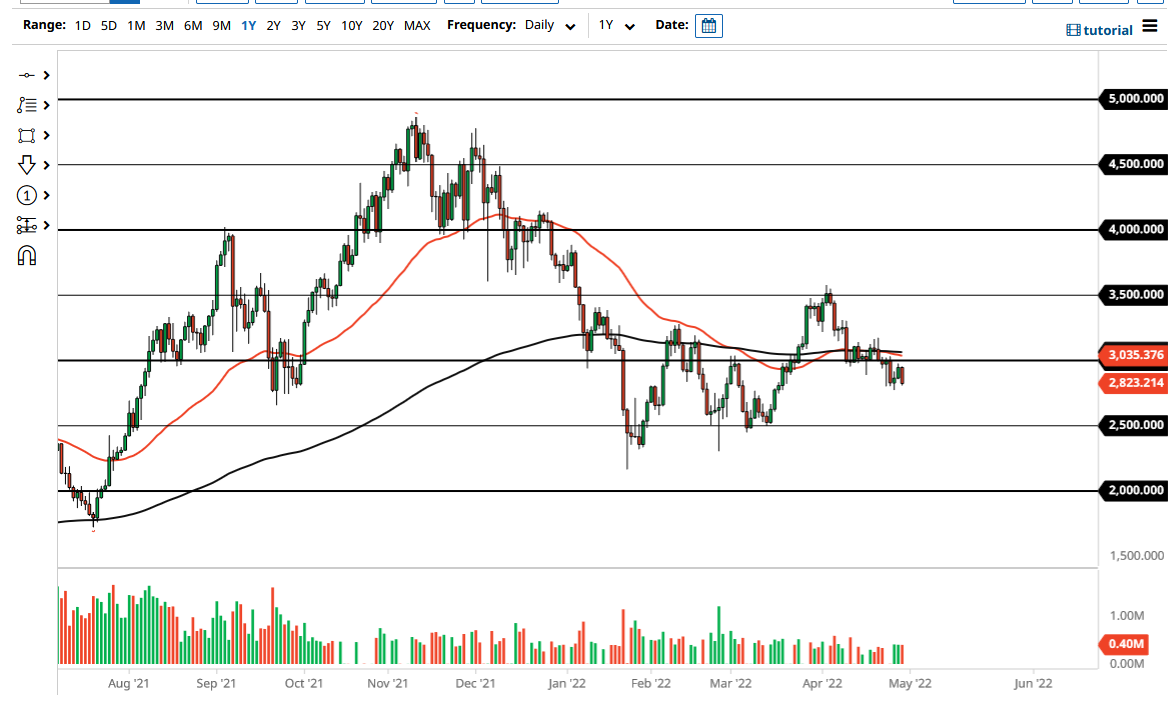

Ethereum fell significantly on Friday to show further weakness. At this point, the market is likely to continue to see downward pressure, as the $2750 level will be supported. If we break down below there, then the market is likely to continue going much lower, perhaps reaching the $2500 level.

Just above, the $3000 level is further backed up by the 50-day EMA, and the 200-day EMA. Because of this, it will be interesting to see how this plays out due to the fact that the crypto markets in general have struggled, and the US dollar has been very strong. The Ethereum markets are pretty far out on the risk spectrum, so institutional money will be running away from it. As long as there are major concerns around the world, it is difficult to imagine a scenario where the crypto markets take off to the upside, and I do think that there is further pain ahead. Short-term rallies will more than likely offer selling opportunities, as we continue to see a real lack of interest.

Further causing problems is the fact that Ethereum continues to struggle moving forward. The Ethereum improvements seem to never be coming, and if that is going to be the case it is likely that we will continue to be a bit hesitant to get involved. The $2500 level underneath has been significant support previously, so I do think that it is probably only a matter of time before buyers would come back into the picture. That being said, I think that a lot of traders are looking at this through the prism of weakness, so I think it is only a matter of time before we get short again. The markets will continue to see a lot of noisy behavior but given enough time I think we have got a situation where rallies continue to offer opportunities to the short side. If we break down below the $2500 level, the market then goes looking to the $2000 level. Ultimately, I have no interest in buying Ethereum in the short term, but longer term it may end up being a nice investing opportunity. I do not see it happening anytime soon though, so keep in mind that we will continue to be noisy and you need to be cautious about your position size.