Today’s USD/JPY Signals

Risk 0.75%.

Trades may only be entered before 5pm Tokyo time Tuesday.

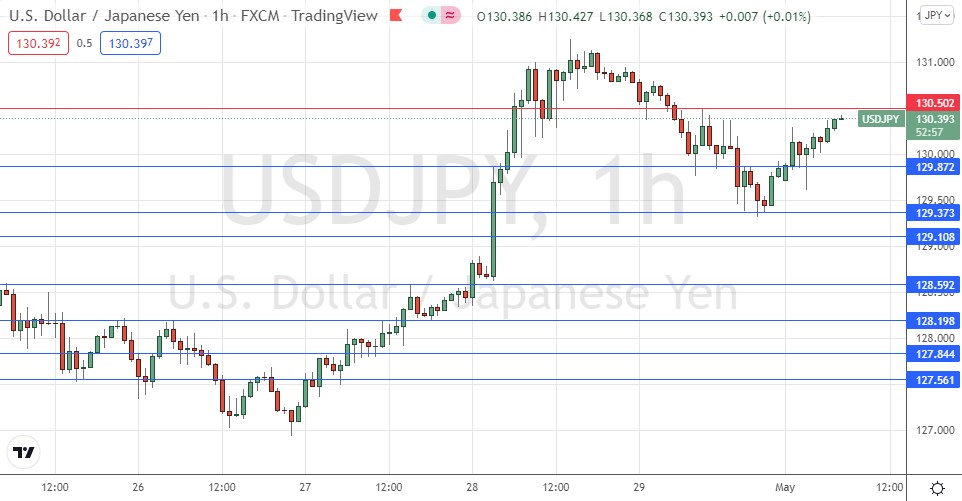

Short Trade Idea

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 130.50.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 30 pips in profit.

- Take off 50% of the position as profit when the price reaches 30 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 129.87, 129.37, or 129.11.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 30 pips in profit.

- Take off 50% of the position as profit when the price reaches 30 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/JPY Analysis

This currency pair is undergoing a rare and very strong bullish trend. It has risen for each of the past 7 weeks and has appreciated in value by well over 10% during this period, which is a large move in the Forex market.

The price rose to reach a new 20-year high last Thursday at ¥131.24, and after making a deep bearish retracement on Friday, it is now rising again.

There is clearly residual bullish momentum and a strong long-term bullish trend, which would be foolish to ignore. The best opportunities are highly likely to be on the long side until we see some more bearish price action, and we have not really seen that yet.

The price has been rising since about halfway through Friday’s New York session, continuing to advance during Monday’s Asian session. The price action seems to have printed new higher support at ¥129.87 although the exact level of that support does look uncertain.

The price is now close to the resistance level at the half-number of ¥130.50. I think that this will be today’s pivotal point – if the price can get established above ¥130.50 then we are likely to see a test of the 20-year high at ¥131.24. If the price instead turns bearish at ¥130.50 then we are going to see a move down to about ¥129.11 at least.

I will prefer to take a long trade than a short trade, from a bullish bounce either at ¥129.87 or from a retest of ¥130.50 from above after the price gets above that level.

Concerning the USD, there will be a release of ISM Manufacturing PMI data at 3pm London time. There is nothing of high importance scheduled today concerning the JPY – it is a public holiday in Japan.