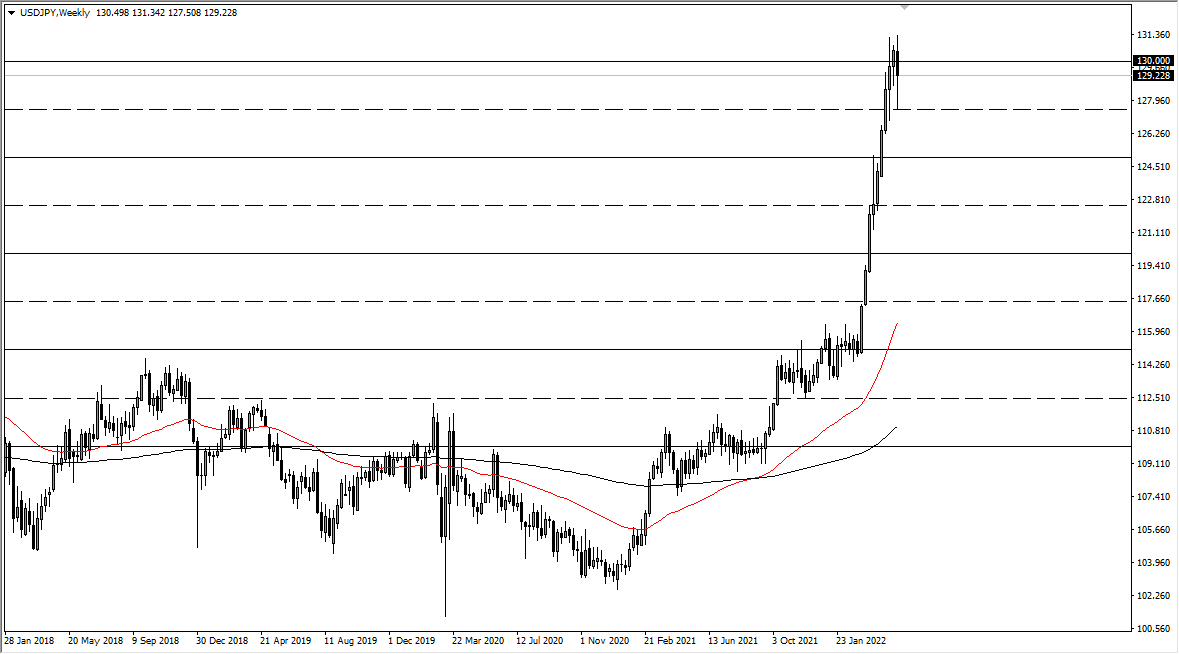

EUR/USD

The euro broke significantly to the downside over the course of last week, slicing through the 1.05 level. We broke down below the 1.04 level but then turned around to show signs of life on Friday. Regardless, I think that we will sooner or later get a bounce that gets sold into, especially near the 1.05 handle, and then the 1.06 level. This is a market that is negative for a reason, and until something fundamentally changes between the Federal Reserve and the ECB, I will be looking for rallies that I can short. Ultimately, this is a market that could very well go down to parity until the Federal Reserve loosens its monetary policy.

