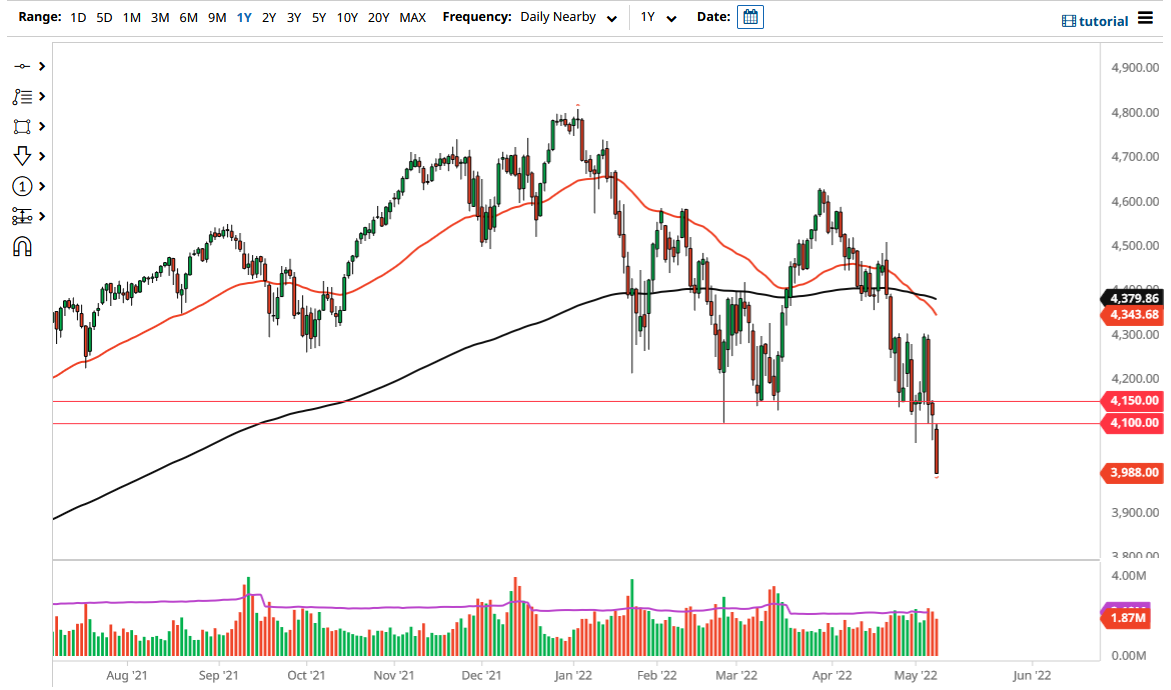

The S&P 500 gapped lower in the futures markets to kick off the trading week on Monday, opening up just below the 4100 level. By doing so, we started to see more negativity in this market as we have cleared a major support level, and now it looks like we are more likely than not going to see more carnage. If we remain below the 4000 level, I do anticipate that we have further to go. In the short term, we may see an attempt to recover, perhaps in a bit of a “short-covering rally.”

The fact is that the Federal Reserve is not in the business of support in the market anymore, so it is very likely that we will continue to see selling pressure. As long as the Federal Reserve governors are not day trading, they have no real interest in trying to protect the market until we get to a point where it starts to affect the real economy. As the stock market in the real economy has been disconnected over the last decade or so, this seems like a real stretch of the imagination.

At this point, it looks like any rally will be sold into, and with that being the case I have no interest in buying. In fact, we need to overcome the 4300 level before I would do that, so I do not see a situation where I will be buying in the short term. Yes, I would not be surprised at all to see this market bounce, but that bounce should offer yet another opportunity to get short of the market.

If you follow me often, you know I almost never short US indices because they are far too manipulated. That being said, the market has clearly shifted its attitude, so I think the “Fed put” is dead. The Federal Reserve is going to tighten, the US economy is going to go into a recession, and inflation is going to continue to be very nasty. The CPI print this week will be followed closely as well, which I do not have a lot of hope for.

Regardless, you do not chase the trade no matter what the direction is. Because of this, I will wait to see what happens near the 4100 level on some type of rally and then take advantage of it. Furthermore, you could even make an argument that the 4000 level will now offer quite a bit of noise.