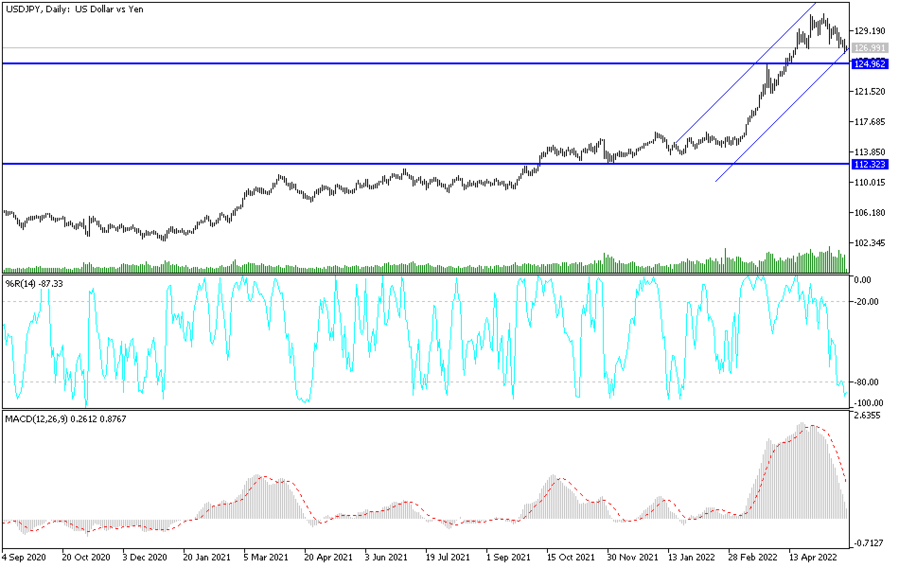

By simply observing the performance of the USD/JPY currency pair on the daily chart below, it seems clear that the currency pair breached the ascending channel. It pushed it towards its highest level in 20 years, as it fell to the 126.35 support level, the lowest in a month, before settling around the 127.00 level at the time of writing the analysis, before announcing the contents of the minutes of the last meeting of the US Federal Reserve.

Commenting on the performance of the US dollar. Just one week after the DXY rose to 105, BNY Mellon says that the strength of the US dollar is pending for the time being and “looks like it is ready to continue rising against most currencies”.

The dollar's decline at the time released pressure on the British pound, the euro and the Japanese yen, both of which recovered from multi-year lows.

Why did the dollar's rise stop?

BNY Mellon tells clients in its regular daily currency briefing that the expected interest rate differentials between different global central banks have stabilized for the time being, halting the bullish trend of the US dollar. The dollar benefited from a massive increase in US interest rate hike expectations thanks to the Federal Reserve's guidance that a series of 50 basis points of rate hikes lie ahead. But this is now restricted in the value of the dollar and other central banks are catching up; Nothing more than the European Central Bank (ECB).

ECB Governing Council members were preparing the market for a rate hike in July, but it was ECB President Christine Lagarde's intervention on May 23 that fueled the rally in July. In an unusual blog post, she said, a July rally would be appropriate while it is now very likely another rally by September.

As a result, the Euro rose sharply, and economists raised the ECB interest rate files accordingly.

Can the dollar setback continue?

However, the dollar did not appreciate as BNY Mellon says as analysts do not believe that the asset market volatility is complete, and this volatility is "usually a friend of the dollar." Moreover, the market will start pricing in higher US yields as the Federal Reserve is expected to raise US interest rates. Accordingly, the bank’s analyst says, “The next phase of the dollar’s rally may take some time to materialize. And we think it's likely to be driven by another dose higher in the spreads."

"We've been on the record that the Fed's current pricing (which raised the fed funds rate to just above 3% late next year) is pretty shallow," he adds. Indeed, BNY Mellon economists believe the US faces a persistent inflation problem heading into the second half of this year and into 2023, which will force a rethink of the course of policy. And they see the fed funds rate at 4% by this time next year, which is somewhat ahead of the market (current peak of 3.05% which is lower than it was as of May 06).

According to the technical analysis of the pair: The USD/JPY currency pair has breached the ascending channel, continuing its losses to the support level 124.95. Technical indicators will move towards oversold levels. I still prefer buying the currency pair from every descending level, as the variation in economic performance and the future of tightening central banks policy The world will be in favor of the US dollar in the end.

According to the performance on the daily chart, the resistance levels 128.20 and 130.00 will be important in returning strongly to the vicinity of the last bullish channel for the currency pair. The US dollar will react strongly today with the announcement of the minutes of the last meeting of the US Federal Reserve.