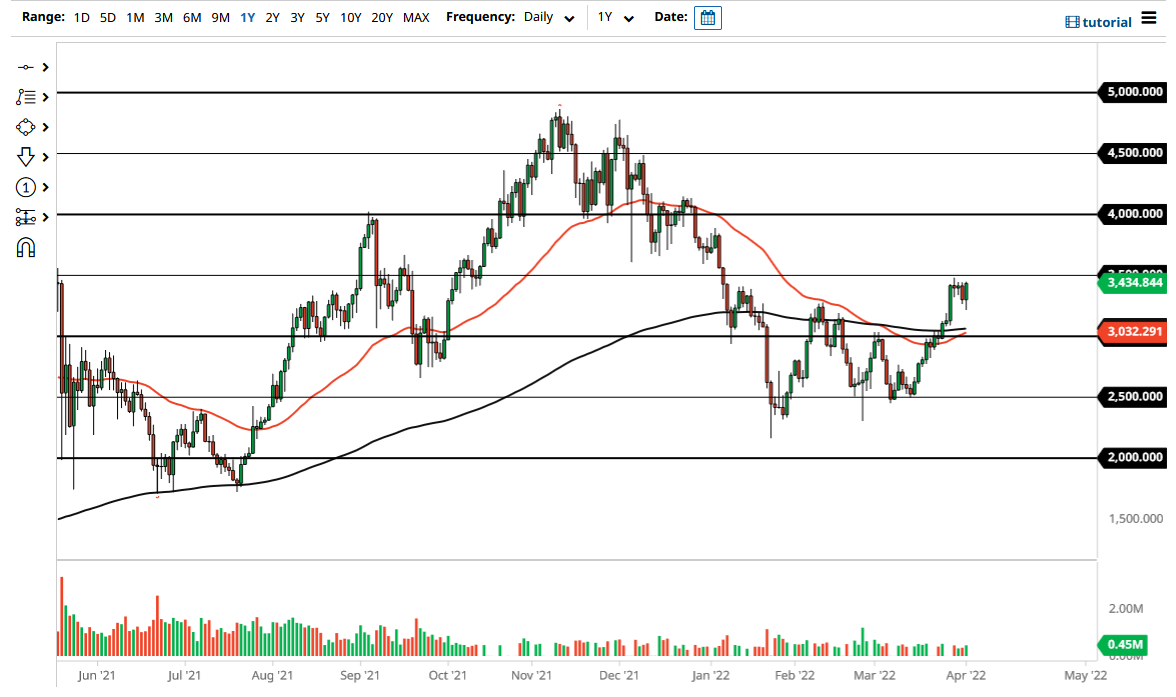

The Ethereum markets initially fell during the trading session on Friday but then turned around to gain for the session, closing near the $3440 region. This is an area that previously has been a bit of resistance for the market, so if we were to break above there and then perhaps even clear the $3500 level, then it is likely that we could go much higher.

Pullbacks at this point should continue to find plenty of buyers, extending all the way down to the $3200 level. We have found ourselves on the precipice of breaking out of a major “W pattern”, and that could send Ethereum much higher. In fact, the so-called “measured move” would be that we move to the $4500 level over the longer term. Keep in mind that the markets had gotten oversold, so the question is whether or not we can continue to see this type of momentum? I think not, but I do think that we will see more upward momentum.

Underneath, as long as we can stay above that $3000 level, the trend is still threatening to break out to the upside, but we should also watch the Bitcoin market because that is the first place money throws itself at when it comes to crypto. If we were to break down below that $3000 level, then I think you could probably lose another $500 rather quickly in this market. Keep in mind that Ethereum is one of the big winners over the longer term, as it is the base layer for many other protocols.

I believe at this point we are more likely than not going to continue to see plenty of buyers on every dip that occurs, as there has to be a certain amount of “FOMO” out there at the moment. The market has been rather steady over the last couple of weeks, as we have simply continued to grind higher, showing real strength in markets, despite the fact that we have not had a lot of massive momentum. That being said, it also shows that there is a lot of effort to go higher, meaning that there is a lot of conviction underlying the market. Keep an eye on Bitcoin, it will lead the way but Ethereum could lead the way for other markets.