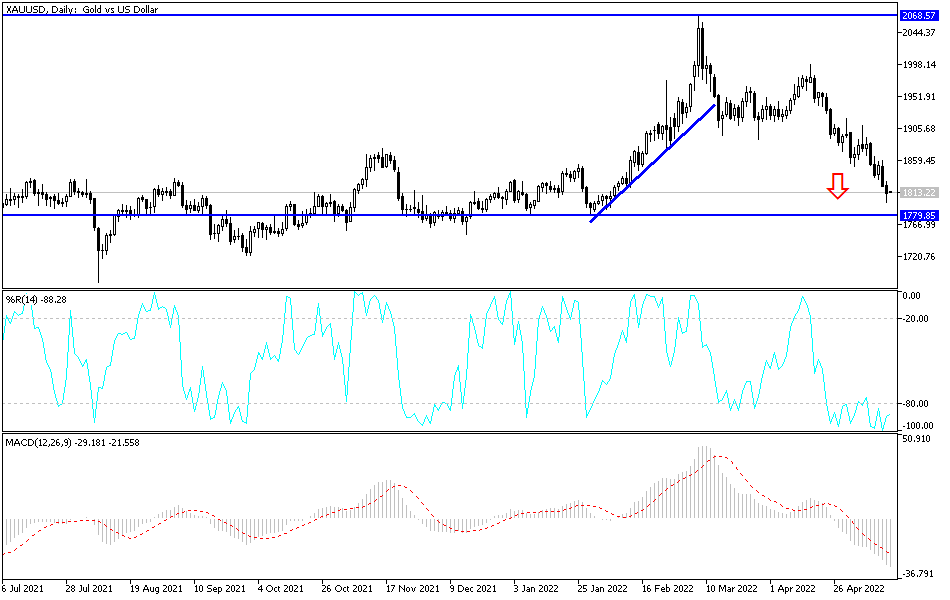

For now, the bull market appears to be over, even if inflation has risen significantly. The price of gold fell to the support level of $ 1799 for an ounce, the lowest price of the yellow metal in three months. We ended the week's trading around the level of $ 1811 an ounce.

In general, gold prices fell by 3.85% during the past week, bringing its decline since the beginning of the year 2022 to date to about 1%. Silver, the sister commodity to gold, joined the rally at the end of last week's trading. Silver futures rose to $21.125 an ounce. The price of the white metal fell by more than 5.5% last week, adding to its decline during 2022 by about 10%.

All in all, gold prices are trading at their lowest in 14 months. Furthermore, gold is below the 200-day moving average, which is usually considered a bearish component. But will the precious metal maintain this downtrend? Not exactly, as some market analysts suggest.

Investors were selling gold due to the rally in the stock market and higher Treasury yields. The Dow Jones Industrial Average and Nasdaq Composite Index each added more than 400 points, while the S&P 500 jumped nearly 100 points. The US Treasury market was green, with the benchmark 10-year bond yield rising 11.1 basis points to 2.928%. One-year yields rose 6.2 basis points to 1.958%, while the 30-year yield rose 11.7 basis points to 3.088%.

Gold is generally sensitive to a higher interest rate environment because it raises the opportunity cost of holding non-yielding bullion.

Besides this, the dollar weakened as the US Dollar Index (DXY), a measure of the US currency against a basket of major currencies, fell to 104.47, from an opening at 104.77. A weak dollar is beneficial for dollar-priced commodities because it increases the cost of purchasing them for foreign investors.

Relative to the prices of other metals, copper futures rose to $4.1645 a pound. Platinum futures fell to $930.80 an ounce. Palladium futures advanced to $1,925.50 an ounce.

According to the technical analysis of gold: There is no doubt that the movement of the gold price below the psychological support level of 1800 dollars an ounce threatens the outlook for the rise of gold, but at the same time it may be an opportunity to think about seizing opportunities to buy after the recent selling operations. The most prominent support levels for the market are currently 1788 and 1760 dollars Straight. Despite the recent performance, I still prefer buying gold from every bearish level, and whoever bought and continued to decline is doing buy reinforcement trades. On the other hand, breaking the resistance of 1835 dollars an ounce on the daily chart will be important for the bulls in more momentum to return on its upward path.