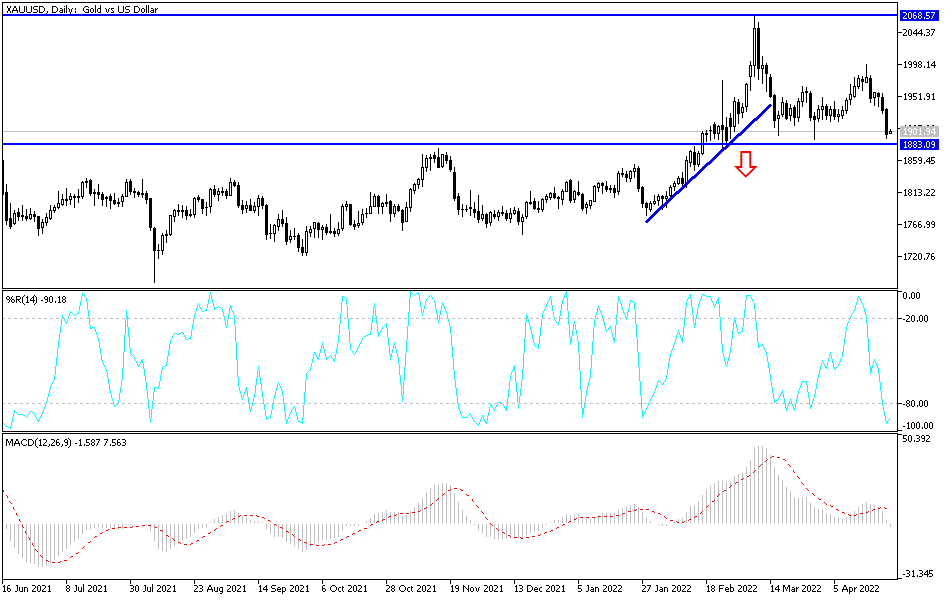

Strong gains for the US dollar from expectations of raising interest rates higher than previously expected contributed to the decline in the price of gold for six trading sessions in a row. The price broke down below the psychological resistance of $1900 with losses to the support level of $1892 before settling around the $1900 level at the time writing an analysis, waiting for anything new. The yellow metal is poised to end at a nine-week low as investors look for a haven in the US dollar. All in all, gold joined the sell-off in the broader commodity market as investor fears intensified over stagflation.

Gold prices are retreating from their weekly decline by about 2%, to reduce their rise since the start of the year 2022 to date to less than 4%.

As for the price of silver, the sister commodity to gold, it collapsed with the start of trading this week. Silver futures fell 2.65% to $23.615 an ounce. The white metal has erased almost all of its gains in 2022, down more than 9% over the past week.

US financial markets are bleeding red ink at the beginning of this week due to global economic growth concerns, monetary policy tightening, and China is suffering from an outbreak of COVID-19 infection. Investors pressed the sell button and fled to the US dollar. Gold usually thrives in this type of environment, but rising Treasury yields have discouraged investors from buying the precious metal.

The US Treasury market was red across the board, with the 10-year bond yield dropping to 2.779%. The one-year note fell to 1.996%, while the 30-year note fell to 2.872%. Gold is generally sensitive to a higher interest rate environment because it raises the opportunity cost of holding non-yielding bullion.

An important factor influencing the gold market. The dollar rose against the other major currencies, as the US Dollar Index (DXY), which measures the dollar's performance against a basket of major currencies, rose to 101.61, from an opening at 101.07. Overall, the index is up about 1% over the past week, bringing its gains in 2022 to nearly 6%. Over the past 12 months, the liability value has strengthened by about 12%. A strong dollar is a bearish trend for dollar-denominated commodities as it increases the cost of purchasing it for foreign investors.

All in all, financial markets are concerned about global growth prospects, especially if Beijing shuts down major economic centers in China. Moreover, this week, Q1 GDP is expected to come in at 1.1%, down from 6.9% in Q4. In other metals markets, copper futures fell to $4.431 a pound. Platinum futures fell to $905.80 an ounce. Palladium futures fell to $2,101.50 an ounce.

There is no doubt that the gold price’s breaking of the psychological resistance level of $1900 negatively affects the bullish outlook, but at the same time it is an opportunity to monitor new buying levels, the most appropriate of which will be $1880 and $1858. As I mentioned a lot before, the gold market has many factors of strength represented in the increase in global geopolitical tensions led by the Russian-Ukrainian war. In addition, Covid 19 remains a threat to the world, starting from China, as usual. This contrasts with the expected steps by global central banks to raise interest rates to face record sharp inflation waves.

The return of stability above the psychological resistance of $1900, giving the bullish trend a new opportunity. I still prefer buying gold from every bearish level. The gold price will be affected today by the level of the US dollar and the extent to which investors take risks or not, as well as the reaction to the announcement of the results of US economic data, durable goods orders, US consumer confidence and US new home sales.