The NASDAQ 100 has had a very rough month in April, as traders are starting to focus on the fact that the Federal Reserve is not willing to step in and save Wall Street on every dip now. Inflation continues to be a major concern, and therefore the month of May might be a rather difficult trading. At the very least, I anticipate seeing a lot of volatility, and do not expect to see that go away anytime soon. In this scenario, I believe that we are going to continue to struggle for clarity.

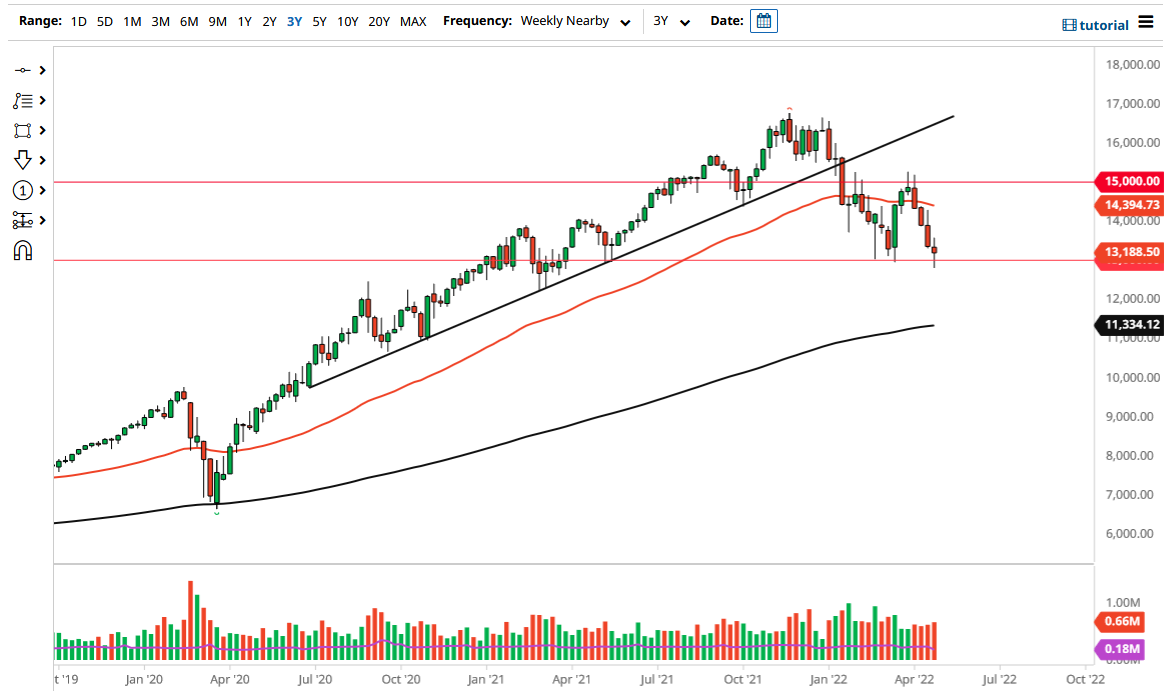

If we break down below the 12,500 level, then it is likely that the NASDAQ 100 will go looking to the 12,000 area underneath. The 200 Week EMA sits at the 11,334 level and is climbing, so that could also be a potential target for short-sellers. I would also anticipate that there might be a certain amount of buying pressure in that general vicinity as well unless of course, we get a complete meltdown.

The more bullish scenario that I see is that economic numbers continue to slump as the GDP number has in the United States, suggesting that perhaps the Federal Reserve will be able to tighten as much as once thought. I do not think that is going to happen, because quite frankly the most important figure will be inflation. As long as inflation numbers are hot, the Federal Reserve is going to tighten and therefore dampen profits in the stock market.

If we get some sign of a shift in attitude, that might be enough to get the market bullish, at least to reach the 15,000 level above. In the bullish scenario for the month, I suspect that we continue to trade in the overall consolidation area that I see at the moment. This is probably the best-case scenario unless, of course, the Federal Reserve comes out and completely changes its attitude. That seems to be very unlikely at this point, so keep that in the back of your mind. Ultimately, I do think that the Federal Reserve is serious about driving down asset prices, and the most obvious place that they would do so would be the stock market. Keep in mind that a lot of these high-flying technology stocks desperately need low-interest rates to continue rising the way they had over the last several years.