My last GBP/USD signal on 16th May was not triggered, as unfortunately the support was given a few pips below $1.2226.

Today’s GBP/USD Signals

Risk 0.75%.

Trades may only be entered between 8am and 5pm London time today.

Long Trade Ideas

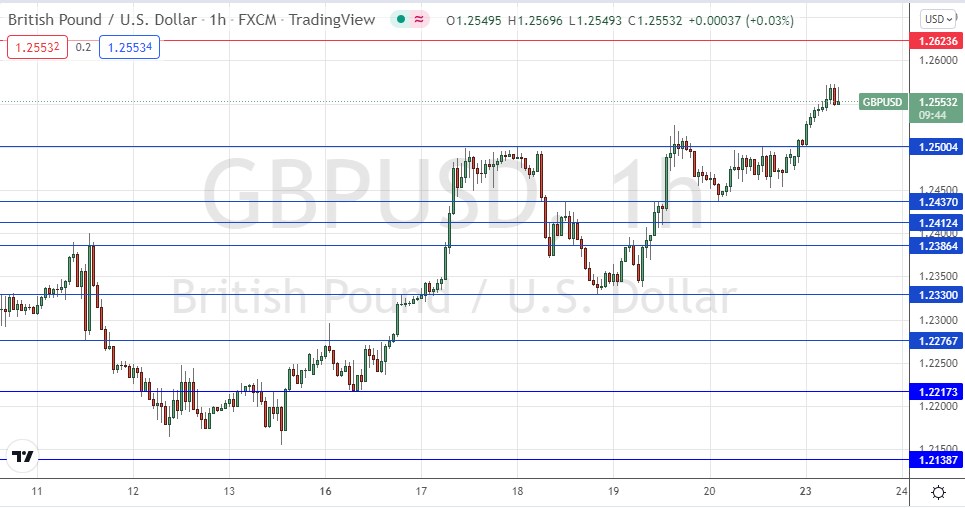

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of $1.2500, $1.2437, or $1.2412.

- Place the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 25 pips in profit.

- Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Short Trade Idea

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of $1.2624.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 25 pips in profit.

- Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

I wrote in my last piece on 16th May that despite the long-term bearish trend and the price still not far off that long-term low, we were seeing an important bullish sign – a first higher low at $1.2226.

I thought the best approach would be to stand aside and wait for the price to get established below $1.2226 (bearish sign) or above $1.2277 (bullish sign). It seemed quite possible that the price would basically hold within this range until the end of today’s London session.

This was a good call, as waiting for the breakout above $1.2277 at the end of the day would have produced profit over the next day, and close to 300 pips of profit if that long trade was held open until now.

We have seen a quite strong reversal in the US Dollar over the past week or so, after the greenback rose firmly for several consecutive weeks and reached new 1 year+ highs. The move against the Dollar is universal and is benefiting almost every other currency, and the British Pound is no exception. Of course, this may just be a retracement in the long-term bullish trend in the US Dollar, which could reassert itself.

My feeling is that the Dollar decline will continue at least until the FOMC Meeting Minutes are released on Wednesday. It is hard to see what other news could change sentiment before then, there is nothing of high importance scheduled before then.

I will be happy to take a long trade today from a bullish bounce at $1.2500.

Regarding the GBP, the Governor of the Bank of England will be speaking on a panel at 3:15pm London time. There is nothing of high importance scheduled for today concerning the USD.