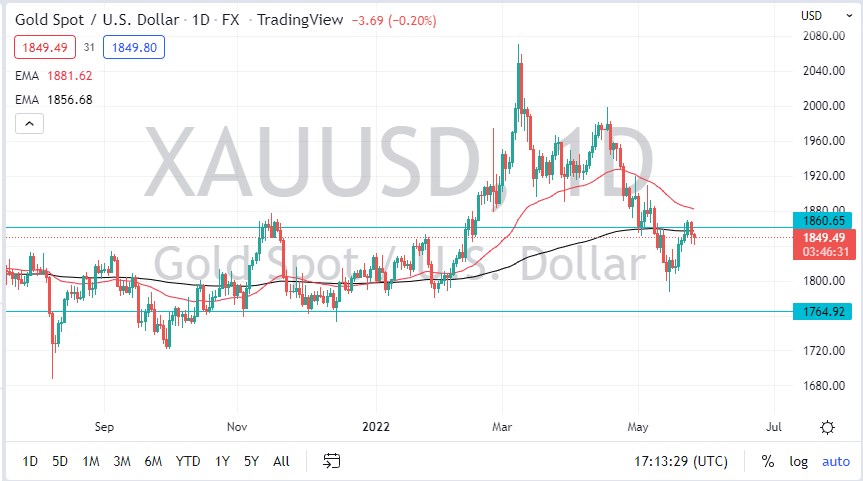

Gold markets have fallen initially during the trading session on Thursday but turned around to show signs of life again. By doing so, the market looks as if it is trying to overcome the 200 Day EMA, but it’s obvious that there is a lot of noise in this general vicinity. With that in mind, I think we will continue to see a lot of choppy behavior, and as we have had very little clarity, I would anticipate that we will continue to focus more on short-term charts than anything else.

Keep in mind that gold is highly sensitive to interest rates, so you need to pay attention to what’s going on in the bond market. As of late, interest rates have started to calm down a bit, and that helps gold become a bit more attractive. If interest rates truly start to sell off, then it’s likely that gold will be a rather major beneficiary. It is worth noting that the markets had been sold off quite viciously, so even though we have had a nice bounce, we probably have some work to do in order to change the overall trend. After all, the market does tend to be very choppy under the best of circumstances, and therefore I think you will continue to see a lot of short-term back-and-forth trading more than anything else.

If we were to break above the highest of the week, then I think it’s likely that we would go much higher. At that point, we would threaten the 50 Day EMA, and then eventually the $1900 level. On the other hand, if we were to break down below the lows of the last couple of days, we may pull back toward the $1825 level. Although a bearish move, it could be a simple continuation of base building in the market as there had been so much support right around the $1800 level.

The one thing that you can probably count on over the next several days is that things will be rather noisy, so you need to be very cautious with your position size. If the market suddenly takes off to the upside, I think it is likely that we would see a bigger continuation move, and I do think that things are lining up for that. However, it won’t necessarily be easy.