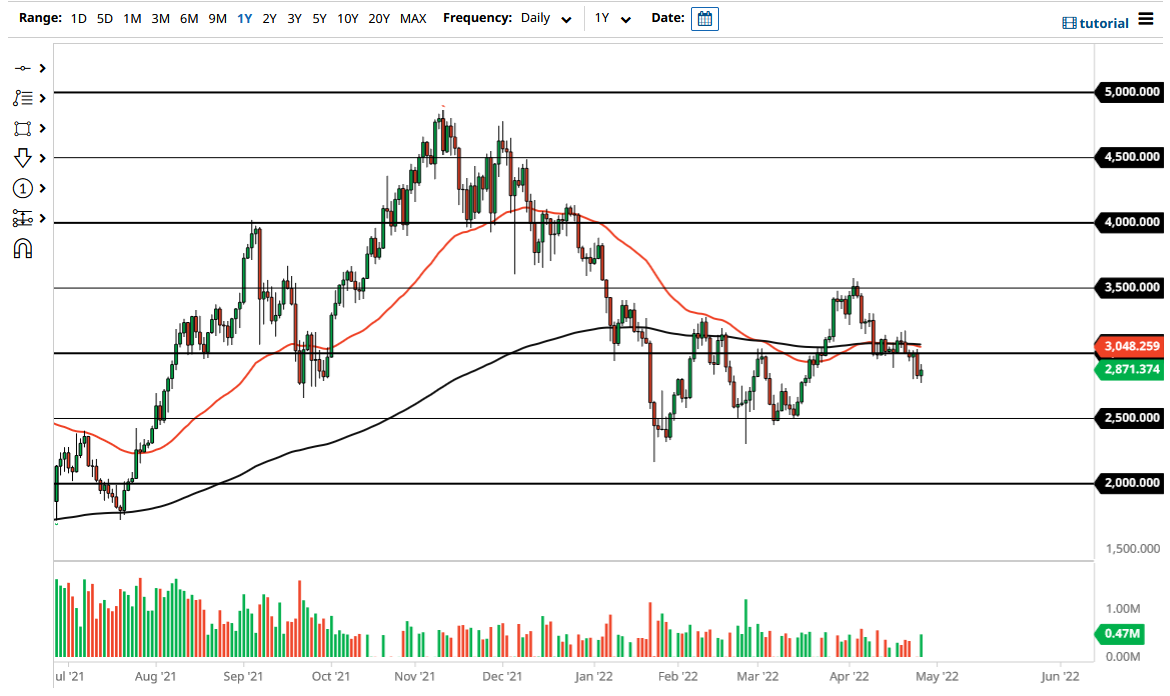

Ethereum went back and forth on Wednesday as we continue to hang around the $2800 level. At this point, it looks as if we are going to try to make a move back to the $3000 level, where we will then face a significant amount of “market memory” due to the fact that it has been both support and resistance multiple times in the past.

Just above the $3000 level is the fact that we have the 50-day EMA and the 200-day EMA hanging about and going sideways. This suggests that the market is trying to go flat, and we may be trying to set up to form some type of longer-term consolidation. That would make a certain amount of sense because there is not a lot of interest in the crypto markets at the moment.

If we break down below the bottom of the candlestick for the trading session on Wednesday, then Ethereum more likely than not will end up reaching the $2500 level underneath. We had recently formed a bit of a double bottom in that area, so it does make sense that it would continue to see a certain amount of support attached to it. Keep in mind that Ethereum is also struggling due to the fact that a lot of the improvements have struggled to be implemented, and as long as the market has to wait for the new and improved Ethereum, a lot of the narrative crumbles.

This does it necessarily mean that the market is going to fall apart, just that there is no real catalyst to get it moving to the upside. The other side of the currency pair is the USD, so you do need to understand that the US dollar has been like a wrecking ball against almost everything. If the US dollar continues to strengthen, then it makes sense that Ethereum could struggle a bit, due to the fact that you are comparing Ethereum to that very same US dollar.

All of this being said, it is probably worth noting that each low gets a little bit higher, but it has been more of a grind than anything else. A little bit more of an upward influence probably still remains, but it is nothing to get overly excited about.