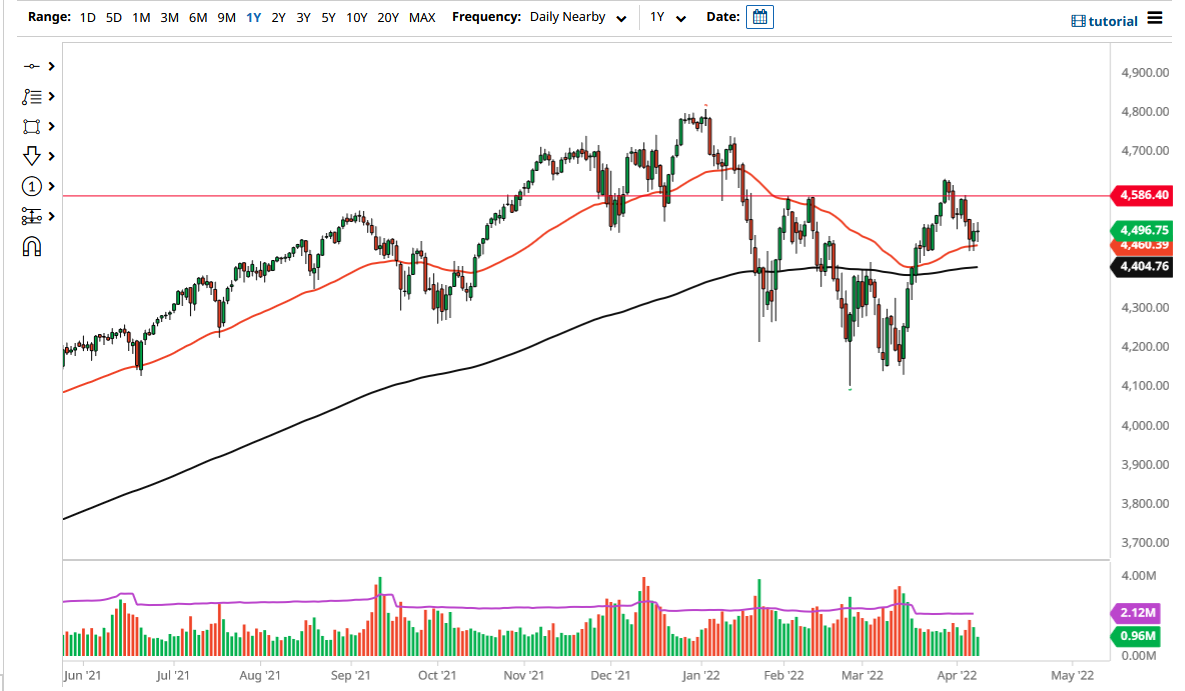

The S&P 500 went back and forth on Friday to show signs of neutrality, as we closed essentially unchanged. This is a market that looks as if it is trying to build up a bit of support at the 50-day EMA, and therefore it is likely that we are going to try to save the market overall. The 50-day EMA has offered support three days in a row, so it does suggest in fact that we are going to try to turn around and reach the top of the bullish flag that we have been forming.

The 4445 level has offered significant support as well, so if we were to break down below there, it is likely that the market will go looking to the 200-day EMA. The 200-day EMA of course is a major indicator and, if we were to blow through there, it would bring in fresh selling. Keep in mind that the S&P 500 and stocks in general for that matter will move based upon the idea of liquidity. The underlying economy has almost no influence on the markets, at least not in the last 13 years. As long as Wall Street believes that the Federal Reserve is going to shy away from raising rates aggressively, then it is possible that they will continue to buy stocks.

However, if they become extraordinarily aggressive, then it is likely that stocks will get sold off. At this point, it is more or less a game of chicken between the two possibilities, so I think we will continue to see massive amounts of volatility. You need to keep your position size reasonable, due to the fact that every time somebody speaks from the Federal Reserve, you could get a huge dump lower. That being said, the market is going to continue to be very noisy, but be cautious about getting too excited right away, due to the fact that the market is going to be difficult to get your hands around at times.

With all that being said, this is probably going to be more or less a range-bound market, as we are trying to find a bit of clarity. Markets hate uncertainty, and that is pretty much all we have at the moment.