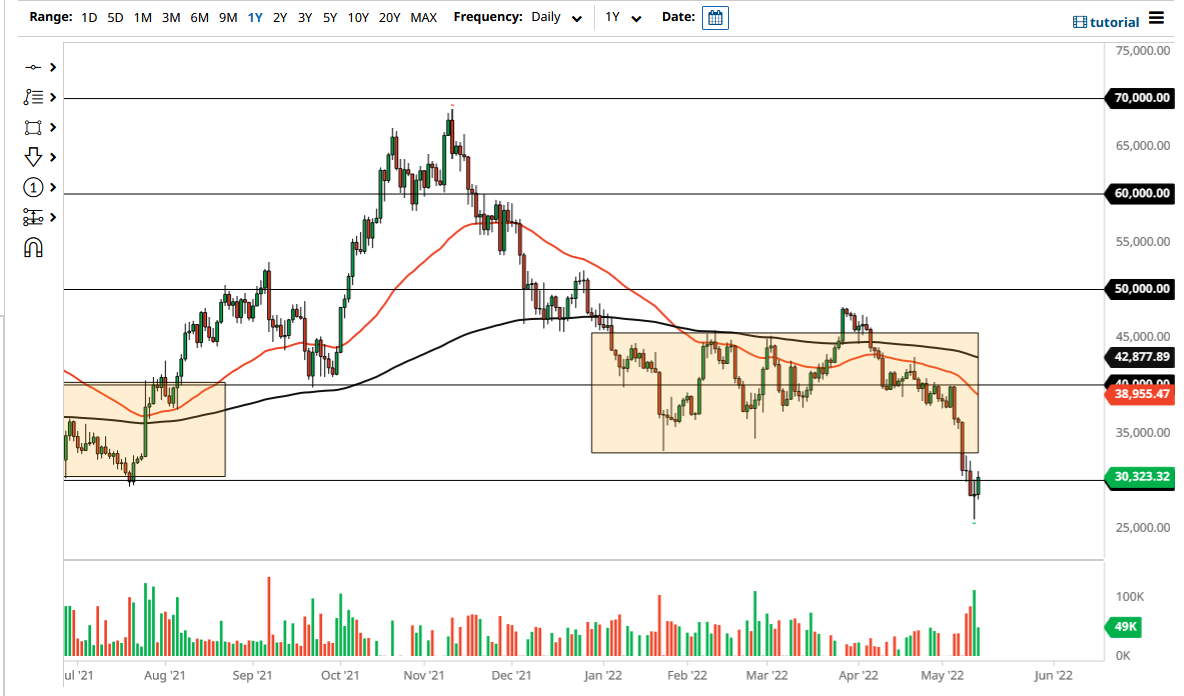

Bitcoin has rallied a bit during the trading session on Friday to break above the $30,000 level. By doing so, it does suggest that perhaps we are getting ready to try to build some type of base, but we need to see a major shift in the US dollar to give Bitcoin any real chance of taking off. Keep in mind that the market does tend to be very volatile, and we are most certainly in a bear market at the moment.

If the US dollar continues to strengthen quite drastically, then it is likely that Bitcoin will slice through the $25,000 level. The market breaking through there would be a very negative turn of events, opening up a move down to the $20,000 level. Bitcoin is a major rack at the moment, as we have seen so much in the way of trouble by strengthening the greenback and interest rates rising. Furthermore, there has been a major disaster in the crypto market in the form of Luna, which has had people running for the hills as well. Regardless, this is a market that will continue to see sellers on rallies, and it is not until the market breaks back above the 50 Day EMA that you could even remotely begin to think about buying it.

As long as the US dollar is strong, the Bitcoin market has no real hope, as the quote currency is the greenback. I think at this point, you are looking to fade rallies, and I would not be surprised at all to see the Bitcoin market go all the way down to the $20,000 level. We could be entering “crypto winter”, as all crypto markets look like a disaster just waiting to happen. I have no interest in buying, and even if we did break above the 50 Day EMA, it is more likely than not going to be where the market goes sideways for a long period of time, and the moving average catches up with it. If you are a longer-term holder of Bitcoin, you might be able to make an argument to get involved, but you are going to have lower prices that you can start building from. There is no real reason to get involved to the upside anytime soon.