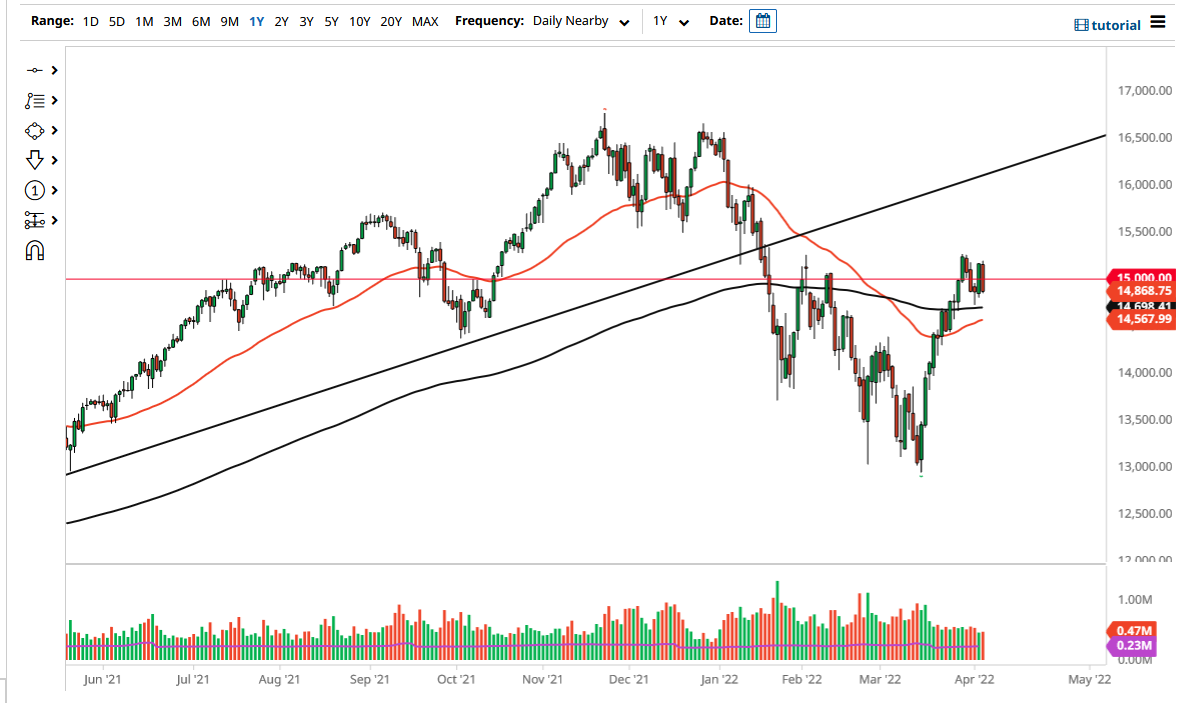

The NASDAQ 100 fell a bit on Tuesday to reach the bottom of the overall consolidation area. The 200-day EMA sits just below underneath the bottom of the hammer, and as a result, it is likely that the area could offer a significant amount of support. Ultimately, this is a market that is trying to figure out whether or not we are going to continue going higher, or if we are ready to pull back. Higher interest rates certainly will not help the overall attitude of the NASDAQ 100, so if we break down below that 200-day EMA, the market is likely to see a significant selloff. After all, the $15,000 level is an area that will attract a lot of attention.

If we were to break above the 15,250 level, it is possible that we could go higher, perhaps reaching the 15,500 level, maybe even the 16,000 level over the next several weeks. We certainly look as if we are trying to find out whether or not we are going to break above this area to confirm the bullish flag. On the other hand, if we were to break it down below here, it would show a complete rejection near the 50% Fibonacci retracement level, suggesting that we could make a run towards the bottom again over the longer term.

Keep in mind that stock markets, in general, continue to cause quite a few headaches, as the volatility has been somewhat out of control. At this point, we are trying to figure out whether or not the Federal Reserve is going to tighten drastically, because if they do it is likely that the stock markets around the world will continue to get sold off, especially these highflying technological stocks that make up the majority of the volume for the NASDAQ 100. Because of this, we are going to have to watch a handful of stocks even more significantly than most times. It certainly looks as if we are trying to form some type of reversal pattern, or perhaps even a topping pattern. Pay close attention to the rectangle we are forming it could give us a clue as to where we go next once we finally break out above it, especially if it is a long candlestick.