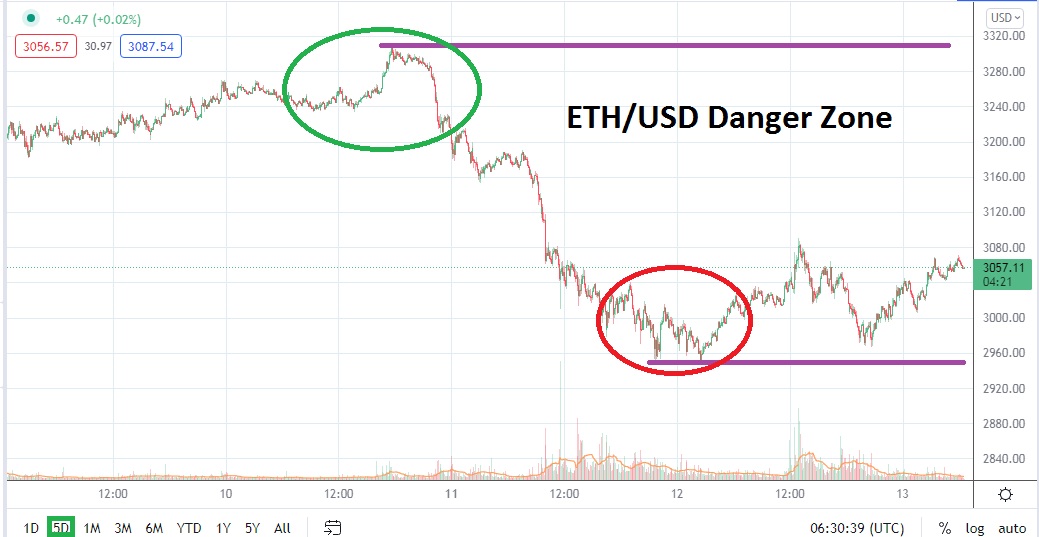

As of this writing, ETH/USD is trading near the 3060.00 level, the cryptocurrency has come off lows seen yesterday when Ethereum approached the 2945.00 price realm. Yesterday’s high of nearly 3086.00 was achieved after the lowest values were tested, but the reversal upwards then ran into stiff headwinds. ETH/USD is now within the grasp of a dangerous price range, and day traders will have to make wise decisions if they plan on wagering.

ETH/USD lows yesterday brought it within sight of values not seen since the 23rd of March. These values are still above the lows seen in the middle of March when ETH/USD traded near a value of 2500.00 before securing a strong bullish trend higher through the 2nd to the 5th of April, when ETH/USD traded above the 3500.00 juncture.

However, the current price of ETH/USD is floating pretty much between the lows seen around the 14th of March and the highs seen on 3rd of April. Traders now have to decide if the bullish demonstration achieved simply was a temporary phase and the long term bearish trend will resume in full force. Speculators can also take the view point that what has been experienced in the past week and half of trading has been profit taking and that ETH/USD will be able to climb higher again sooner rather than later.

The broad cryptocurrency market is displaying nervous sentiment. The downward momentum has not been able to produce a sudden reversal higher with a substantial kick. Perhaps that is a sign of a maturing marketplace, but it also may be a sign that traders who have been burned pursuing upside may not be willing to put their money on the line quite yet. If ETH/USD sustains its current price range in the near term, it may be a signal additional lows will be seen.

Conservative traders may want to wait for momentum to lead the way. By placing a sell order below the current market price, below perceived support levels, speculators may want to simply try and follow the trend towards yesterday’s lower value depths. If the 3035.00 to 3025.00 levels are challenged and made to look vulnerable, pursuing short term trades with a target near the 3000.00 mark may prove to be a worthwhile wager for bearish speculators.

Ethereum Short-Term Outlook

Current Resistance: 3082.00

Current Support: 3032.00

High Target: 3152.00

Low Target: 2925.00