The Dow Jones Industrial Average continued to rise during its recent trading at the intraday levels, to achieve gains for the sixth consecutive session, by 1.76%. It added to it about 575.77 points, to settle at the end of trading at the level of 33,212.97. This is after rising in trading on Wednesday by 1.61%. During the past week, the index rose by 6.24%, to break a weekly series of losses that lasted eight weeks, which is the longest recorded by the index since 1932.

Inflation in the US as measured by the personal consumption expenditures index rose just 0.2% in April for the smallest monthly increase in a year and a half, largely due to lower gas prices. While gas prices subsequently rebounded, there were other signs that rising inflation may be easing.

Last year's core PCE inflation, the Fed's preferred metric, slowed over the past year to 4.9% from 5.2%, the second consecutive monthly decline. The last time the base rate saw a back-to-back decline was in the pandemic's first few months in early 2020.

US stocks posted weekly gains amid some relief from the release of the Federal Reserve's meeting minutes in early May. The Fed boosted its forecast of a half-point rate hike in the summer to fight inflation, but also indicated that it would remain flexible after that to reassess the economy.

However, hawkish comments from US Federal Reserve Governor Christopher Waller yesterday pushed back recent expectations that the Fed might take a breather after the increases in June and July.

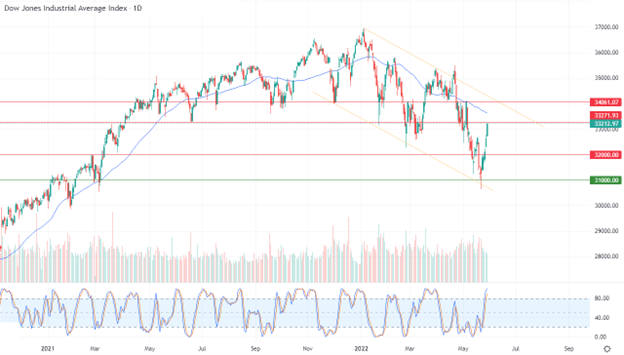

Technically, the index continued to rise with its recent trading on intraday levels, to reach its recent rise to approaching retesting the important resistance level 33,271.90. This is amid the dominance of the bearish corrective trend and the index’s trading in a bearish price channel range that limits its previous trading in the short term, as shown in the attached chart for a period of time. (Daily). The continuation of the negative pressure of its trading below the simple moving average for the previous 50 days, causes us to notice that the relative strength indicators reached areas of overbought operations, and exaggeratedly compared to the movement of the index. This suggests that divergence is starting to be negative.

Therefore, we still expect the index to return to decline during its upcoming trading, especially if the resistance level 33,271.90 remains intact, to target the first major support levels 32,000.