It is settling around the level of 127.85 at the time of writing the analysis, waiting for anything new. Despite the recent performance, the US dollar is still the strongest with expectations of raising US interest rates strongly throughout 2022 to contain the largest inflation rate in the country in 40 years.

In this regard, US Federal Reserve policymakers, including Chairman Jerome Powell, repeatedly indicated in May that the bank was likely to raise the US federal funds rate by another 50 basis points at each of its next meetings, but it did not.

US inflation results will be useful in determining whether the Fed ultimately needs to raise interest rates more than is generally seen as likely, which is a big part of why the April core PCE price index reading on Friday is so important to the dollar.

The core PCE price index is the Fed's preferred measure of price pressures, and therefore will do little to help the dollar if it shows inflation abating in both months.

Amid a torrent of statements by US Federal Reserve policy officials. Atlanta Fed President Rafael Bostik said policy makers may pause interest rate increases in September after raising half a point at each of their upcoming meetings. "I have a basic view where I think a stop in September might make sense," Bostick told reporters yesterday after a speech to Rotary Atlanta. “As we get through the summer and think about our place in terms of politics, I think a lot of it will depend on the dynamics on the ground that we're starting to see. My motto is observation and adaptation.”

Bostick reiterated that he supports Governor Jerome Powell's plan to raise US interest rates by half a point at the FOMC meetings in June and July, adding the warning that a surprise rally in rates may warrant more aggressive action. Inflation was near its highest level in four decades and at rates more than three times the central bank's 2% target.

"I'm at 50 basis points as long as the economy progresses as I think it will go," Bostick added. And “if inflation starts moving in a different direction than it is now, I would be open to moving more aggressively. I want to make it clear that nothing is off the table. As the months go by, we will see how it goes.”

Bostick also said he expects inflation to be in the "high 3%" range at the end of the year, with a lot of uncertainty around the outlook. Economic growth is expected to be higher than the general trend for this year. Bostick added that recent moves in financial markets, including a sharp drop in stocks last week, have been consistent with the Fed's goal of fiscal tightening. There have been few signs on the real side of the economy that the economy is slowing since the Fed began rate hikes in March.

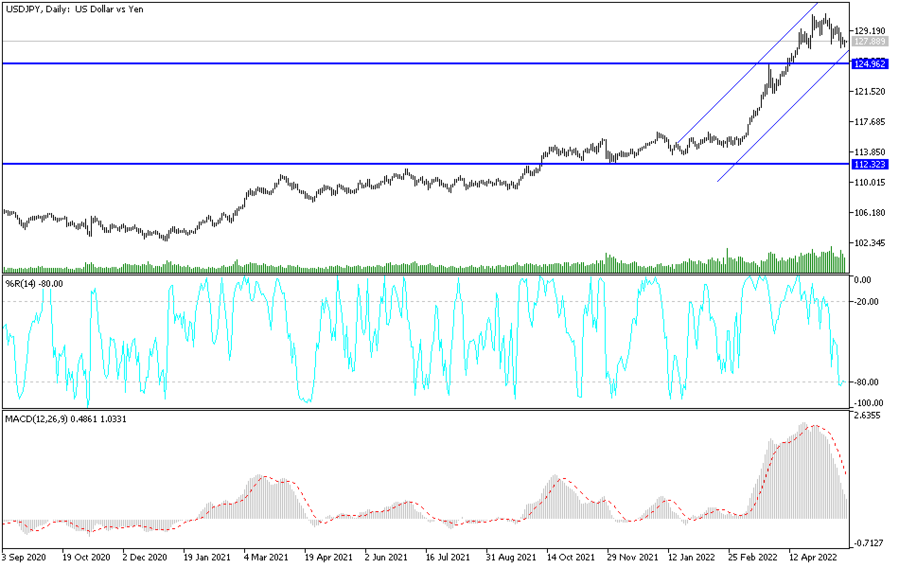

According to the technical analysis of the pair: On the daily chart below, it seems clear that the bears are currently controlling the path of the USD/JPY currency pair. Their control of the trend will increase if the currency pair moves towards the support levels 126.80 and 125.00, respectively. From the last level, it is preferable to think about buying the currency pair, as expectations of a US interest rate hike are still strong and will eventually support the US dollar. On the other hand, the bulls' control over the trend will be strengthened if the currency pair moves towards the 130.00 psychological resistance level again.

The USD/JPY currency pair will be affected today by the extent to which investors take risks or not, as well as the reaction from the expected statements of US Central Bank Governor Jerome Powell and the announcement of the results of US economic data, the manufacturing PMI, services, and US new home sales.