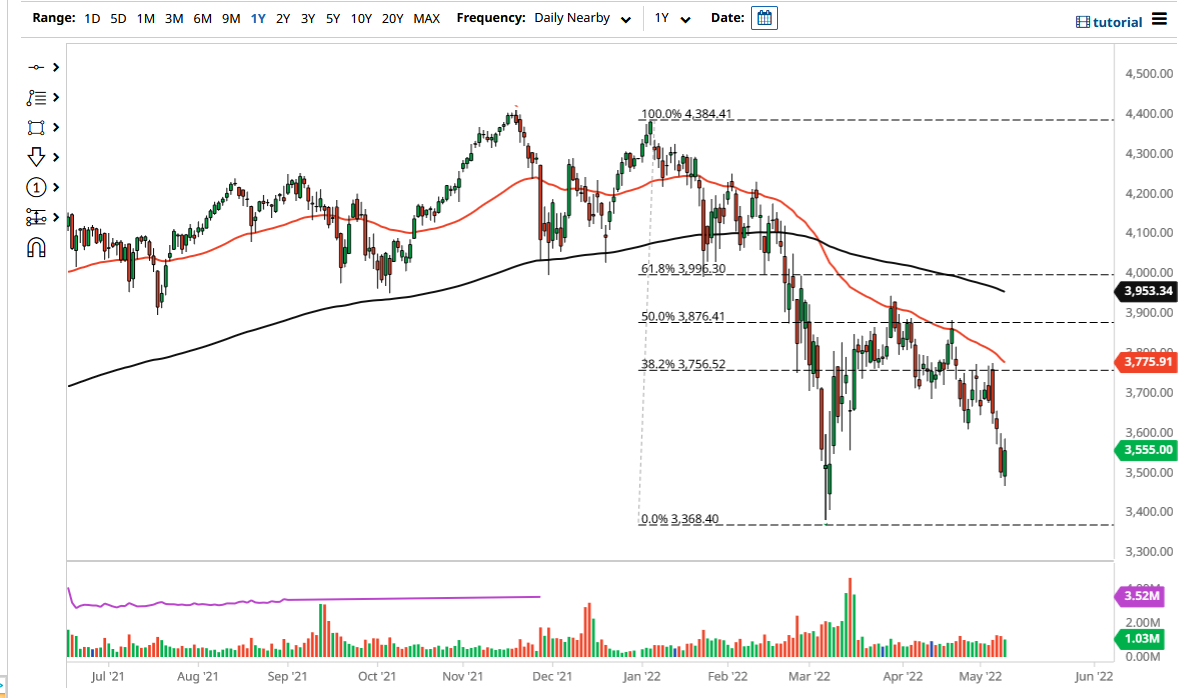

The Euro Stoxx 50 rallied rather significantly after dropping in the early hours on Tuesday, as it looks like the oversold condition has caused a bit of profit-taking. Ultimately, the market is likely to continue to see the negativity around the world as something to be shorted. However, markets do not go in one direction forever, so it is likely that a bit of a rally will probably get sold into. The €3600 level is an area that we had gapped below over the last couple of days, so it does suggest that we are going to see a lot of resistance.

If we do break above there, then the market has to deal with a lot of selling pressure from the previous trading, as the 50-day EMA is currently sitting just below the €3800 level. That is an area that we would have to break above to think that the Euro Stoxx 50 would suddenly turn around. After all, the index is a collection of nine different countries, and it is likely that the index will eventually see a lot of shorting pressure.

If we did break above all of that, specifically the €3800 level, then we could see a significant turnaround to reach the 200-day EMA. That obviously would be a huge turn of events, but ultimately this is a market that still has further to go before testing the previous lows, which is near the €3400 level. The market breaking down below that level could send the market much lower, in a huge flush. That being said, I think the only thing you can probably count on is a lot of volatility, so you should probably be cautious about position sizing, and look for rallies to sell into as it should be more or less a continuation of what we have been seeing for quite some time.

As long as there are a lot of concerns coming out of the European Union, and the European Central Bank has done nothing to increase liquidity, it is difficult to imagine a scenario where the Euro Stoxx 50 takes off. I do believe it is only a matter of time before the bears come in and punish the market yet again. Volatility should remain high, which is typically a negative sign.