The difference between success and failure in Forex / CFD trading is very likely to depend mostly upon which assets you choose to trade each week and in which direction, and not on the exact methods you might use to determine trade entries and exits.

So when starting the week, it is a good idea to look at the big picture of what is developing in the market as a whole, and how such developments and affected by macro fundamentals, technical factors, and market sentiment. Read on to get my weekly analysis below.

There are a few strong trends in the markets, and following them might help put the odds in your favor, so it is an interesting time to be trading.

Fundamental Analysis & Market Sentiment

I wrote in my previous piece last week that the best trade for the week was likely to be long of USD/JPY, the 10-Year US Treasury Yield, and Corn. This was a profitable call overall as the USD/JPY rose by 1.69%, the 10-Year US Treasury Yield rose by 1.50%, but Corn closed lower by 2.16%, giving an averaged win of 0.34%.

The news remains dominated by the Russian invasion of Ukraine which is now into its second month. Russian forces have withdrawn from the northern part of the company, switching focus to an offensive aimed at fully capturing the eastern and southern coastal regions of Ukraine. The war initially caused quite strong movements in some markets, especially in some agricultural commodities such as wheat and corn, but now seems to be having negligible effect except an overall negative impact upon Eurozone growth. This is hardly news, but analysts are beginning to judge the full impact more harshly, with the President of the European Central Bank speaking over recent days of a “triple hit” to the Eurozone economy. The Euro has certainly been weak lately but has been reluctant to fall to a new long-term low against the US Dollar. It remains quite likely that the war continues to weigh on stock markets and inflationary fears in a general way.

Stock markets fell almost everywhere over the week, with the biggest market index the S&P 500 looking especially bearish, as it closed the week with accelerating downwards momentum with the 1-year low in sight. Bearish sentiment has been boosted in the US by public comments from several FOMC members taking more hawkish views on rate hikes, although a “shock and awe” hike of 0.75% seems to be off the table. This has kept US treasury yields relatively high, with both the 2-year and 10-year yields ending the week higher at new 3-year highs.

Last week saw strong movements in the British Pound and the Japanese Yen, with the depreciation of the latter having been underway for several weeks. The Governor of the Bank of Japan has insisted that the Bank must maintain its policy of aggressive monetary easing even as the Yen continues to depreciate.

The British Pound has been looking heavy in most of its technical charts lately, with the key GBP/USD currency pair finding flagging support repeatedly at the big round number and psychological level of $1.3000, but this level finally broke down towards the end of last week, producing a strong, high volatility drop as low as $1.2832. This breakdown had been waiting to happen, but its final trigger was likely deteriorating sentiment on inflation at the Bank of England and poor retail sales data in the UK, rather than strength in the Dollar. The Dollar did end the week up nearly everywhere, and the US Dollar Index closed at a long-term high price.

Markets are continuing to pay a lot of attention to inflation data and pace at which central banks are tightening monetary policy to fight the rising inflation. This past week saw Canadian CPI (inflation) data came in considerably higher than anticipated, at a 31-year high annualized rate of 6.7%, compared to the 6.1% which had been expected. However, this was balanced by New Zealand CPI (inflation) data coming in lower than expected, at an annualized rate of 6.9%, which was still a 31-year high. There are some signs that the pace of inflationary increase is beginning to slow in some countries, giving some hope that headline rates will begin to decline soon. Some analysts speculate it is particularly important for US inflation to remain below 10% to avoid triggering a devastating inflationary spiral, with 10% likely to function as a key psychological level in this calculation.

Chinese GDP data released right at the start of last week was higher than had been expected, showing an annualized gain of 4.8%, compared to the 4.2% which had been forecast. This gave a small boost to stock markets right at the start of the week, but this effect quickly faded away.

There is increasing hope that as rates of coronavirus infection globally fall for yet another consecutive week, the pandemic may effectively be almost over. The strongest growths in new confirmed coronavirus cases overall right now are happening in Finland, Samoa, and Taiwan.

The Week Ahead: 25th – 29th April 2022

The coming week in the markets is likely to be less volatile as there are few data releases of high importance scheduled. They are, in order of likely importance:

French Presidential Election – the final opinion polls show Le Pen almost 10% behind Macron, so if Le Pen pulls off a shock upset, expect strong volatility in the Euro and in Eurozone stock markets, especially the French market. It should be noted Le Pen no longer supports a French withdrawal from the European Union, but a far-right party taking power in the heart of the EU would be a major political shock.

US Advance GDP data – this is the first hint of how US economic growth is faring and will be closely watched.

Bank of Japan Outlook Report – the report will certainly include thoughts on the Yen’s weakness and could trigger renewed bullish momentum, or a recovery.

Australia CPI (inflation)

