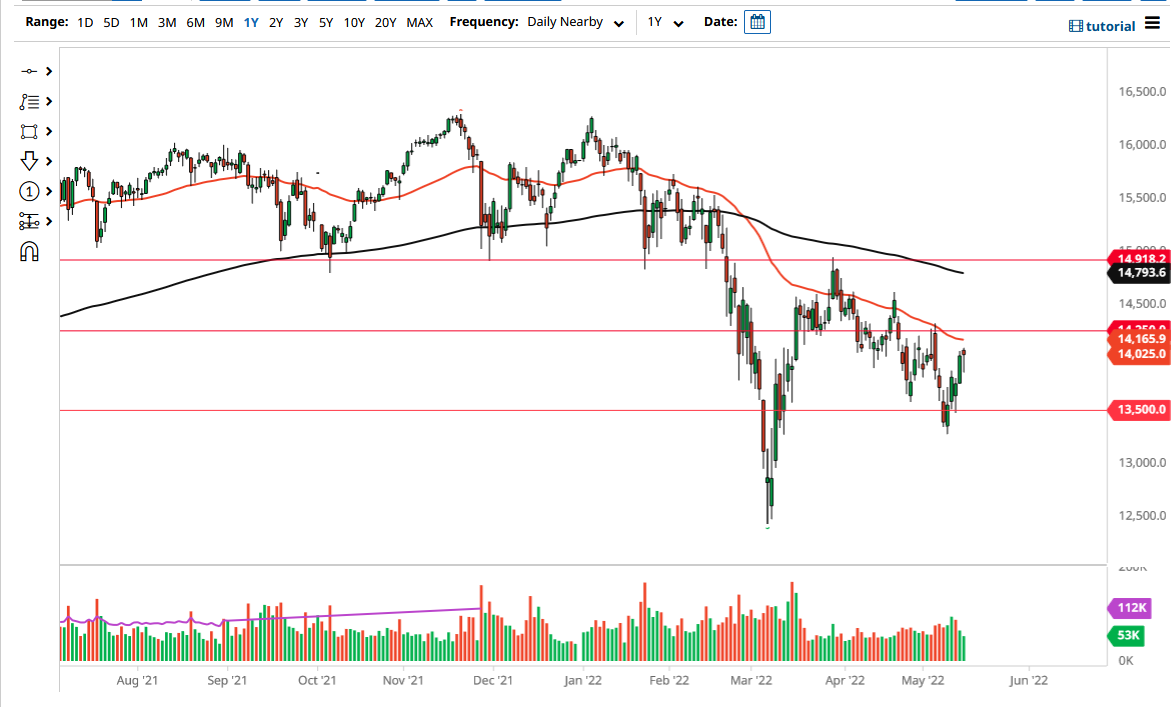

The German DAX index gapped slightly higher to kick off the Monday future session but then fell rather hard. That being said, the market has found enough support at the €13,871 level to turn things around and form a hammer. Now the question is whether or not the hammer is going to show some type of continuation to the upside or if it will be a scenario where we break down below the bottom of the candlestick to form a “hanging man”, which of course is a very negative turn of events.

I do think that it is only a matter of time before we have to make a bigger decision, but it is also worth noting that the 50-day EMA sits just above and is starting to break down. The 50-day EMA is an area where we would see a lot of dynamic resistance, so if we can break through there then it gives the DAX an opportunity to test the €14,250 level, an area that has been important a couple of times in the past. If we can break above there, then you can make an argument for a nice trendline break as well, allowing the DAX to go to the €14,750 level.

If we break down below the bottom of the candlestick for the trading session on Monday, then it opens up a potential selloff down to the €13,500 level. We have been in a down-trending channel for a while so it does sense that we would see a continuation of what has been going on as far as the trend is concerned. That being said it does look as if the market is trying to continue to press against the downtrend, but given enough time, I think we have got a situation where we have to make a bigger decision. Whether or not the ECB is willing to loosen monetary policy to bail out the markets would be a completely different question, but we also need to pay attention to the global economy as the DAX is highly levered to exports coming out of Germany. At this point, it is probably only a matter of time before we have to make a bigger decision so I am more than willing to follow a large candlestick.