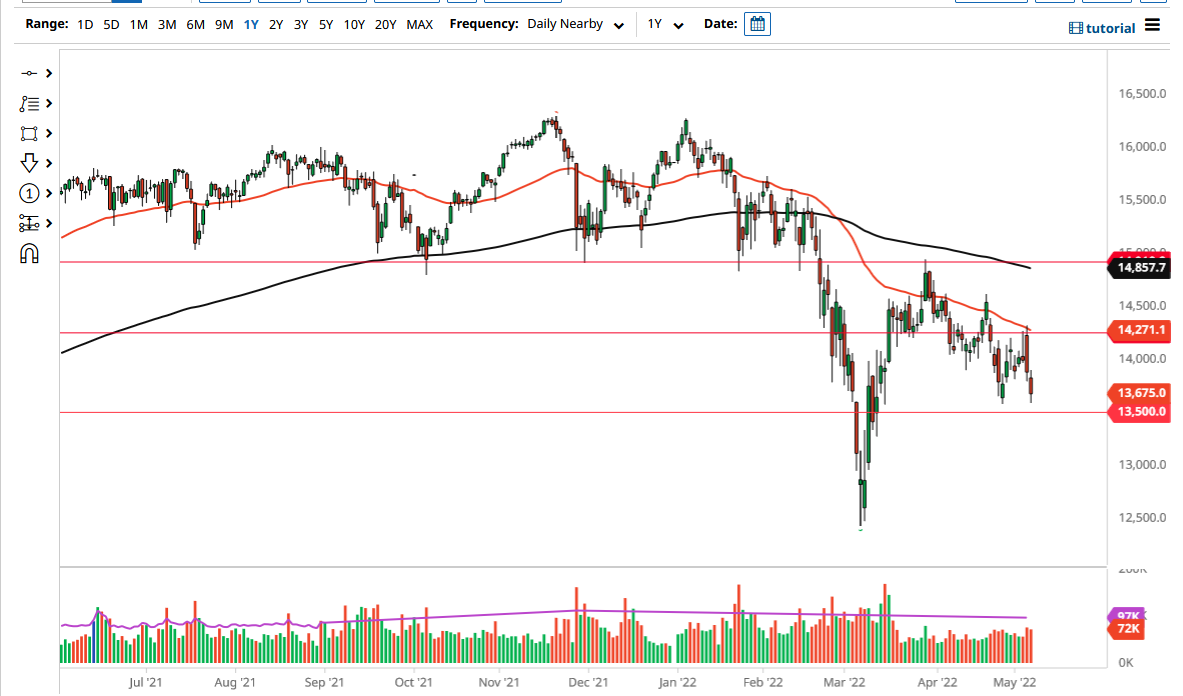

The German DAX Index fell a bit on Thursday to grind down towards the €13,500 level. The €13,500 level is an area that is important, as we had bounced from there previously. Furthermore, it is somewhat psychologically important, so that needs to be paid attention to as well.

By falling the way we have and then turning around, we have not quite formed a hammer but have formed a candlestick that is very similar. This suggests to me that we might get a little bit of a bounce, but the market still has a significant amount of resistance above that will come into the picture. After all, the 50-day EMA is sitting at the €14,272 level and dropping from here. There is also significant resistance sitting around the €14,250 level at the same time, so I think it is probably only a matter of time before we get sellers in that region.

If we were to break down below the €13,500 level, then the €13,000 level would probably be targeted next, followed by the €12,500 level, where we had bounced from previously. It is also worth noting that the market has been in a nice downtrend channel for a while, so it looks as if we are steadily selling off, not necessarily in some type of panic. The European Central Bank will not be tightening monetary policy anytime soon, but they are starting to suggest that they might sell off some of the assets that they hold on their balance sheet. That is a form of monetary tightening, albeit a minor one. Keep in mind that the global economy also has a major influence on the DAX, as so many of the major components are worldwide exporters.

When you look at this chart, it is easy to see that we have been very choppy, despite the fact that we have been very direct in our negativity. Unless something changes from a macroeconomic outlook, I just do not see how the DAX will recover for anything more than a short-term pop. Short-term rallies should be nice shorting opportunities going forward. The German economy has printed some rather disturbing economic figures as of late, so I think that is also going to continue to weigh upon the DAX, as we have seen over the last several weeks.