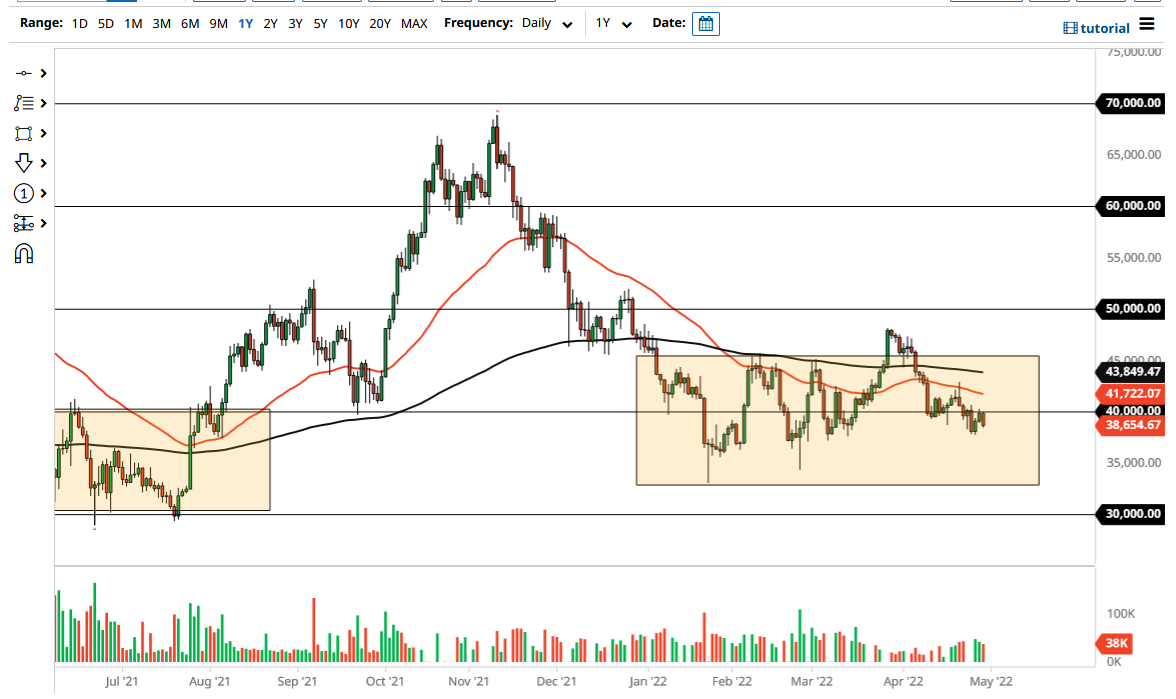

Bitcoin pulled back from the $40,000 level, an area that continues to be a major indicator of confusion, as we are bouncing around in the same vicinity. The last couple of weeks have been very noisy, and therefore I think you need to keep in mind that this consolidation area has been difficult to break out of. You should pay close attention to the 50-day EMA which is currently at the 41,700 level and dropping lower, as it is a bit of dynamic resistance.

Above there, we also have the 200-day EMA at the 43,800 level, and I think it is going to be a huge area of resistance that Bitcoin will not be able to get above anytime soon. In fact, it looks as if the market is more likely than not to go lower, because at this point we could go down to the $37,500 level, maybe even the $35,000 level. This is a market that looks very lackluster, to say the least, and I think rallies will continue to be shorted.

Looking forward, it is difficult to imagine a scenario where Bitcoin suddenly takes off, because the US dollar is so strong. Furthermore, there are a lot of concerns about growth, so that has a huge weight around the neck of Bitcoin as it is pretty far out on the risk spectrum. As risk is shunned, it is difficult to imagine that the market is going to be overly attracted to the crypto markets, because they are pretty far out on the risk spectrum. In fact, one of the few things that seem to be working overall is going to be the US dollar, so keep that in mind. The US dollar is half of the equation here, so you need to pay close attention to it.

Ultimately, we are in a larger consolidation area, so I think we are probably more likely than not just to go back and forth. There is no real catalyst to see this market go higher anytime soon, so with that being said the market will just kill time in this general vicinity, putting people to sleep. In fact, we are now going sideways so much that you have to determine whether it is consolidation, or accumulation.