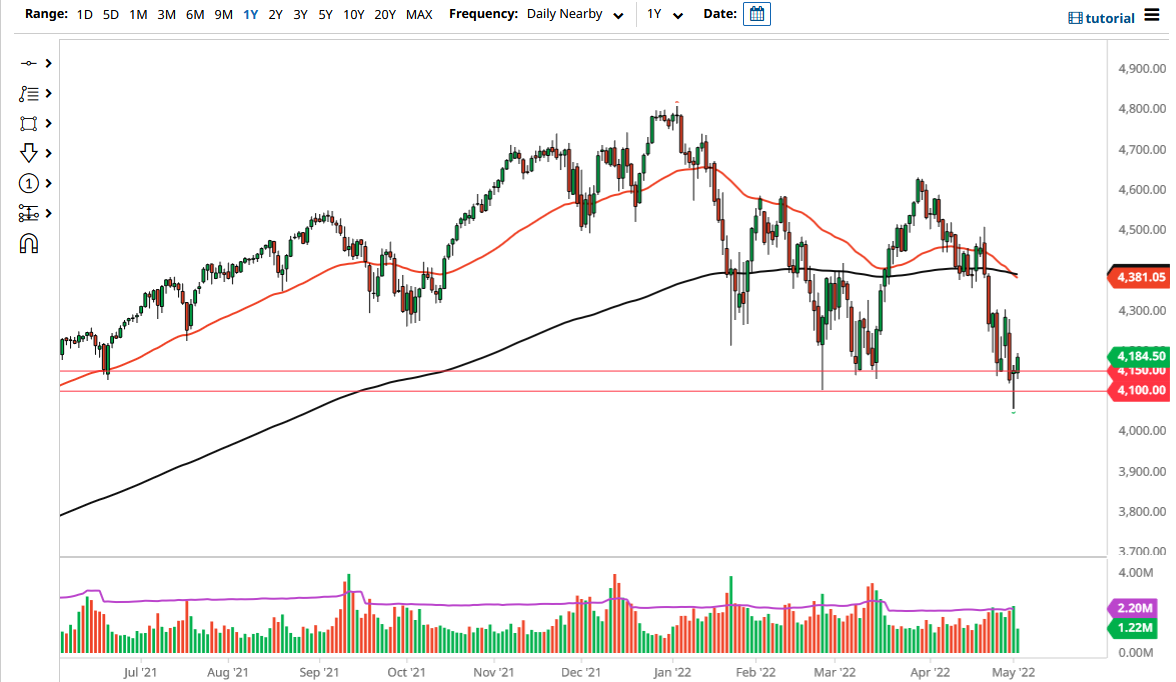

The S&P 500 rallied a bit on Tuesday to continue the upward pressure from the Monday low. As we have bounced this way, it does suggest that it is probably only a matter of time before we go higher, but it is very likely that the market will continue to focus on the Federal Reserve, and not anything else. After all, the Federal Reserve is the only thing that the stock market cares about right now, and with the FOMC meeting ending on Wednesday, it is very likely that we will continue to see a lot of volatility afterward.

After all, we will not only have an interest rate high, but we will also have the statement and press conference afterward that traders will be paying close attention to. Because of this, traders are trying to figure out just how hawkish the Fed will be, perhaps sending the market spiraling lower. If we were to see the Federal Reserve sound extraordinarily hawkish, that could be enough to kick the market down below the lows on Monday. It is worth noting that at the end of the day on Tuesday, we did start to see a little bit of selling pressure, so it shows just how tenuous this position is.

I believe at the end of the day on Wednesday we should have a lot more clarity as to where the markets are about to go, so pay close attention to where we close. The size of the candlestick shows that there is less than strong enthusiasm, so I think it is probably more likely than not that we will continue to see a lot of back and forth between now and the Fed statement/press conference.

On the upside, I see the 4300 level as a major barrier that will be difficult to overcome. It is not until we break above the level on a daily close that I think we can get truly bullish. In the short term, is very likely that we go back and forth, but again, if we were to break down below the hammer from the Monday session, then it is likely that we could go down to the 4000 handle, perhaps even lower than that. I would be very cautious between now and closing on Wednesday.