For seven consecutive trading sessions, the price of gold has been sold off. It moved towards the support level of $1892, the lowest for the yellow metal in nearly a month, and settled around $1905. Gold is trying to avoid moving below the psychological level of $1900, as the selloffs do not increase. The recent sales were primarily due to the strength of the US dollar thanks to expectations of raising US interest rates strongly during the year 2022.

We still notice a divergence in the performance of global stock markets. US stock indices are pointing to lower openings when the New York daily session begins. Traders and investors are concerned early this week as China continues to shut down its major cities to prevent the spread of Covid. This leads many to believe that the Chinese economy, the second largest in the world, will suffer significantly this year, including more disruptions in the supply chain in Asia and around the world.

Coronavirus shutdowns are making China's economy sway as cases spread Xi puts ideology ahead of the economy as the market crashes and the global supply chain crisis erupts again as everything from Beijing begins Covid testing for most cities as the specter of lockdown looms on and on The Central Bank of China is trying to calm the markets with more support.

The Russo-Ukrainian War has also increased risk aversion in the market over the past several weeks. For his part, a senior Russian government official said today that the United States and Russia risk a nuclear war.

In general, inflation concerns remain at the forefront of global markets.

On the other hand, and amid the continuation of the Russian-Ukrainian war: The second largest gold producer in Russia, Polymetal, prefers to sell its gold abroad since Russian local banks started buying the yellow metal at a discount. In light of Western sanctions imposed on Russia after its invasion of Ukraine in February, Polymetal's options for selling its gold are limited. Bloomberg reports that the miner is targeting non-sanctioned banks, citing CEO Vitaly Nesis as saying during a call to investors on Monday.

However, those domestic banks buy the yellow metal at a discount compared to international rates. In the past, the local banks that Polymetal usually sold were state-run banks, including Sberbank PJS, VTB Bank PJSC and Bank Otkritie.

Because of the sanctions, the miner could no longer sell his gold to those institutions. And Bloomberg reported that the Russian Central Bank, which has restarted its official purchases of domestically produced gold, is not expected to buy as much as before. This is why the miner is looking to sell his gold internationally, despite the price discount described as small. "Our strategy is to sell as much as possible for export," said Neeses. Polymetal is listed on the London Stock Exchange, the Moscow Stock Exchange, and the Astana International Exchange in Kazakhstan.

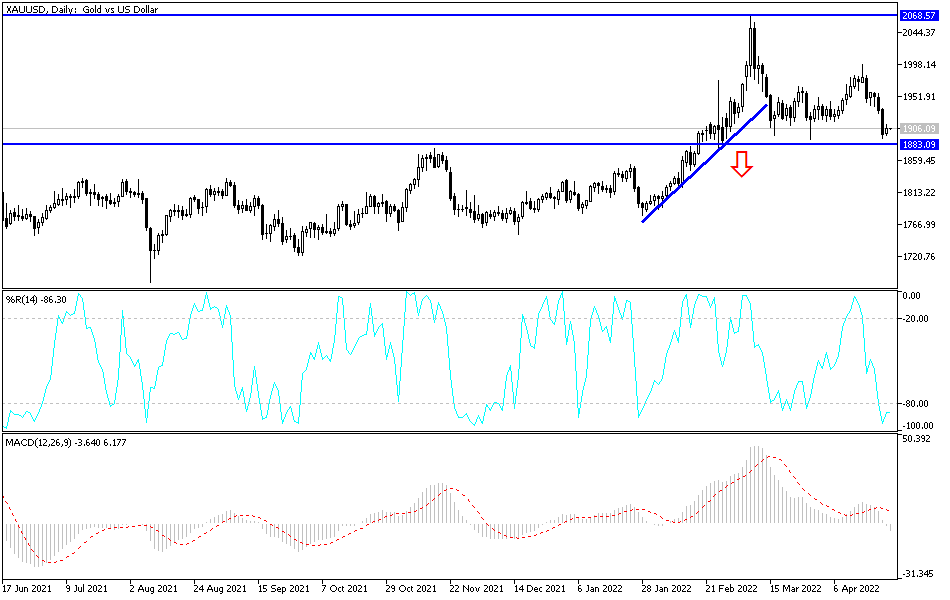

Sticking to the price of $1900 will continue to support the bulls to return to the upside. However, the gold futures bulls have lost their general slight technical advantage in the near term. Therefore, the next bullish price target for the bulls is to achieve a close in the futures contract above the strong resistance at $1950. The bears' next bearish price target in the near term is pushing futures prices below the strong technical support level at $1,850. We notice the first resistance at the recent high at $1,910.40, then at $1,925. The first support is seen at the low of $1896 and then the low of this week at $1891.

Despite the recent performance, the continuation of the Russian-Ukrainian war and its repercussions on the future of the global economic recovery, along with a new outbreak and restrictions to contain Covid-19, will remain factors supporting bulls to launch higher at any time. I still prefer buying gold from every bearish level and the closest buying targets are currently $1880 and $1862.