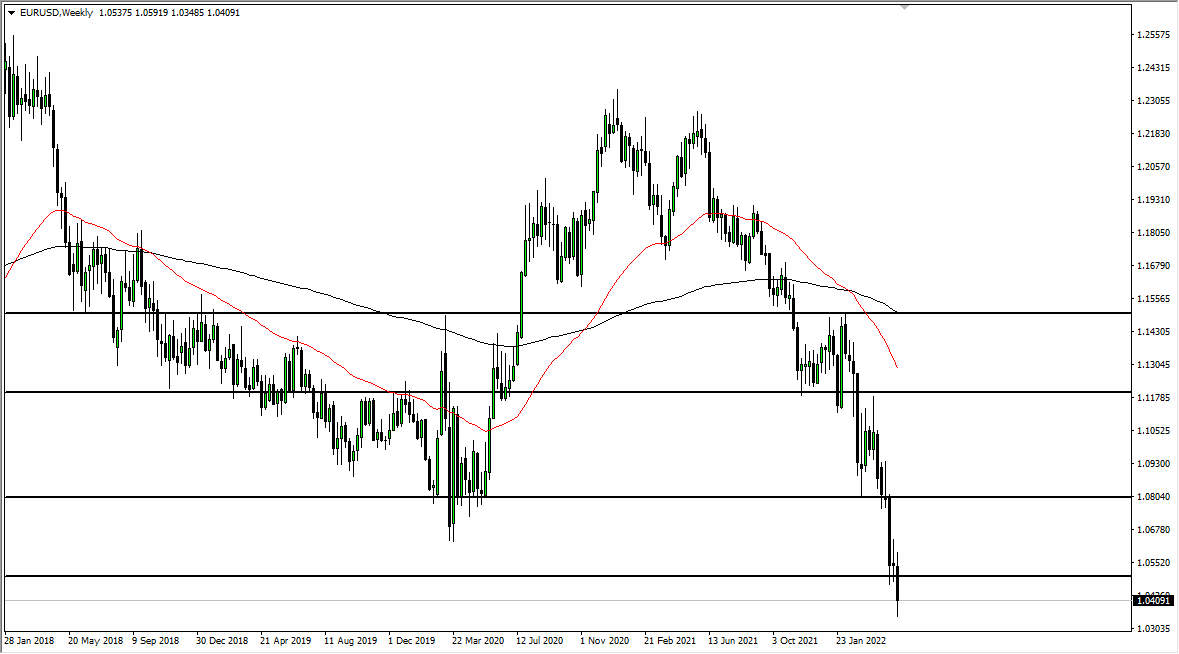

GBP/JPY

The British pound has bounced hard at the end of the week, as it looks like we are trying to stay above the previous resistance. That being said, the market looks as if we are ready to go higher, but we need to get above the ¥160 level. If we break above the ¥160 level, then it is likely that we will go looking to the ¥165 level. On the other hand, if we turn around and break down below the ¥157 level, it is likely that we could go looking to the ¥155 level given enough time. You should also keep in mind that risk appetite has a major influence on what happens here as well.

