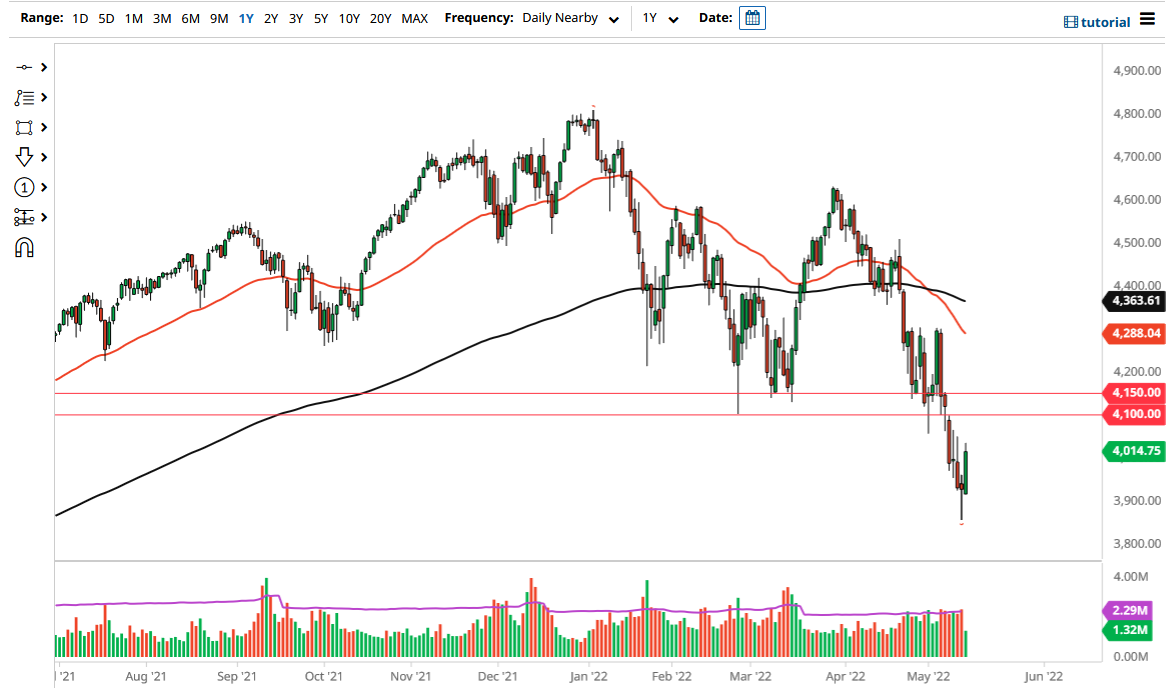

The S&P 500 has rallied significantly in the futures market on Friday as we headed into the weekend. The question at this point is going to be whether or not the market can keep up this momentum. Even if it does, it is possible that we could see the market reach to the 4100 level where we should see plenty of resistance. The area between 4100 and 4150 should continue to be very noisy, as it was massive support previously.

A rally towards that area should attract a lot of “market memory” could come into the marketplace. Any sign of exhaustion in that area will be jumped upon, just as the area all the way to the 4300 level could be resistant. The 50 Day EMA is slicing through the 4300 level and falling. It is not until we clear all of that that I would consider buying this market, and would take a massive amount of momentum to make that happen, and more importantly, some type of fundamental change. At this point, it does not look like things are going to change quickly enough to make that a reality. I suspect that a lot of the noisy behavior will be difficult to overcome, and I also believe that the rally is more likely than not going to be a short-covering rally heading into the weekend. After all, there are a lot of profits for the short-sellers out there if they are willing to take them.

The 3900 level underneath is massive support, just as the hammer shows from the Thursday session. If we break down below the bottom of the hammer, then it is likely that we go much lower. I suspect that we need a little bit of a relief rally in the short term, but that should only reload shorts. After all, the interest rates are still very strong, and of course, there are a lot of concerns when it comes to the Federal Reserve tightening going forward. We also have to worry about inflation, which of course works against the economy and therefore it is likely that we will see companies struggle longer term. Simply looking for signs of exhaustion will be the best way to take advantage of this move that is almost certainly going to happen.