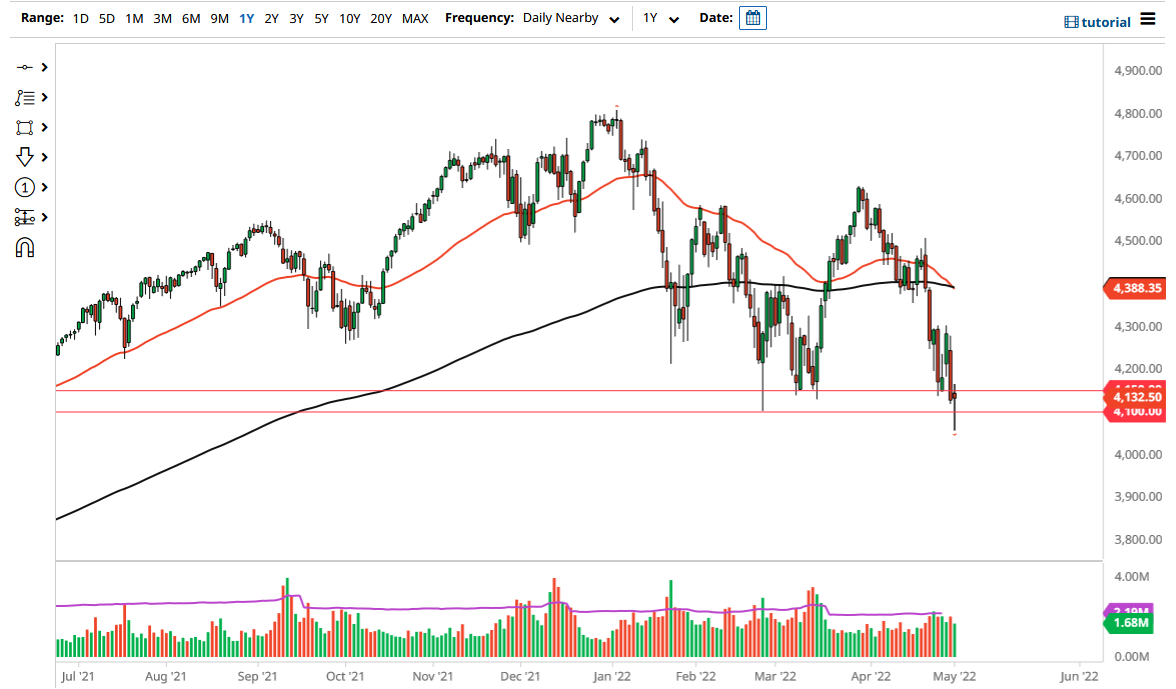

The S&P 500 initially fell rather hard on Monday, breaking down below the 4100 level. That being said, at the very end of the day there was a suspicious surge much higher. This is widely attributed to the so-called “plunge protection team.” (Whether or not that is a real thing is still open for debate, but I am looking at you, New York Fed.)

By forming a hammer, it does suggest that we may get a little bit of a bounce, but it is difficult to imagine a scenario in which we are suddenly going to turn around and take off to the upside. Most traders are probably focusing on the Federal Reserve and what the statement will say on Wednesday, as although people are expecting a 50-basis point hike, the real question is going to be whether or not the Federal Reserve looks as if it is ready to go even more aggressive when it comes to tightening. At this point, I think that the market is reading a bit of a fever pitch, but obviously, we will have to wait to see what happens at the press conference and press statement after the announcement.

If we break down below the bottom of the candlestick for the session on Monday, then it is likely that we will threaten the 4000 level. Breaking down below the 4000 level will open up the possibility of a massive selloff. At that point, I think that we would get a massive unwind in the long positions. At this juncture, you should pay attention to the fact that the “death cross” has just formed. Ultimately, a lot of longer-term traders will pay close attention to this, perhaps starting to get aggressive again. Nonetheless, the Federal Reserve and the inflation concerns out there will continue to weigh upon the S&P 500, so I do think that any rally at this point in time will more than likely offer a selling opportunity. In fact, it is not until we break above the 4300 level that I would be impressed enough to get long of this market. After the FOMC statement and press conference, we may have a different set out but right now you still have to assume that things are pretty pessimistic.