Gold futures have struggled for direction since this week's trading began as the Federal Reserve revealed its willingness to raise US interest rates as long as necessary to fight inflation. The yellow metal wiped out all of its gains for 2022 amid a price rally environment. The price of gold tried to recover from the recent selling operations. It pushed it towards the support level of $ 1787 an ounce, its lowest in five months, by rebounding to the level of $ 1836 an ounce. With the lack of momentum, it returned to stability around the level of $ 1811 an ounce at the time of writing the analysis.

Overall, gold prices are down about 1% over the course of 2022, with a loss of 8.5% over the past month.

Silver, the sister commodity to gold, is posting modest gains. Silver futures rose to $21.63 an ounce. In general, the price of the white metal has decreased by 7.3% since the beginning of the year 2022 to date, but it has decreased by more than 23% during the past 12 months.

Despite gold's losses on Tuesday, market analysts believe that gold may recover soon.

“Gold is on the upside,” Samir Samana, chief global market analyst at Wells Fargo Investment Institute, wrote in a weekly note to clients, adding that support could be found at the 200-day moving average. However, the US central bank reiterated its position that the Fed has room to maneuver to be bolder in raising interest rates. But first it needs evidence that inflation is declining.

Speaking during an event in the Wall Street Journal, Jerome Powell stressed his central bank's aggressive campaign to fight US inflation, adding that it was possible for the institution to achieve a "soft landing" rather than a recession. "There are a number of reasonable paths to getting a smooth landing," Powell added yesterday. and “Sometimes it can be a little bumpy. Still a good landing. And what we need to see is inflation coming down in a clear and convincing way and we will keep pushing until we see that.”

He added that the financial markets are operating normally despite the tightening of financial conditions. This may allow the Fed to continue raising US interest rates at a robust pace, but first the Eccles building needs to see "clear and convincing evidence that inflation pressures are easing, and inflation is declining."

Despite its weakness seen yesterday, the US Dollar Index (DXY) was strong in 2022, rising nearly 8%, which was bearish for gold prices. The US dollar index DXY, which measures the performance of the US currency against a basket of major currencies, fell to 103.35. A lower profit is beneficial for dollar-priced commodities because it makes it cheaper to buy for foreign investors. Another factor affecting the gold market The US Treasury market was mostly in the green, with the benchmark 10-year bond yield rising ten basis points to 2.979%. The one-year bond yield rose 2.1 basis points, while the 30-year bond yield jumped 9.7 basis points to 3.181%.

Gold is sensitive to rising rates because it raises the opportunity cost of holding non-yielding bullion.

The weak US dollar and a slight decline in Treasury yields were seen as the main factors that led to the move to the upside. Accordingly, Lukman Otunuga, senior research analyst at FXTM, said in a note: "Regardless of recent gains, the precious metal is not out of danger yet."

Better-than-expected economic data also weighed on gold prices: US retail sales rose 0.9%, industrial production jumped 1.1%, industrial production jumped 0.8%, and business inventories increased 2%. In other metals markets, copper futures rose to $4,231 a pound. Platinum futures rose to $941.20 an ounce. Palladium futures rose to $2022.00 an ounce.

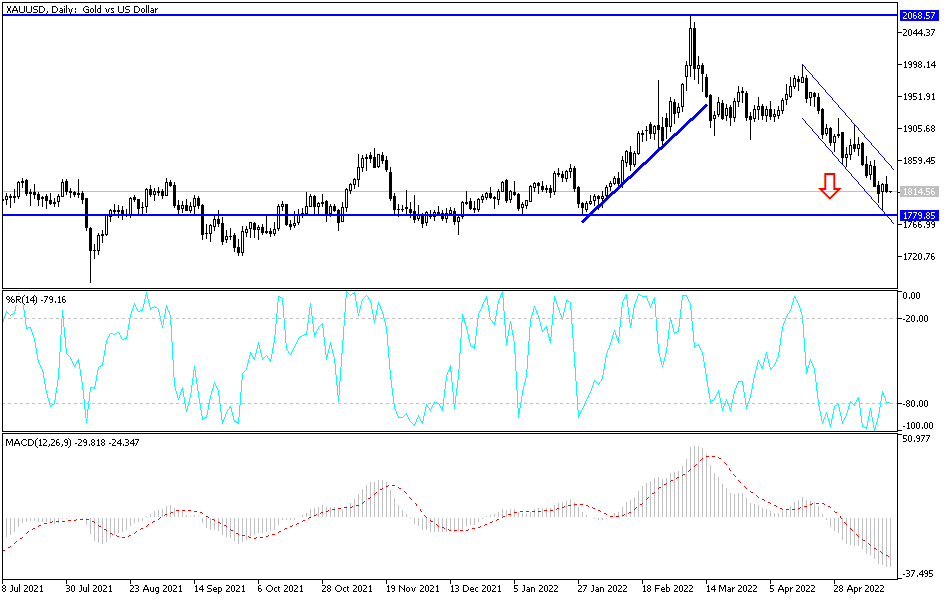

According to gold technical analysis: On the daily chart, the price of gold is still around $1800 an ounce. A separating line between the two directions, and the stability above gives the bulls some hope to launch higher again. It supports more buying deals to move towards the resistance levels 1825 and 1855 dollars, which supports the upward trend, then Back to the psychological top 1900 dollars an ounce again.

On the other hand, breaking the support level of $ 1785 an ounce supports the bears to launch in the same last performance, but I still prefer buying gold from every descending level. Despite the desire of global central banks to raise interest rates, which will be negative for gold, we are finding other factors of geopolitical tensions due to the Russian-Ukrainian war and skirmishes from both sides of the Brexit. In addition, a new outbreak of the pandemic that threatens the second largest economy in the world.