Bank of Canada Governor testifies before Parliament

US Core PCE price Index

Technical Analysis

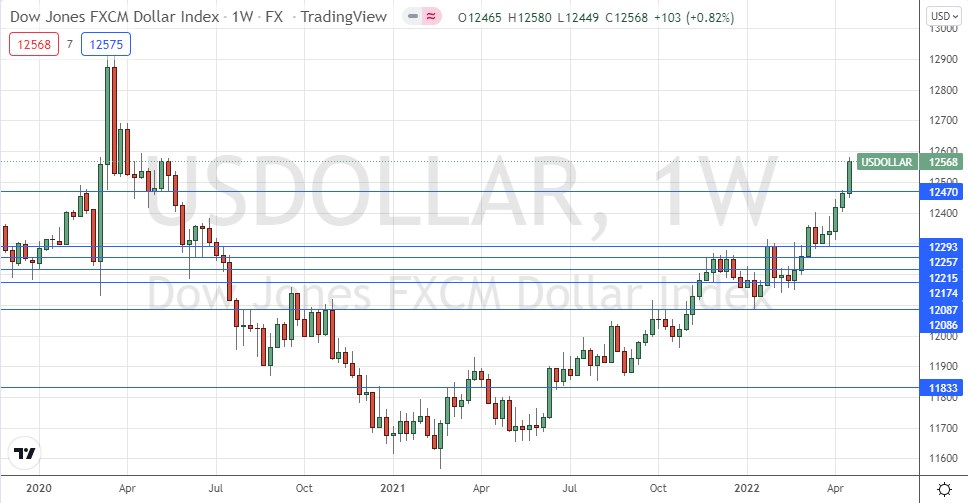

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar Index rose very strongly last week, in line with the long-term bullish trend, printing a bullish candlestick that closed well within the top quarter of its range. This was the highest weekly close seen since April 2020. The price made a breakout strongly above the former key resistance level at 12470, which will probably now become new support. Dollar bulls will be encouraged that the bullish momentum has continued, and the price has continued to advance to new highs. However, much of the Dollar’s gains over the week were made at the expense of weak currencies such as the British Pound, Japanese Yen, and Swiss Franc.

It will probably be wise to take trades in favor of the US Dollar in the Forex market over the coming week.

S&P 500 Index

The world’s most important stock market index, the S&P 500, fell again last week, closing well into correction territory, after rejecting the resistance level at 4596 which I have been noting over recent weeks. One the daily chart, the price is again trading below its 200-day and 50-day simple moving averages. These are bearish signs. However, downwards momentum is not yet strong enough to make any short trade here an interesting prospect, although the price is not far from 1-year lows which could set off a lot of selling if broken.

I see the US stock market as an uncertain trade right now due to signs of deteriorating consumer demand and a tightening monetary policy from the Federal Reserve, and certainly dangerous on the long side.

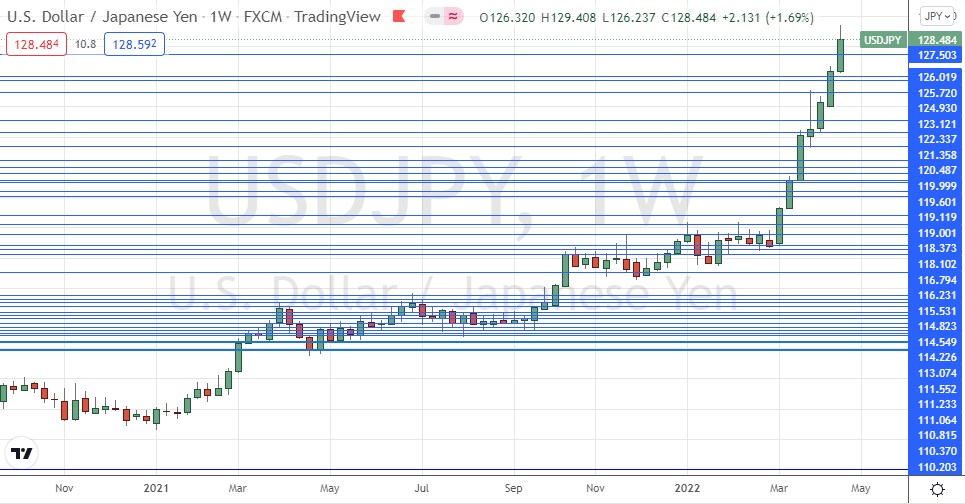

USD/JPY

The USD/JPY has risen like crazy over the past seven weeks, gaining each week. The past week saw the price rise again strongly, peaking at ¥129.41, which is the highest price seen in almost 20 years.

Despite that weekly picture, the end of the week saw bullish momentum dwindle away into a consolidation. The Bank of Japan continue to talk up their expansionary monetary policy despite the sharp recent decline in the relative value of the Yen. Although this logically points towards further upside over the near term, but the Bank of Japan has also expressed a view recently that ¥130.00 is as high as this currency pair should go.

As momentum has declined strongly, and as the price has already reached so close to ¥130.00, I do not want to be involved in this currency pair for the first time in several weeks.

10-YR US Treasury Yield

There has been much focus on US treasury yields lately, after the yield curve briefly inverted a few weeks ago, and as the Fed and other major central banks begin to take significant steps to tighten monetary policy.

The US Dollar is the strongest major currency right now, and this is partly because the yields on its treasury bills continue to reach new long-term highs not seen in 3 years.

Although the 10-year yield increased again last week, the weekly candlestick is almost a doji, which suggests the price is not likely to rise very strongly over the near term. The 2-year yield performed better than the 10-year, which is perhaps a good reason to be somewhat cautious about entering a new long trade in the 10-year, unless a new high is made. Trading the 2-year long might be a better approach.

GBP/USD

The British Pound fell sharply at the end of last week to reach a new 17-month low against the US Dollar. The Pound ended the week as clearly the weakest major currency, with even more selling momentum behind it than the Japanese Yen or the Swiss Franc (other weak currencies).

There were two immediate causes of the sharp bearish momentum, which saw the week finish with a down day more than twice the typical daily range: a long-term technical breakdown below a very key former support level at $1.3000, and bad economic data from the UK which suggest growth and consumer demand are both slowing. The IMF recently significantly downgraded its growth forecast for the UK, which had already been causing worries.

The price chart below shows not only the length of the decline, with the week’s fall the largest seen in many months, but also that the price closed the week right on its low, which is another bearish sign.

The price will be prone to suddenly snapping back with extremely high volatility, but it looks highly likely that we will see further lows in the price of this currency pair over this week.

Bottom Line

I see the best opportunities in the financial markets this week as likely to be long of USD/JPY or short of GBP/USD, but only in short-term swing or day trades. A better longer-term trade might be the 10-Year and 2-Year US treasury yields.