Fed officials agreed at their meeting this month that they need to raise US interest rates by half a point in their next two meetings and continue with a set of aggressive moves that would leave them the flexibility to change gears later if necessary. Despite that, the price of the USD/JPY currency pair remained stable bearishly around the support level 127.25 after lower losses to the support level 126.35 this week, amid strong selling to correct from its highest level in 20 years.

Highlighting the "strong commitment and determination" of all policy makers to restore price stability, the minutes of the May 3-4 meeting, released yesterday, showed that officials are concerned about financial conditions as they prepare to raise US interest rates further. In the weeks since the meeting, financial market volatility has increased as investors fret about recession risks, though investors cheered as they digested the report's less hawkish tone than feared.

The minutes point to uncertainty about potential fault lines in financial markets as well as the price level that would hamper demand as officials battle the hottest price pressures in 40 years. Signs of a possible move to restrictive policy also suggest that officials will not stop until inflation is on a compelling path back to their 2 per cent target. It is a strategy that indicates that policy will be more data dependent after the Fed meetings in June and July.

US stocks rose after the minutes' announcement, while Treasury yields fluctuated, and the dollar pared its gains. Markets continued to show investors seeking 100 basis points for rate hikes over the next two meetings. According to the meeting minutes, “most participants felt that 50 basis point increases in the target range were likely appropriate in the next two meetings” and “many participants felt that expediting the removal of policy consensus would leave the committee in good standing later in the year to assess Effects of policy constancy and the extent to which economic developments justify policy adjustments.

The minutes stated that Fed officials "indicated that a restrictive policy stance may become appropriate depending on the evolving economic outlook and risks to the outlook." They added that the demand for labor continued to exceed the available supply.

Concern about the outlook for corporate earnings and higher interest rates has also caused turmoil in financial markets. The S&P 500 is down about 17 percent year-to-date, while the two-year US Treasury is at 2.5 percent versus about 0.8 percent in early January.

At the meeting, officials finalized plans to allow their $8.9 trillion balance sheet to begin to shrink, putting additional upward pressure on borrowing costs. As of June 1, Treasury holdings will be allowed to decline by $30 billion per month, with increases rising to $60 billion per month in September, while mortgage-backed securities holdings will shrink by $17.5 billion per month, rising to $35 billion.

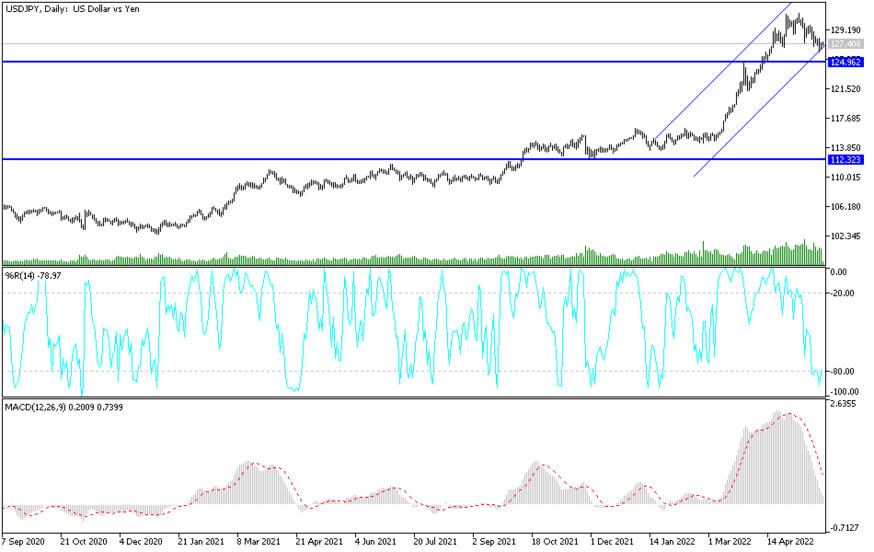

According to the technical analysis of the pair: The USD/JPY currency pair has breached the ascending channel, continuing its losses to the support level 124.95. Technical indicators will move towards oversold levels. I still prefer buying the currency pair from every descending level, as the variation in economic performance and the future of tightening central banks policy The world will be in favor of the US dollar in the end.

According to the performance on the daily chart, the resistance levels 128.20 and 130.00 will be important in returning strongly to the vicinity of the last bullish channel for the currency pair. The US dollar will interact strongly today with the announcement of the US economic growth rate, in addition to the announcement of the number of weekly jobless claims, and the reaction of investors to what was stated in the minutes of the last meeting of the Federal Reserve.