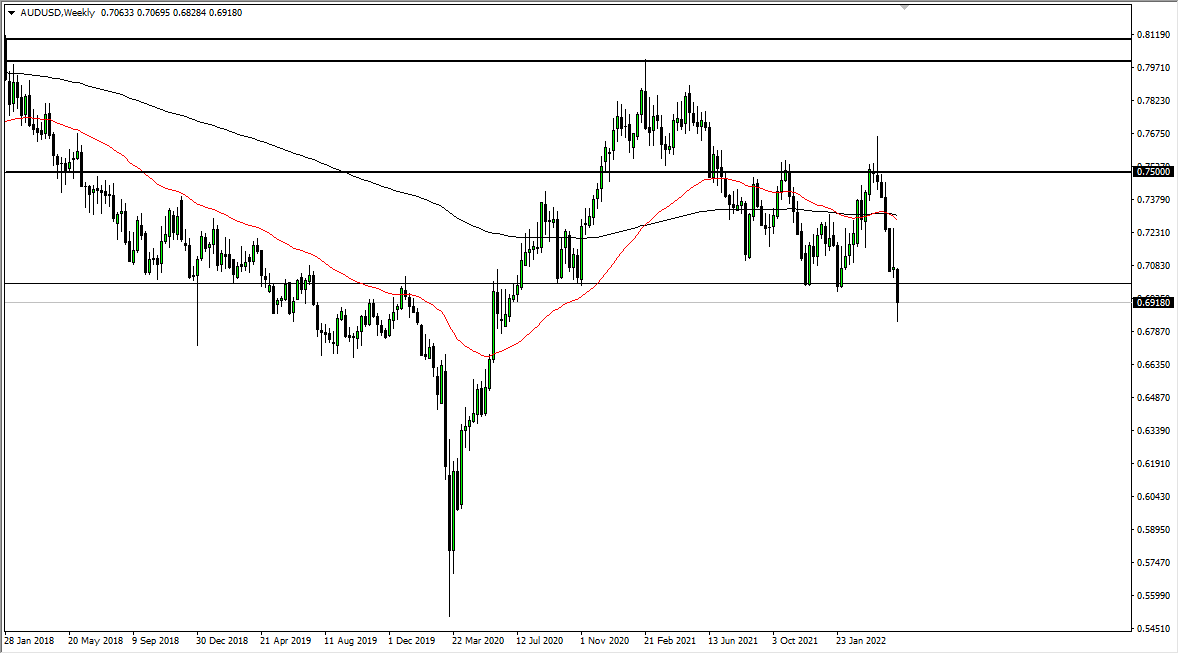

AUD/USD

The Australian dollar broke through significant support during the week, and it looks to me as if we are more likely than not going to go lower. Keep in mind that the Australian dollar is highly sensitive to commodity markets, and therefore global growth. The 0.70 level above should offer resistance as it has been that massive support we have been paying attention to. Because of this, I will be looking for signs of exhaustion anywhere near that area. On the downside, the 0.68 level is an area that could offer a little bit of support.

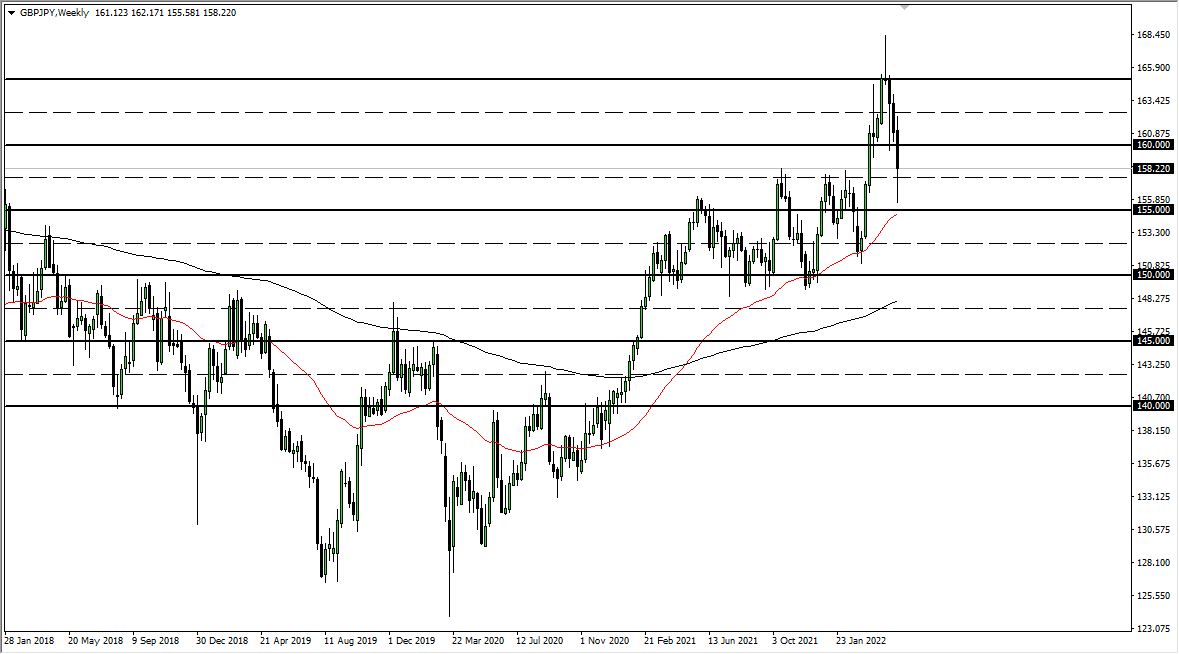

USD/JPY

The US dollar has fallen hard during the week to reach the ¥127.50 level. However, we have turned around to show signs of life again, and now we have ended up forming a bit of a hammer. That being said, the ¥130 level continues to be a bit of an issue, so I think we are more likely than not going to continue to see a lot of sideways trading, as we need to digest some of the excess froth from the parabolic move higher.