At the beginning of this week's trading, the price of an ounce of gold moved towards the resistance level of 1969 dollars, the highest for the gold market in nearly a month. The recovery of the US dollar returned the price of gold to stability around the level of 1950 dollars an ounce at the time of writing the analysis. The price of gold stabilized, as investors prepared for the critical US inflation report on Tuesday. In general, the price of the yellow metal has stabilized during the past month, while maintaining its gains since the start of the year 2022 to date, as they are.

Overall, the price of gold is retreating from weekly gains of about 0.8%, adding to its 2022 annual gains to date by about 7%.

In the same way, prices of silver, the sister commodity to gold, rose again above the $ 25 level in the beginning of this week's trading, although it rose as much as $ 25.60 in pre-market trading. The white metal enjoyed a 2% rise last week, bringing its year-to-date rally close to 8%. Despite the strong dollar and rising Treasury yields, investors are flocking to buy metallic commodities ahead of Tuesday's inflation report.

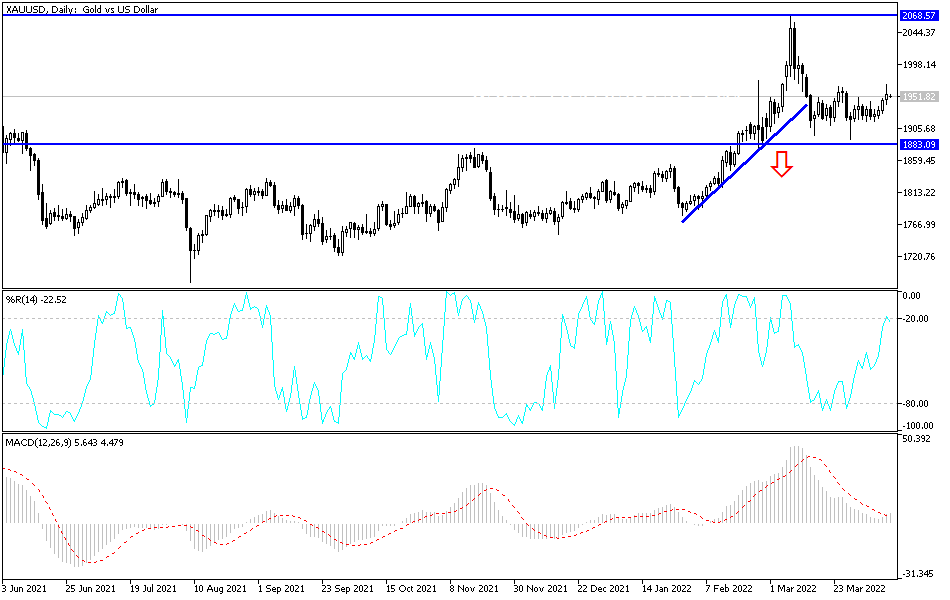

In this regard, economists expect the annual US inflation rate to reach 8.5% for the month of March, up from 7.9% in February. There are expectations that inflation may have peaked amid falling energy prices. At the moment, it is quite certain that the US Consumer Price Index (CPI) will cross 8% last month. However, market analysts stress that the technical situation is improving for gold prices, says Carlo Alberto de Casa, market analyst at Kinesis Money. “The new week started with the gold price jumping above the key resistance of $1,950 an ounce and trying to leave the sideways trading range between $1,890 and $1,950 for the past few sessions,” he wrote in a note.

The analyst added, “This positive move confirms the increasing bullish pressure already seen in the past few trading sessions, when the price of gold approached the $1.950 threshold without being able to stay above it at the end of the day. Therefore, this move can be read as an improvement in momentum and a clear breach of the $1,950 level could open the way for further recovery, confirming the upside.”

Meanwhile, the US Dollar Index (DXY), which measures the performance of the US currency against a basket of major currencies, rose to 99.94, from an opening at 99.80. Overall, the index rose 0.9% over the past week, bringing its rise in 2022 to above 4%. And over the past 12 months, the index has risen nearly 9%.

Overall, a strong profit is bad for dollar-denominated commodities because it makes them more expensive to buy for foreign investors.

US Treasury yields rose across the board, with the 10-year bond yield rising to 2.744%. One-year bond yields increased to 1.8%, while 30-year bond yields increased to 2.977%. Gold is usually sensitive to a high interest rate environment because it raises the opportunity cost of holding non-yielding bullion. As for other metals markets, copper futures fell to $4.6625 a pound. Platinum futures rose to $981.50 an ounce. Palladium futures rose to $2,469.50 an ounce.

According to gold technical analysis: Despite the trend of global central banks, led by the US Federal Reserve, towards raising interest rates to face record inflation around the world, which was caused by the pandemic and the Russian war. However, the gold market is receiving momentum from the last factor in maintaining a bullish outlook. As mentioned before, stability will remain above the resistance of 1900 dollars an ounce, motivating the bulls to stick to the performance currently, their closest targets are the resistance levels 1965 and 1980, then the historical psychological top of 2000 dollars an ounce.

On the downside, there won't be a turn in the general trend without breaking the $1880 support and I still prefer buying gold from every bearish level. Global geopolitical tensions and continuing fears of an epidemic are important factors for gold bulls.