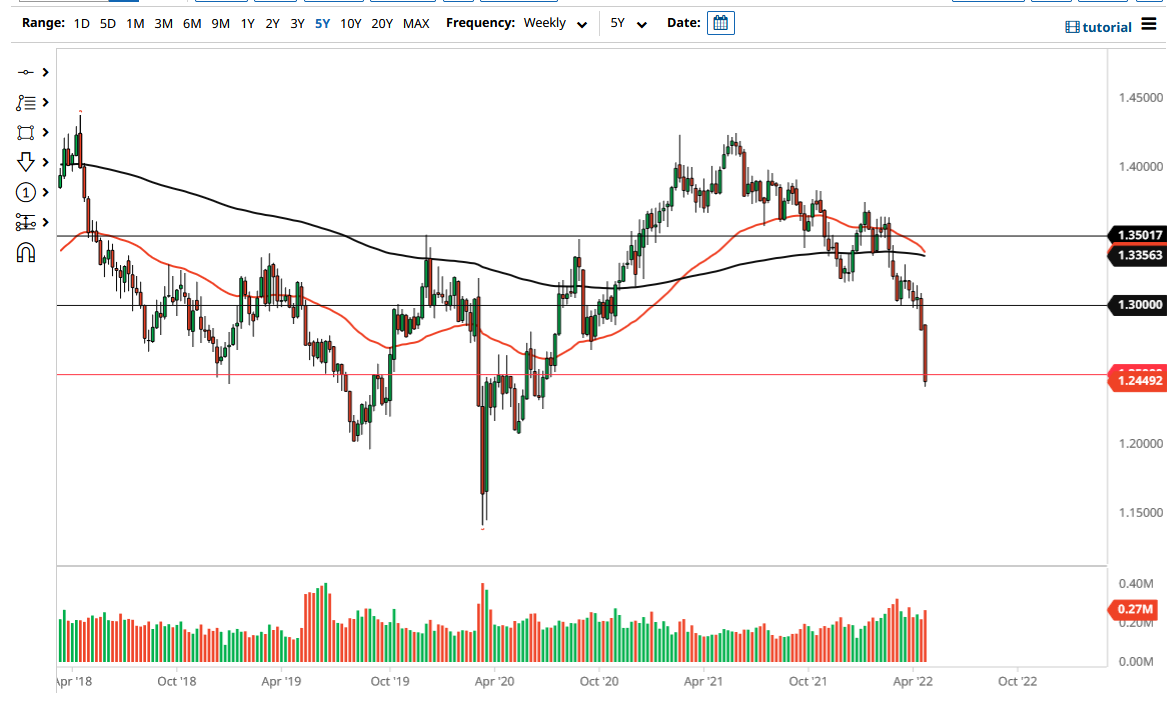

The British pound has had a very rough month for April, just as almost all currencies have. The only currency that seems to be doing very well is the US dollar. The Bank of England has announced that they are not willing to sell off the assets on its balance sheet, so this means that they are not quite as hawkish as the Federal Reserve. If that is going to be the case, then it makes a lot of sense that the British pound continues to fall.

The 1.25 level being pierced during the month of course is a very negative sign as well. That being said, there is a lot of noise just below and it is worth noting that the British pound is oversold. It is because of this that I think there will be a certain amount of support sooner or later, if for no other reason than we might have profit-taking. If we do get that profit-taking, then it is likely that we could see a rather significant bounce. That bounce is more likely than not going to offer a nice selling opportunity though, and therefore I will be waiting to see signs of exhaustion after that short-term rally.

The 1.30 level above should be significant resistance, as it had been significant support and resistance previously. Furthermore, there is a certain amount of psychological importance to this number, so it does come back into the picture as well. The British pound has to worry about what is going on with its energy market at home because Russia does supply the United Kingdom with quite a bit of natural gas. Furthermore, it appears that the global economies are going to be slowing down in general and that typically means that people will be looking to get US dollars.

Unless the Federal Reserve changes its overall attitude, I do not see a situation where we have the British pound taken off to the upside against the greenback. Yes, we may get the occasional rally, but I think that is all is going to be, short-term at best. The one outlier might be is if the Bank of England suddenly changes its attitude. With the inflation that we see in the United States, the Federal Reserve is looking very hawkish and probably will be for the rest of the year.