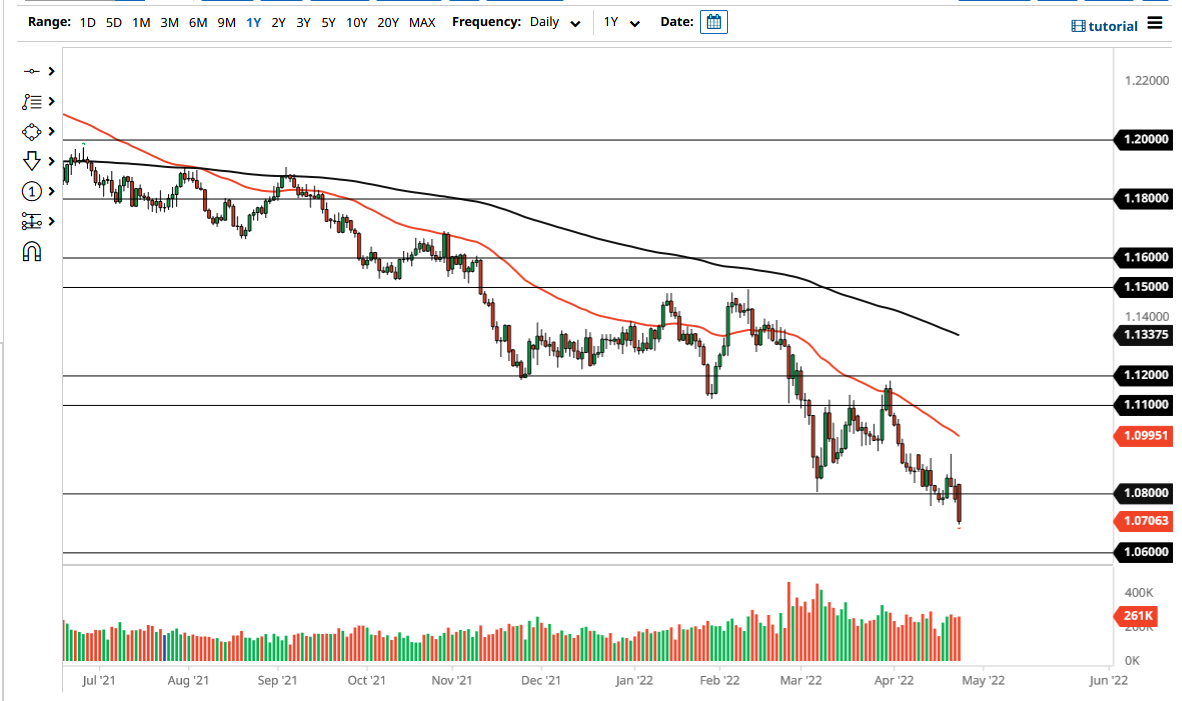

The euro finally broken through support on Monday as the 1.08 region has been very stubborn. By breaking down the way we have, it looks as if we are going to kick off further US dollar strength, not only here but in other markets as well. Looking at this chart, the 1.06 level underneath is more likely than not going to be the target, but I also suspect that the market could break down through there given enough time.

We are in an extraordinarily negative trend, which is something that people need to pay close attention to right away. The trend has been extremely strong, and even though this pair will more often than not grind sideways overall, we get the sudden moves lower that tell you which way we are still going. With “real rates” in the United States going positive, it is the only place to be at the moment. The US dollar is not only getting a boost due to rates being positive but the fact that some traders are simply looking for a bit of safety.

This safety play cannot be overlooked, because there are a lot of concerns out there when it comes to global growth, and a lot of traders will rush to the United States. Furthermore, we also have to pay close attention to the fact that the Federal Reserve seems very hawkish, which is the exact opposite of what you see when it comes to the European Central Bank. Although traders are starting to try to price in a couple of rate hikes for the ECB, they have priced in almost 14 rate hikes for the Federal Reserve. In other words, expectations for the United States will be much stronger than Europe.

As far as they will rally is concerned, the 1.08 level should be resistance, just as the 1.0933 level should be. That is an area where we had seen a lot of selling pressure previously, so I think both of these levels are areas that you need to pay close attention to when it comes to any rally that you are trying to jump on. I also recognize that this is a market that has been rather noisy and choppy as of late, but clearly a one-way situation for the foreseeable future.