After the Federal Reserve raised interest rates 50 basis points during the trading session on Wednesday, the S&P 500 continued its bullish move, as we went straight up in the air. In fact, now looks as if we are going to threaten the 4300 level as Jerome Powell has stated that although hawkish, the central bank will be paying attention to financial conditions, perhaps opening up the door for potential loose behavior later.

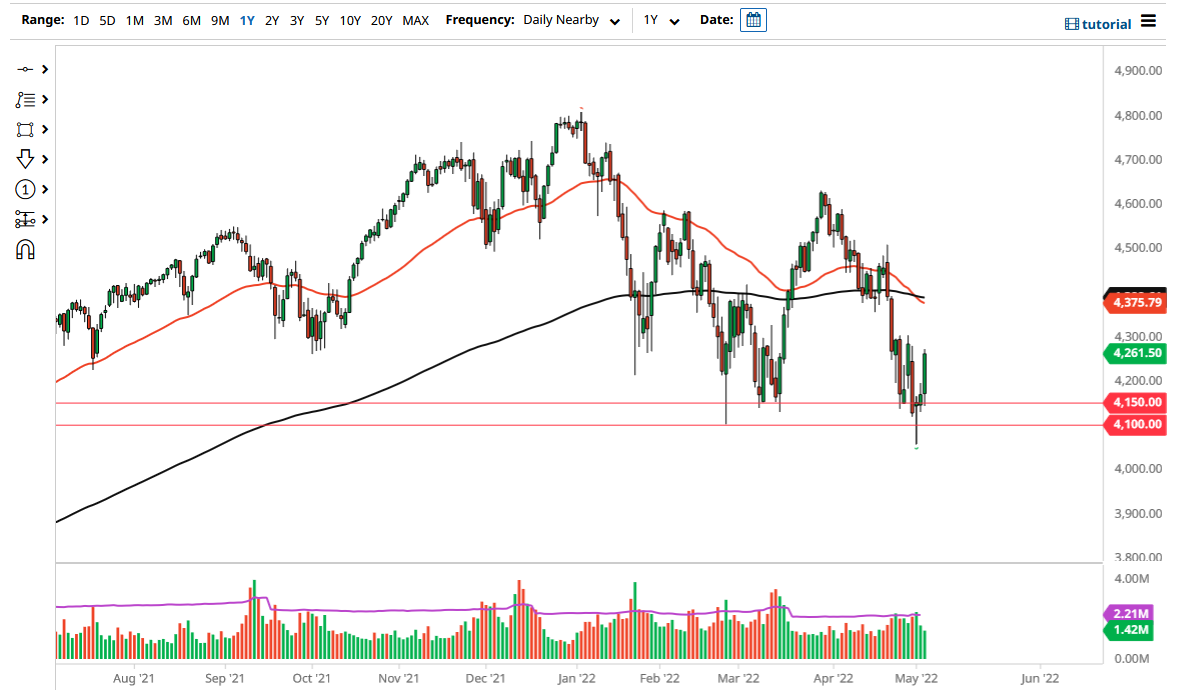

As Wall Street always goes out of its way to find a bullish narrative regardless, the reality is that they at least see the possibility of the Federal Reserve saving them. Whether or not they will is a completely different question of course, but at the end of the day, it does not really matter what the market thinks or what the reality is, because the only reality that matters is price. Price has rallied, and now it looks as if we are going to threaten the 4300 level just above. The 4300 level is an area that will cause a bit of resistance, so if we were to break above there it is likely that we will continue to see the market take off. At that point, it is very likely that we would see the 200 Day EMA eventually tested.

On the other hand, if we pull back then it is possible that we reach the 4150 level again to form some type of consolidation. Either way, the only thing that you can count on is volatility as the VIX continues to get thrown all over the place. I do not see that changing anytime soon, so therefore you need to be cautious about your position sizing, but it is obvious the buyers have come in to step up the pressure. Perhaps it is the fact that Powell was not ready to throw Wall Street under the bus, showing that the Federal Reserve still serves The Street over anything else, as he failed to suggest that they were going to get much more aggressive. Because of this, there was a huge sigh of relief and therefore we have had a nice relief bounce. Whether or not that sticks is a completely different question, so pay close attention to that 4300 level and whether or not we get a daily close above it.