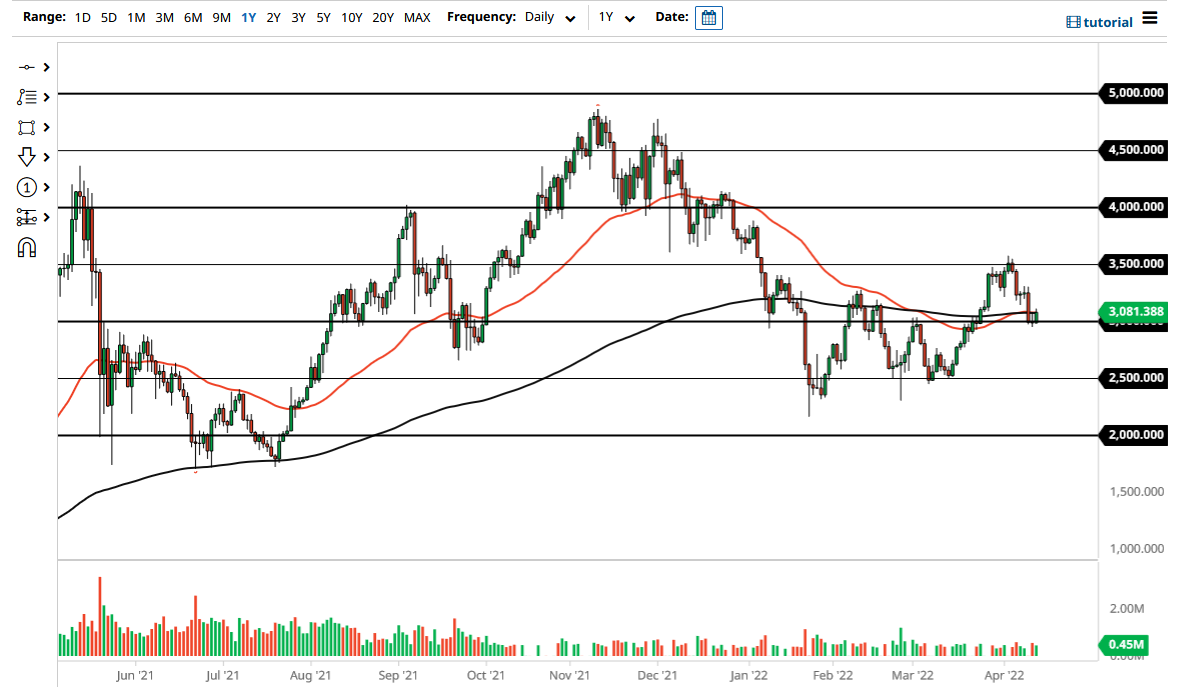

Ethereum bounced a bit from the $3000 level, as it continues to be important. At this point, the market may be able to break above the 50-day EMA, which would be the first sign of bullish pressure. At that point, the market would more likely than not go looking toward the $3250 level. That is an area where we had seen noise previously, so it does make sense that we would see that level as a target.

If the market were to break above there, then the next target would be the $3500 level, which had been a significant target and resistance barrier previously, so at this point I would anticipate that we would have a lot of pressure. If we were to break above the $3500 level, then it is likely that we go to the $4000 level. That being said, it would be a very strong move and would show real momentum and the likelihood of more of a “buy-and-hold” type of market.

On the other hand, if we were to break down below the candlestick from the Tuesday session, it is likely that Ethereum would go looking towards the $2750 level. That is an area where we have seen a little bit of noise previously, but it is a minor support level. Because of this, it would not surprise me at all to see the market break down through there and go looking to the $2500 level on a negative move like that. The $2500 level has been rather crucial multiple times in the past, so I do anticipate that there would be a lot of buyers there. Breaking down below that level could open up the concept of “crypto winter.”

Looking at this chart, it seems as if we are on the precipice of a bigger move, as we are at an inflection point. The moving averages sitting right here also suggests that we are at an area where we will have to make a bigger decision, and perhaps where we are looking at “fair value.” That being said, pay attention to the overall risk appetite of markets, because it will have a lot of influence on what happens with Ethereum and most other crypto markets in general. Ultimately, once we get an impulsive candlestick we should know which direction to go.