Despite the strength of the US dollar, gold markets stabilized after three weeks of decline, posting a rise of 0.36% despite the upcoming interest rate hike in the market. This week, the price of gold rose to the resistance level of 1945 dollars an ounce. This is before settling around the level of 1921 dollars an ounce at the time of writing the analysis, and before announcing the content of the minutes of the last meeting of the Federal Reserve. This is affecting the performance of the US dollar and therefore the gold market.

In general, gold prices rose as markets were increasingly affected by reactions to the increasingly volatile geopolitical events. While the current price is more than $100 below the peak recorded last month's rally - when prices climbed to $2,057 an ounce - it is well above last week's low of $1,907.

The recovery comes despite reports that US Federal Reserve Chairman Jerome Powell is ready to support a 50 basis point increase next month, raising interest rates to 0.75-1 percent from May 4. Inflation concerns maintain gold's appeal as a flight to a safe haven, with risk appetite declining among investors as the cost of living crisis deepens. There is a growing expectation of a recession later this year across advanced economies, in the wake of historic market volatility caused by the pandemic and Russia's invasion of Ukraine.

Craig Erlam, chief market analyst at OANDA, explained: “The only thing that came with these high-volume hikes is recession risks, as evidenced by the inversions we're seeing now on the yield curve in the US. The 2-10 reversal is now visible to everyone and was previously a fairly reliable recession indicator. While gold remains flat, he also noted that it has not made any real progress since last month's rally - describing it as a "completely volatile market" with "little evidence of direction".

Ole Hansen, commodities analyst at Saxo Bank, suggested a tension between gold's long-term appeal and short-term setbacks. This was reflected in the movements of the exchange-traded funds. “Over the past three weeks, momentum-driven short-term hedge funds cut their net length by 46,000 lots to a six-week low of 130,000 contracts,” he stated. With total holdings of bullion-backed ETFs up 2.9 million ounces or 29,000 lots over the same period, it highlights the current battle between short and long-term investment strategies. The latter is driven by concerns about the growth outlook, a prolonged period of inflation that has forced the Federal Reserve to take strong action and yet the risk of policy error.”

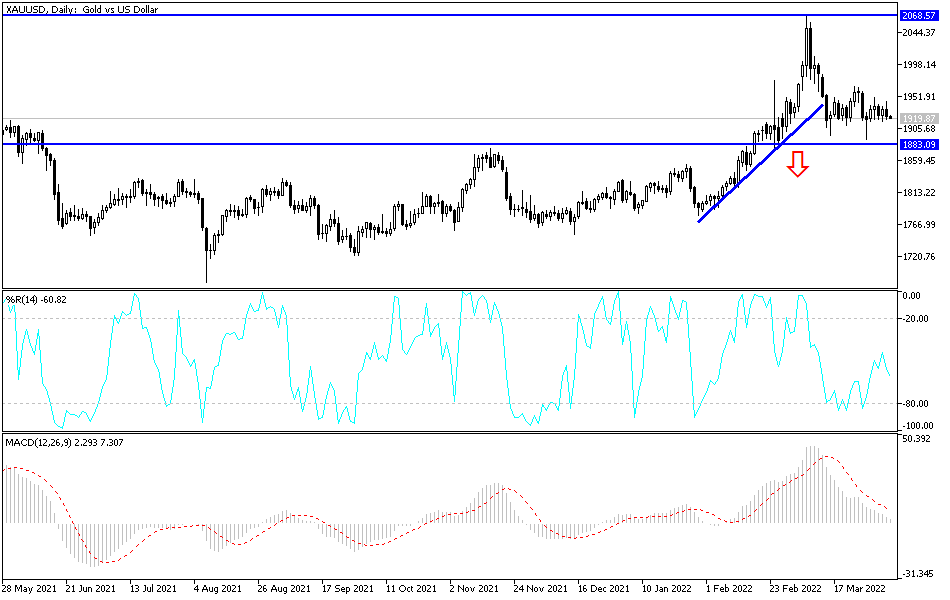

According to gold technical analysis: Despite the strength of the US dollar, the gold market still maintains the bullish trend. Global geopolitical tensions and the return of anxiety over the Corona epidemic will remain supportive factors for the gold market. According to the performance on the daily chart, stability will remain around and above the resistance 1900 dollars an ounce, supporting the bulls' continuous control of the trend. The bullish gold price, the closest to testing the resistance levels 1945 and 1970, and the last level is important for the expectations of the historical psychological peak of 2000 dollars for an ounce again.

On the downside I still see that the psychological support of $1880 an ounce is the most important for a turn down but so far, I still prefer buying gold from every bearish level. The US dollar and therefore the gold market will be affected by the announcement of the minutes of the last meeting of the US Federal Reserve later today.