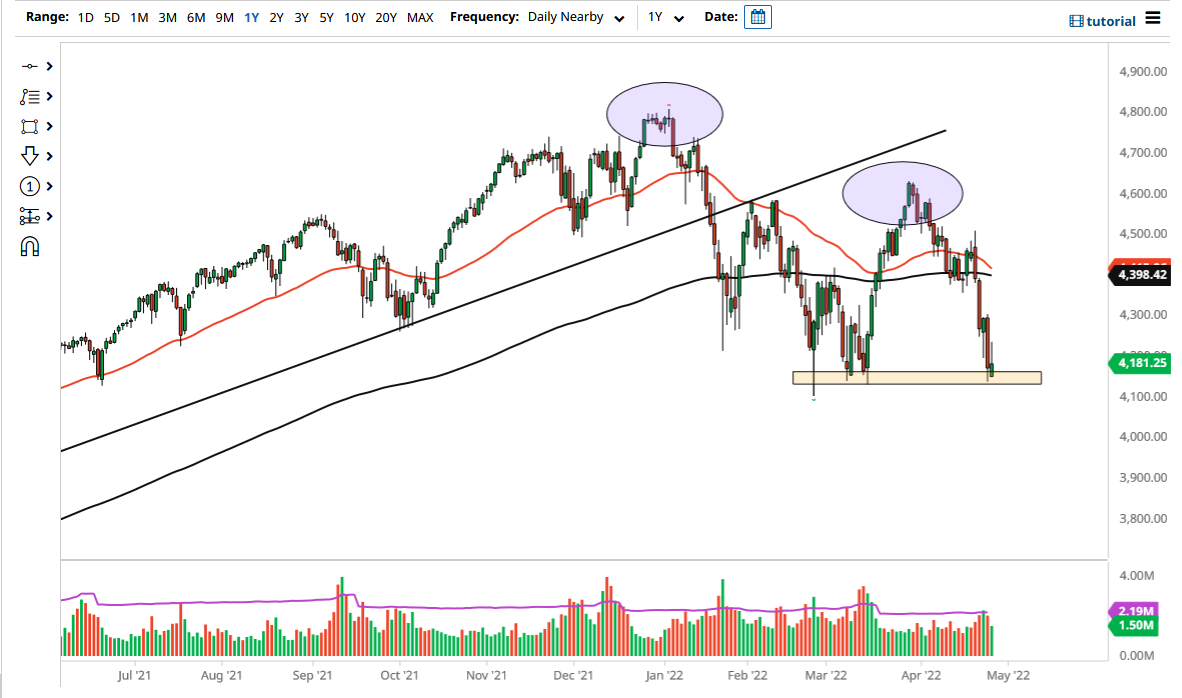

The S&P 500 gapped a little bit lower to kick off the trading session on Wednesday, only to bounce significantly. However, the market could not hang on to the gains so it looks as if we have further to go to the downside. We are currently sitting on top of a significant support level just above the 4100 level, and I think that it will more than likely try to break through there rather soon. If and when it does, this is a market that is ready to go ripping lower. 4000 would be very likely at that point because this is a market that is facing an uphill battle all the way around.

Inflation numbers continue to suggest that the economy is in trouble, not that the stock market has anything to do with the economy. It is about liquidity coming out of the Federal Reserve or the other central banks, and that is disappearing. This is why you see stock markets rise when the economy is in bad shape, because people can borrow cheap money and gamble with it on Wall Street. However, now that the Federal Reserve looks likely to turn off the spigot, there is an entire generation of traders on Wall Street who have no idea what to do with this information. This has a lot to do with what we are seeing currently, and it does suggest further pain ahead.

If we were to turn around and take out the 4300 level to the upside, I might be convinced to start thinking about going long. There is nothing on this chart to suggest that is going to happen anytime soon, but it should be noted that a lot of times you get these nasty rallies in a bear market that can give you massive headaches if you are on the wrong side of it.

At this point, any rally looks like it is going to be a selling opportunity, and I do not think that is changing anytime soon. With this in mind, I am more apt to be a seller of signs of exhaustion than I am to get involved in this market and try to pick things up again. Ultimately, this is a market that has more working against it than for it, and that is something that you will have to keep in the back of your mind.