It reached the support level 1.0470, but the rebound attempts did not exceed the level of 1.0641, as the bears are still in control and may start trading. EUR/USD is stable around the 1.0545 level. The disparity in the economic performance, the future of raising interest rates and the continuation of the Russian-Ukrainian war are still the main weakness factors for the performance of the Euro-dollar. Its demise is an opportunity for the EUR/USD pair to correct. Until that happens, the gains of the EUR/USD will remain subject to selling again.

On the economic side, the EUR/USD is trading influenced by the latest economic data as German industrial production for the month of March fell more than expected (MoM) at -1% with a change of -3.9%. Production (on an annual basis) recorded a change of -3.5% compared to a change of -3.1% in the previous period. Prior to that, it was announced that German factory orders seasonally adjusted for the month of March, the expected change by -1.1% with a change of -4.7% (MoM), while the equivalent (YoY) decreased by 3.1% compared to the growth of 4.3% last year. in the same previous period.

On the monetary policy future front, after the US interest rate hike, we noticed a strong activity of European monetary policy officials to comment on the future of ECB policy.

From the US, the US non-farm payroll for April exceeded the expected number of jobs at 391 thousand by 428 thousand. However, the US unemployment rate remained unchanged from the previous month at 3.6%, exceeding the expected rate of 3.5%, while average hourly earnings grew 0.3% (9 months) compared to an estimated growth rate of 0.4%. The (similar) annual growth rate matches the projected growth rate of 5.5%.

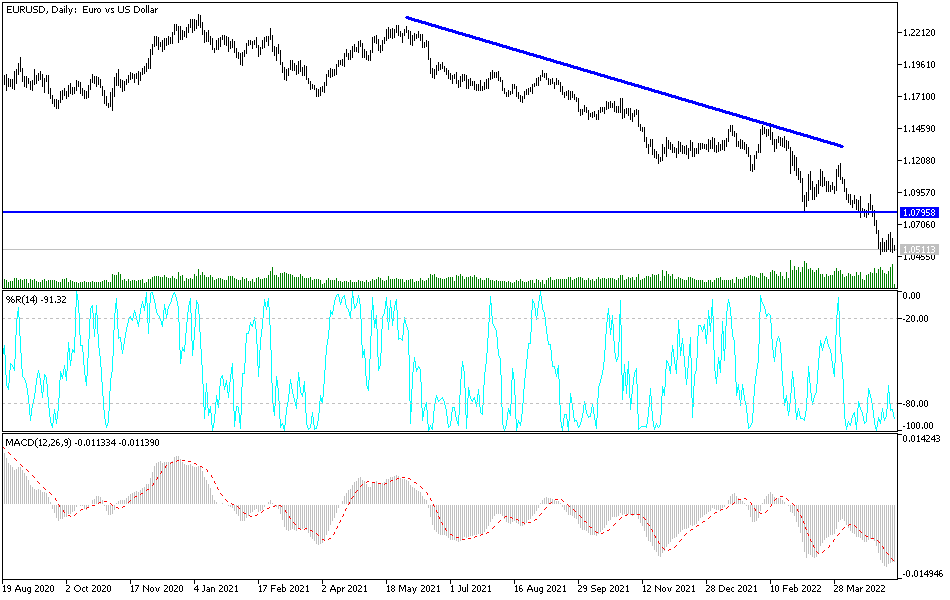

According to the technical analysis of the currency pair: In the near term and according to the performance of the hourly chart, it appears that the EUR/USD is trading within a neutral channel formation with a bearish slope. This indicates that there is no clear directional bias in market sentiment. Therefore, the bulls will target potential channel breakout profits at around 1.059 or higher at 1.062. On the other hand, the bears can target short-term profits at around 1.0482 or lower at 1.0424.

In the long term and according to the performance on the daily chart, it appears that the EUR/USD is trading within the formation of a descending channel. This indicates a significant long-term bearish momentum in the market sentiment. Therefore, the bears will look to extend the current declines towards 1.0324 or lower to 1.0085. On the other hand, the bulls will target long-term profits at around 1.0755 or higher at 1.1015.