The S&P 500 has rallied just a bit during the trading session on Friday to show signs of life again, but we still have to worry about a significant amount of resistance above based on short-term charts. The market has been very strong for a while, so the recent pullback in the hammer that formed on Friday makes a certain amount of sense.

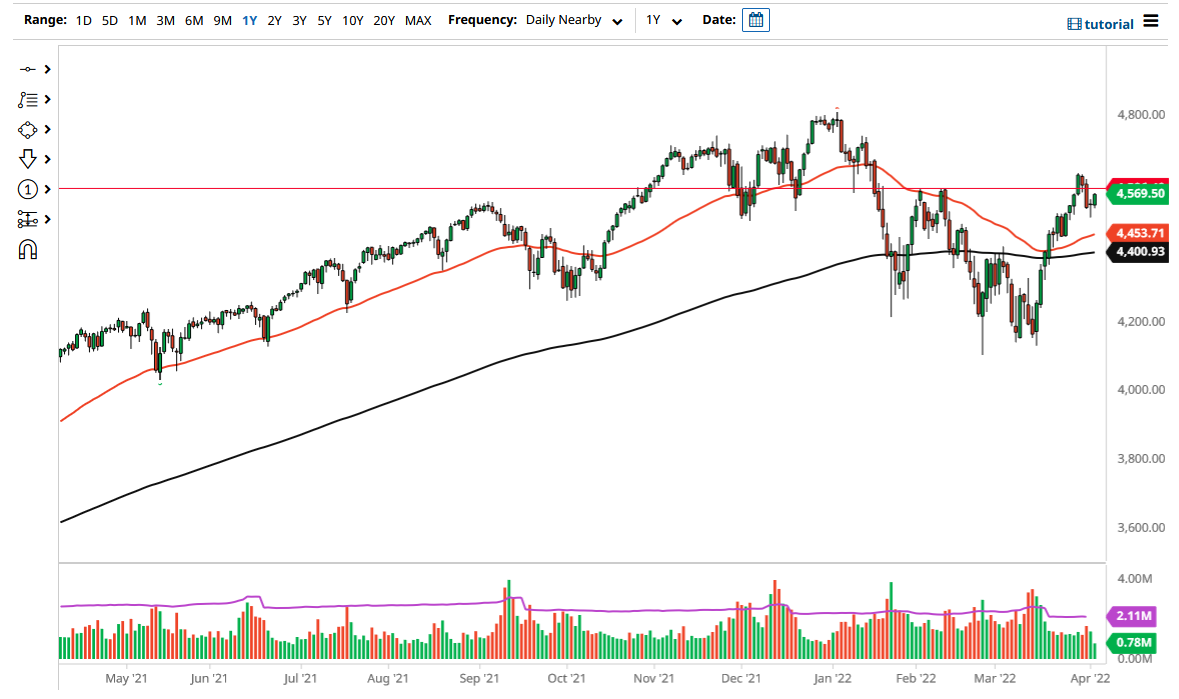

The hammer that formed during the Friday session being broken to the downside could send this market much lower, perhaps down to the 50 Day EMA. The 50 Day EMA sits at the 4453 level, so I would anticipate that area to be dynamic support, and therefore I would anticipate a lot of interest in that general vicinity. Underneath there, we have the 200 Day EMA sitting at the 4400 level, which is the bottom of the move to the upside. As long as we can stay above that area, then it is likely that we could continue to see a lot of interest.

If we were to break down below the 4400 level, then the market could go down to the 4200 level. The 4200 level has been a massive support and therefore if we were to break down below that level it would be a collapse of the overall uptrend. The market has been strong enough that it looks like we are going to try to get to the upside. It has moved beyond anything economic-related, and now it looks as if the only question will be whether or not the Federal Reserve will continue to look liquefy the markets or if they will finally try to fight inflation. If they do try to fight inflation, that will be bad for the stock market because of the rising rates. They do not have a long history of helping the people, but they do have a long history of helping Wall Street.

As things stand right now, breaking to a fresh, new high almost guarantees that we go looking towards the 4800 level based upon the momentum. We are forming a little bit of a bullish flag, so that also suggests that we could go higher as well. I have no interest in shorting this market until we can break down below the 200 Day EMA, so at this point it is a “buy on the dips” scenario.