Gold prices continued to rise, to continue its gains for the fifth consecutive session. The price of gold moved towards the resistance level of 1982 dollars an ounce, the highest for the yellow metal in a month. Gold gains came as concerns about inflation and the ongoing war in Ukraine continued to urge investors to search for a safe haven commodity. The weak US dollar and lower Treasury yields also supported the rise of gold. The yield on the US 10-year Treasury bonds fell from the highest closing level in three years, which was recorded on Monday. The US dollar index slipped to 99.83, losing nearly 0.5% from the previous close, after jumping as high as 100.52 in the Asian session.

On the economic side, data from the Labor Department said that the US producer price index for final demand rose 1.4% in March after advancing by an upwardly revised 0.9% in February. Economists had expected producer prices to jump 1.1%, compared to a 0.8% increase originally recorded from the previous month. Energy prices led the way up, jumping 5.7% during the month, while food prices also rose 2.4%.

With the larger-than-expected monthly increase, the annual rate of producer price growth accelerated to a record high of 11.2% in March from 10.3% in February.

Elsewhere, the Office for National Statistics said consumer price inflation in Britain rose to 7% in March from 6.2% in February. The rate was expected to rise to 6.7%. It was the highest annual inflation rate in the national statistics series, which began in January 1997. It was also the highest in the model historical series since March 1992, when it reached 7.1%.

Technology stocks led gains in the US stock market, with bond traders cutting aggressive bets on the Federal Reserve's rate hikes amid speculation that inflation may approach a peak. Investors also weighed the start of earnings season against geopolitical risks.

The S&P 500 halted its decline for three days, while the high-tech Nasdaq 100 outperformed. Another drop in two-year Treasury yields, which are more sensitive to impending monetary policy decisions - led to a decline this week to about 15 basis points. The Canadian dollar rose after the Bank of Canada raised its interest rate by half a percentage point in its largest increase in more than two decades. Oil traded above the $100 per barrel mark.

Bond yields fell even after the prices paid to US producers jumped by the most ever, topping all estimates. This contrasts with the recent consumer price report, which showed a deceleration in the pace of core inflation. For analysts, the large moves across the front-end of the Treasury market reflect diluted bets on the extent to which the Fed will tighten policy in the current business cycle.

Traders have also been keeping an eye on recent geopolitical developments, with President Joe Biden saying the United States will expand the size and range of weapons it provides to Ukraine in a new $800 million package of military aid. This includes heavy artillery systems and armored personnel carriers - indicating a more intense commitment than the country has already undertaken - along with additional artillery shells and helicopters.

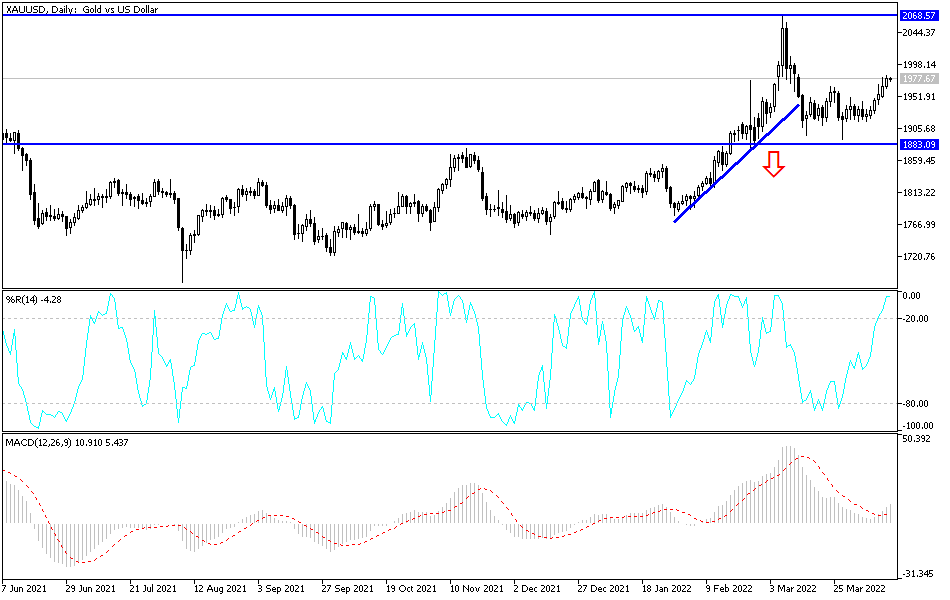

Technical expectations for the gold price: The bullish trend in the gold market is getting stronger, and the price of an ounce of gold crossed the 1975 dollar barrier. Expectations may increase again to move towards the next historical psychological resistance level of 2000 dollars an ounce at the earliest. This is especially if the gold market continues to ignore the trend of global central banks to further tighten their policy. Global geopolitical tensions and the persistence of the epidemic will remain the most important factors supporting the bulls' dominance.

On the other hand, according to the performance on the daily chart, the movement of the gold price towards the support level of 1920 dollars per ounce will be important to enable the bears and I still prefer buying gold from every descending level.