At the end of last week's trading, Gold futures fell below the level of 1950 dollars, with losses to the support level of 1927 dollars an ounce, before closing the week's trading, stable around the level of 1932 dollars an ounce. Accordingly, the price of the precious metal recorded a weekly loss on the back of the Fed's optimism. The yellow metal has managed to withstand a price rally environment amid rising inflation and geopolitical tensions. Gold prices recorded a weekly loss of about 2%, which reduces its rise since the start of the year 2022 to date to less than 6%.

As for the price of silver, the sister commodity to gold, it is trying to stay above the $24 level. Silver futures fell to $24.25 an ounce. Accordingly, the white metal is on track for a weekly decline of more than 6%, reducing its gains in 2022 to less than 4%.

In general, metal commodities are being hit hard by the strength of the US dollar and the rising Treasury yields.

The US Dollar Index (DXY), which measures the performance of the US currency against a basket of major currencies, rose to 101.26, from an opening at 100.62. The index may achieve weekly support by about 0.7%, which raises its rise since the beginning of the year 2022 to date to 5.5%. A stronger currency is usually bearish for dollar-denominated commodities because it makes them more expensive to purchase for foreign investors.

Also, the US Treasury market was mostly mixed with the close of trading last week, as the 10-year bond yield fell to 2.906%. One-year yields rose to 2.067%, while 30-year yields were unchanged at 2.933%. Gold is sensitive to an appreciation rate environment because it increases the opportunity cost of holding bullion that is not yielding.

Investors are flocking to these two primary safe-haven markets due to the hawkish tone issued by the Federal Reserve last week. Dozens of Fed officials, including US Federal Reserve Governor Jerome Powell, acknowledged that a 50 basis point rate hike is likely to occur at the Federal Open Market Committee (FOMC) meeting next month. In this regard, Powell said during an International Monetary Fund event: “It is appropriate in my opinion that we move a little faster.” And “I also think there is something in the idea of front loading.”

This made market analysts expect Treasuries to start rising in the coming months. In this regard, Tom Essay, founder of Sevens Report Research, wrote in a research note, “Bottom line, the Treasury market continues to play “catch-up” with expected hikes in interest rates, and now the market appears to have 150 basis points room to climb by the end of the July meeting, this flattens the curve further.”

In other metals markets, copper futures fell to $4.643 a pound. Platinum futures fell to $928.50 an ounce. Palladium futures fell to $2,394.50 an ounce.

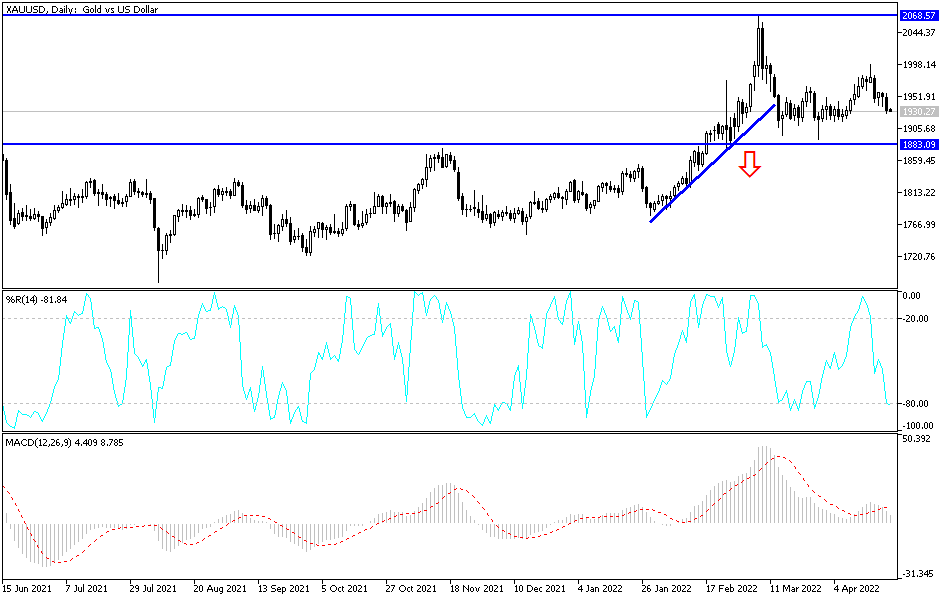

According to gold technical analysis: Despite the movements of the recent trading sessions, the price of gold did not break out of the range of its ascending channel as long as it is stable above the psychological resistance of 1900 dollars an ounce. The channel and trend will not be broken without moving towards the support level of $1880 an ounce. I still prefer buying gold from every bearish level, and the most appropriate buying levels are currently 1910 and 1880 dollars, respectively. Global geopolitical tensions led by the Russian war and the epidemic’s persistence in influencing the future of the global economy support the purchase of gold in the end, despite the determination of global central banks to raise interest rates.

On the other hand, breaking the resistance of 1965 dollars supports the bulls' dominance again to move towards the historical psychological top of 2000 dollars an ounce.