Although there was limited trading, the price of the USD/JPY currency pair moved at the beginning of this week’s trading between the support level 126.85 and the level of 127.82. It settled around the level of 127.60 at the time of writing the analysis. The price of the US dollar fell for the third day in a row against the major currencies, as havens lost their attractiveness amid a slightly improved mood. Treasury notes were not traded due to the US Memorial Day holiday.

Currently, investors are wondering if the bottom of the sell-off is coming soon as investors have been buying on the dip after one of the worst beginnings of the year for stocks. However, there remains a wall of fear from hawkish global central banks underlining fears of a recession, spiraling food inflation from the war in Ukraine, and the shutdown of China hampering economic activity.

Meanwhile, German inflation hit an all-time high, adding to the urgency of the European Central Bank's exit from crisis-era stimulus after figures out of Spain beat economists' estimates. The reports came 10 days before a crucial European Central Bank meeting where officials are set to announce the completion of large-scale asset purchases and confirm plans to raise interest rates in July for the first time in more than a decade. Financial markets bet on a 113 basis point increase by the end of the year, an increase of three basis points since Friday. German bonds maintained declines, with benchmark 10-year bond yields up eight basis points at 1.05 percent.

Investors and markets in general will look to US jobs numbers later this week to gauge the Fed's hawkish path as it seeks to rein in inflation. Meanwhile, the Fed is expected to start shrinking its $8.9 trillion balance sheet from Wednesday.

For his part, Federal Reserve Governor Christopher Waller said that he wants to continue raising interest rates in steps of half a percentage point until inflation falls back towards the US central bank's target. "I am in favor of a policy tightening of another 50 basis points for several meetings," he added, in remarks prepared for delivery in Frankfurt. And "in particular, I won't take 50 basis points off the table until I see inflation drop near our 2 percent target."

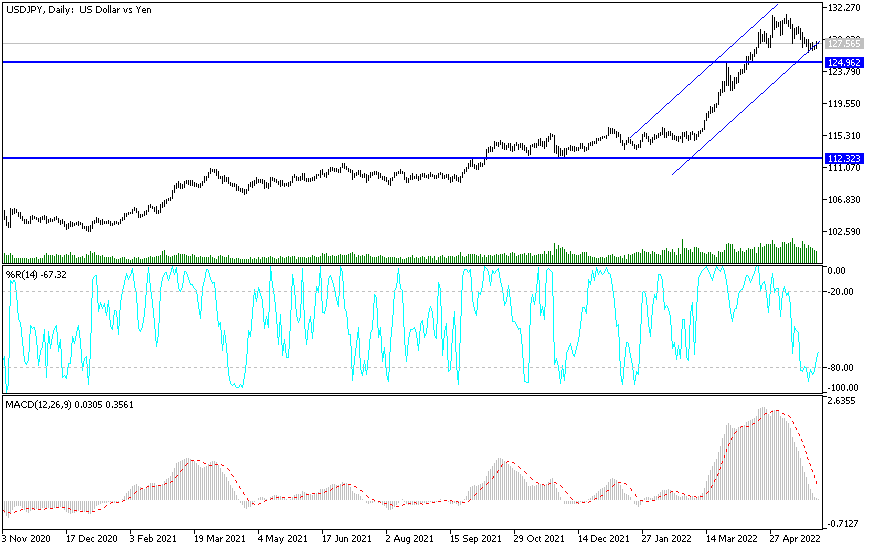

According to the technical analysis of the currency pair: The price of the USD/JPY currency pair is still moving within a recently formed bearish channel on the daily chart. The bears will increase the control of the trend if the currency pair moves towards the support levels 126.50 and 125.30, respectively. On the other hand, the current channel will end by returning to the resistance levels 128.85 and 130.00, respectively.

I expect the dollar-yen rate to remain in narrow ranges until the US jobs numbers are released by the end of the week.