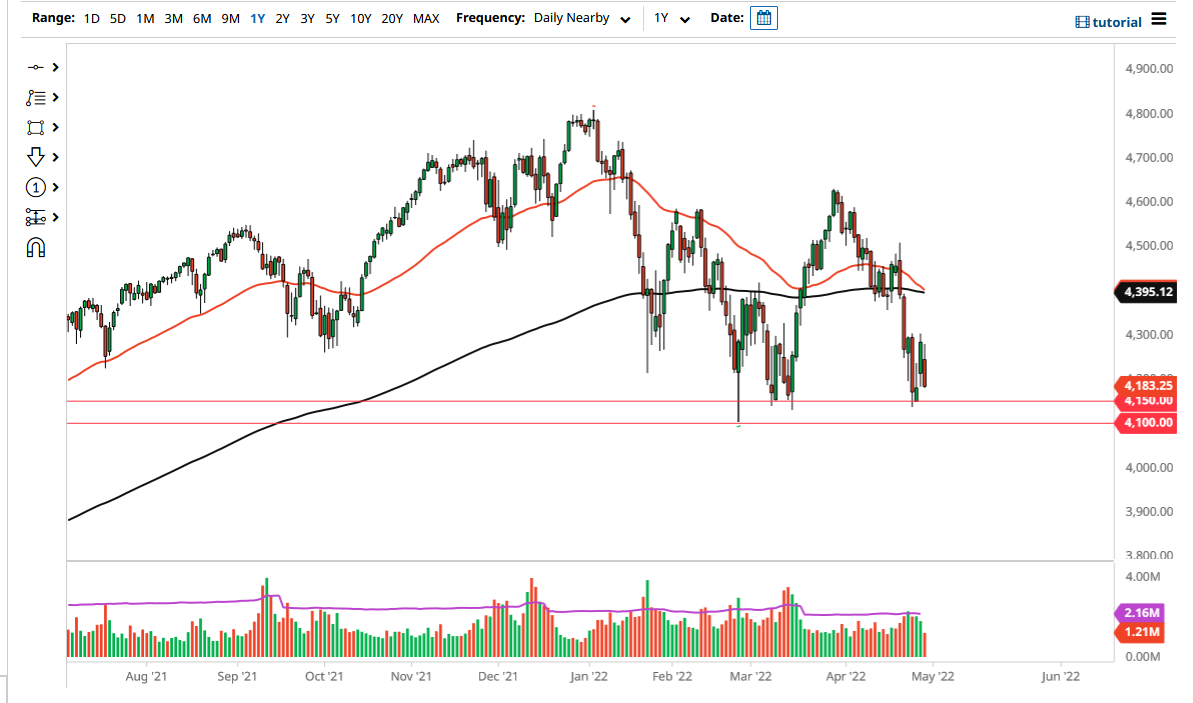

The S&P 500 gapped lower to kick off the trading session in the futures market on Friday but then turned around to fill that gap. After that, the market then fell rather significantly. The 4150 level underneath continues to offer support underneath, extending all the way down to the 4100 level. Keep in mind that the futures market had to deal with options expiration, but it also has been quite a bit of noisy behavior just waiting to happen.

Looking at this chart, if we were to break down below the 4100 level, then it is likely that we will continue to go down to the 4000 level, maybe even lower than that. This is a market that has been noisy as of late, but the 4300 level above has offered a bit of a ceiling. You should keep in mind that if we were to break above there, it would be a very bullish sign, perhaps opening up the possibility of a move to the 200-day EMA.

Speaking of the 200-day EMA, the 50-day EMA is sitting just above it and looking likely to break down through it. After all, the market would then kick off what is known as a “death cross.” This is a very negative signal, and longer-term traders do tend to look at it as a sell signal. That being said, it is normally a bit late, but this time it does have the added benefit of sitting just above the massive support that is so obvious in this chart. Because of this, I think it is probably only a matter of time before everybody would pile in.

The market is currently worried about the Federal Reserve and whether or not it will stay hawkish, which it probably will due to inflation. However, we have seen a lot of noise due to the fact that GDP numbers have been negative. Although we know that there are interest rate hikes coming soon, the question is how aggressive will the Federal Reserve end up being? Looking at this chart, we are in a small consolidation area of 150 points, something that we need to pay close attention to in order to trade in whichever direction we are ready to go in. The candlestick for the Friday session does look rather negative though.