Cardano rallied a bit on Monday, stabilizing right around the $0.50 level. That being said, crypto itself is in a lot of trouble and Cardano is not going to avoid that. We are in a strong downtrend and is difficult to imagine a scenario where things change rapidly. We are in fact in “crypto winter” when it comes to these altcoins. As long as that’s the case, unless something changes in the Cardano ecosystem that makes it head and shoulders above the rest, you can probably count on lower pricing.

Keep in mind that the rest of the crypto market pays close attention to Bitcoin and Ethereum. If both of those are struggling, these coins will not do very well unless it’s a specific case basis. At this point, it looks like both of those markets are trying to build a bit of a base, but the last time they attempted this, they shed 25% on the breakdown. If that happens, there’s absolutely no way that Cardano or other small markets are going to do well.

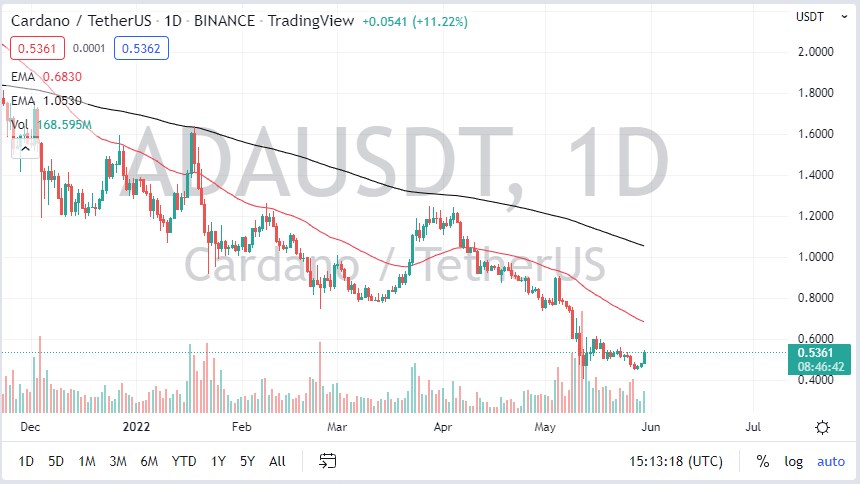

The $0.60 level above looks to be resistance, and it is probably worth noting that the 50-day EMA is racing toward that area as well. If you look at the action for the last couple of months, Cardano has paid close attention to the 50-day EMA, so I would venture to say there will probably be sellers in that general vicinity as well. Cardano seems to be finding a bit of support underneath at the $0.40 level, but there’s nothing particularly special about the $0.40 level that leads me to believe it will be better than any other level.

As far as buying is concerned, if you are a longer-term believer in the Cardano ecosystem, you should have plenty of opportunities to buy at lower prices. Perhaps “scaling in” might be the best strategy in that scenario, but you also have to be aware of the fact it could be a couple of years before crypto takes off again. You would need to see Bitcoin start to rally on a sustainable trajectory before others like Cardano follow along. Remember that this is a highly speculative investment, but it does have a lot of promise as far as its use-case scenario. Because of this, I do think that Cardano may have a future, but a lot of other smaller coins don’t.