Despite the halt of the recent sharp gains of the USD/JPY currency pair, the general trend is still bullish, as last week’s gains reached the currency pair’s 129.40 resistance level, the highest in 20 years, and closed trading stable around the 128.53 level. This is amid the continuation of the bullish momentum that is still supported by strong expectations for the future of raising US interest rates strongly during the year 2022. It will face the fiercest record inflation waves in the country caused by the outbreak of the epidemic and the Russian-Ukrainian war.

On the economic side, the USD/JPY is also trading influenced by the announcement that the Japanese Jubunk PMI for March exceeded expectations at 49 with a reading of 50.5, while the manufacturing PMI missed expectations by 55.7 with a reading of 53.4. On the other hand, the Japanese national consumer price index for March lost expectations (on an annual basis) at 1.3% with a reading of 1.2%, while the national consumer price index excluding food and energy outperformed expectations by -1.1% with a record of -0.7% (on an annual basis). annual). Elsewhere, March's imports beat expectations while exports fell.

From the US, the S&P Global Manufacturing PMI for April beat expectations at 58.2 with a reading of 59.7. On the other hand, both the Services PMI and the Composite PMI missed estimates. Last Thursday, the Philadelphia Fed Manufacturing PMI returned a reading of 17 compared to expectations at a reading of 21. On the other hand, initial jobless claims for the week ending April 15 exceeded 180 thousand with a higher statistic of 184 thousand, while continuing claims for claims the period ended April 8 exceeded 1.455 million with 1.417 million.

Amid the continued collapse of the Japanese yen in the forex trading market. This performance is on a date this week with the monetary policy decisions of the Japanese Central Bank. The Bank of Japan is expected to forecast the fastest inflation in decades outside of tax-raising years, while maintaining an increasingly stimulus stance out of sync with the Fed and other major central banks.

A growing number of economists are expecting the Bank of Japan to take some kind of action in response to the weak Japanese yen and higher prices later this year. Meanwhile, Japanese Prime Minister Fumio Kishida is expected to unveil measures to mitigate the impact of higher energy prices on businesses and consumers ahead of the central bank meeting.

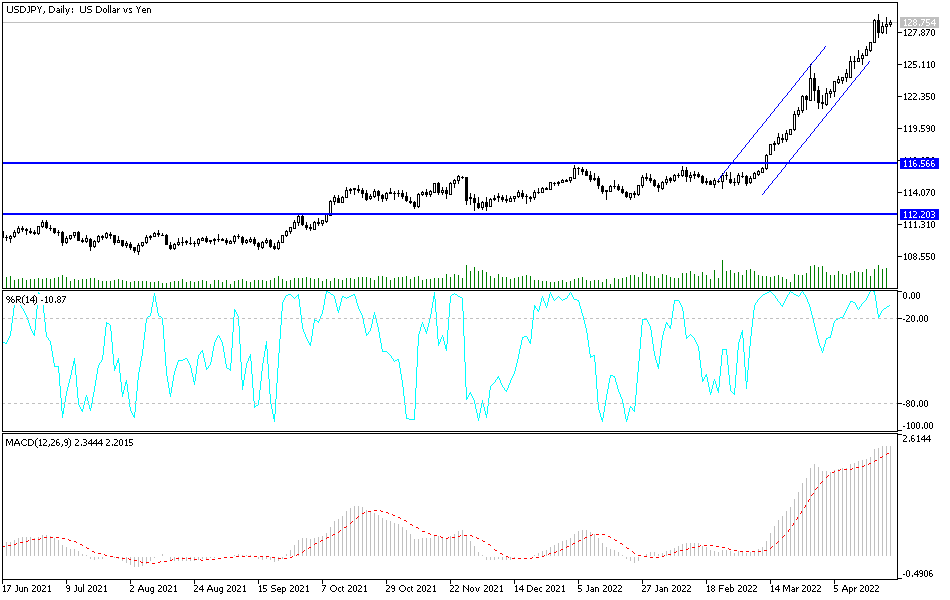

According to the technical analysis of the pair: In the near term and according to the performance on the hourly chart, it appears that the USD/JPY currency pair is trading within the formation of an ascending channel. This indicates a slight short-term bullish momentum in the market sentiment. Therefore, the bulls will look to extend the current rally towards the resistance 128.732 or higher to the resistance 129.126. On the other hand, the bears will look to make profits at around 128.112 or lower at the 127,688 support.

In the long term and according to the performance on the daily chart, it appears that the USD/JPY pair is also trading within the formation of a sharp bullish channel. This indicates a strong long-term bullish slope in market sentiment. Therefore, the bulls will be looking to pounce on long-term profits around the 129.362 resistance or higher at the 130.978 resistance. On the other hand, the bears will target potential reversals at around the support 126,896 or lower at the support 125.365.