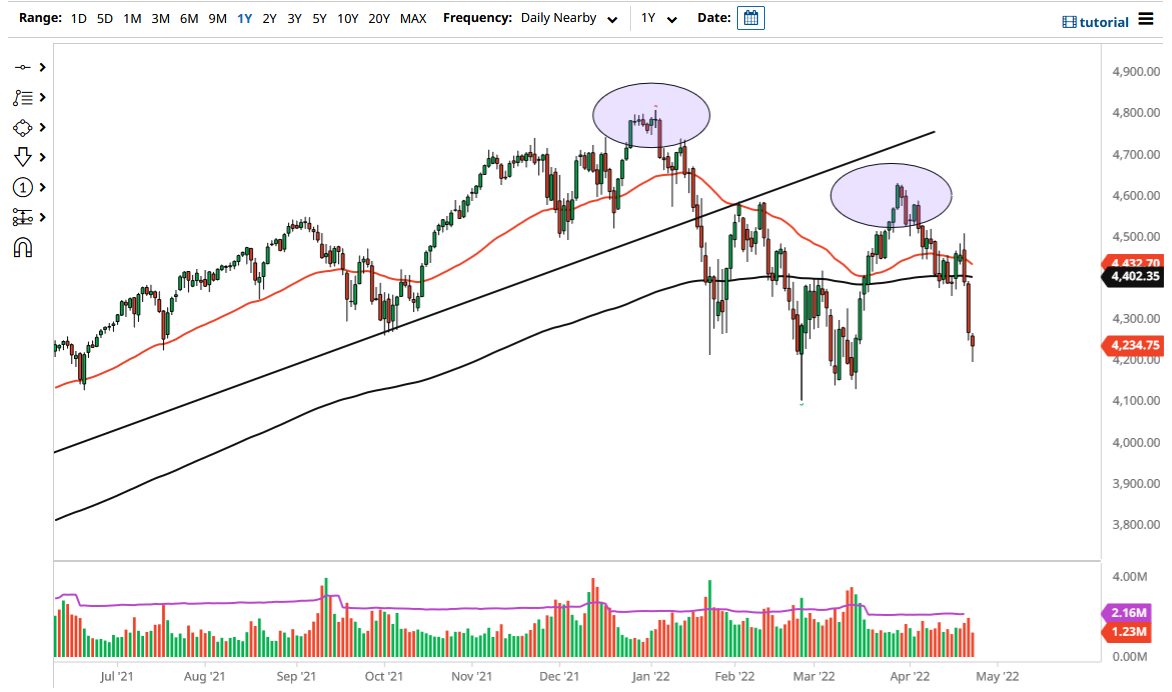

The S&P 500 fell on Monday again to reach the 4200 level. We have bounced ever so slightly from that level, and at this point, the market is trying to find its footing. Whether or not it can bounce is a completely different question, but II do not think that the rally will be anything that traders will be looking to.

At this point, I think rallies are opportunities to start shorting again on signs of exhaustion, as the 200-day EMA currently sits at the 4400 level. The 4400 level is an area that has been important a couple of times in the past, so it does make a certain amount of sense that we would see that offer a barrier anyway. Ultimately, this is a market that has shown itself to be extraordinarily negative at this point, but whether or not we can break down drastically is a completely different question. I think any bounce is more likely than not going to be a selling opportunity given enough time and that is how I am going to play this market.

I do not think that this is a market that I would get long of, and I would probably let it bounce in order to start shorting. Signs of exhaustion will appear, and once they do, it will be an opportunity to take advantage again. If we were to break down below the 4200 level, then it is likely that the market could go looking toward the 4100 level, perhaps even breaking down below there to get to the 4000 level.

The 50-day EMA is starting to sink lower and threatens to cross the 200-day EMA. This is the so-called “death cross”, which is a negative turn of events. At this point, I think this is a market that will continue to be noisy in general, so you need to be cautious with your position sizing. With this, I think you need to be very cognizant of the fact that we have a situation where the market is freaking out about interest rates, and of course a lot of geopolitical concerns. As long as that is the case, you have to think that there are plenty of sellers out there.