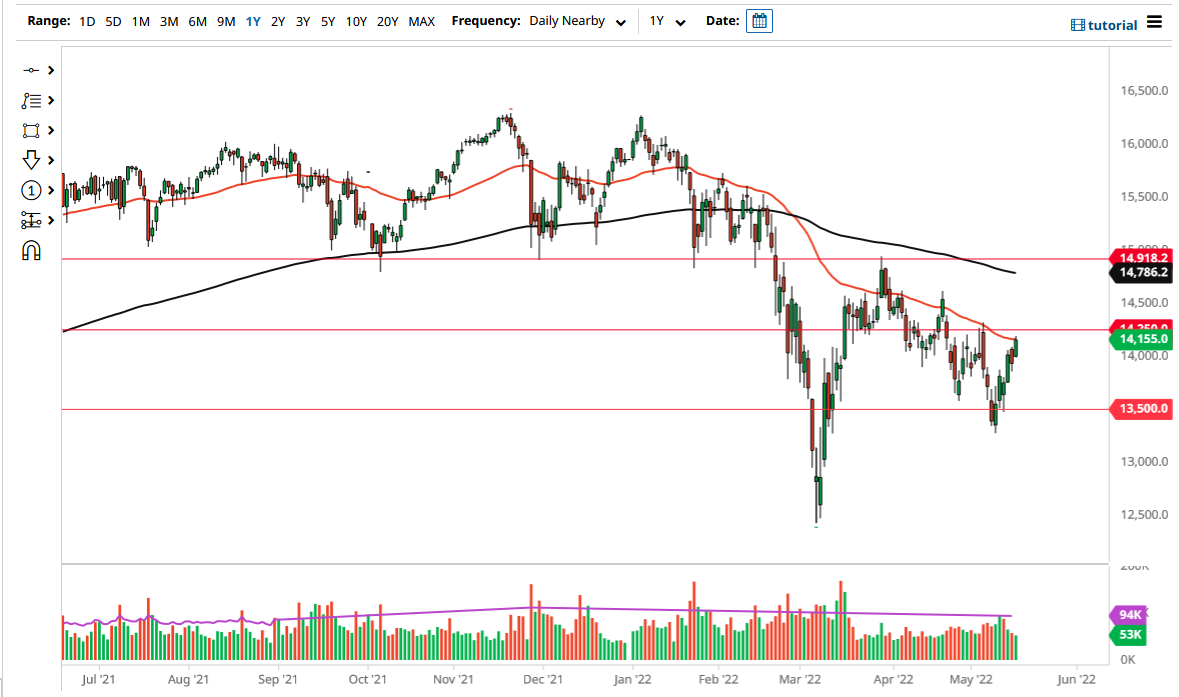

The German DAX Index rallied on Tuesday as we continue to see money flow back into equities in general. That being said, there is a lot of risk out there, and it would not take much to spook the markets. Ultimately, the €14,250 level looks to be difficult to get beyond, and I think we have a scenario where you will eventually find sellers as the market is skating on thin ice and is at the top of the overall channel. The 50-day EMA would offer a little bit of technical resistance as well, so it would remain to be seen whether or not it holds.

If we do fall from here, a break below the €14,000 level could bring fresh selling in, sending the market down to the €13,500 level. Any test of that area that breaks down could send this market much lower, as it would be a bit of capitulation by the markets again. On the other hand, if we were to turn around and break above the €14,250 level, then we have a shot at eating the €14,500 level. After that, then we have the 200-day EMA which is just above the €14,750 level. In other words, every €250 or so, we are going to have a little bit of a fight on our hands.

Keep in mind that the DAX is highly sensitive to global markets and of course global economies as it is such a major exporter. Because of this, you need also to pay attention to what is going on in places like China and the United States. With the massive amounts of inflation that we are seeing, I do think that it is probably only a matter of time before all stock indices get hit again, but bear markets do tend to have massive rallies occasionally, only to sell off quite drastically again. Because of this, I would be wary of any type of rally until we get confirmation, perhaps globally. In the short term, I think that the first signs of exhaustion will be jumped upon rather aggressively, as we had been in such a strong downtrend for quite some time. Markets tend to take a long time to turn around after move like this, so I assume we will continue to find plenty of pressure.