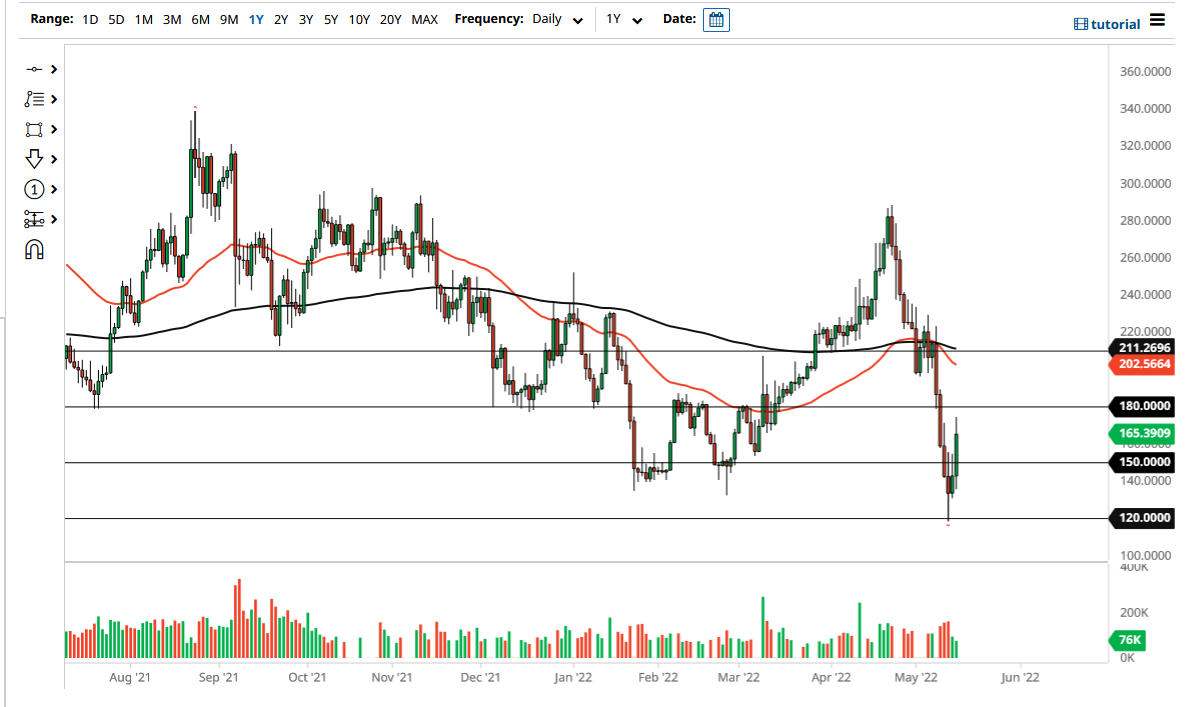

Unlike most of the crypto market, Monero took off to the upside on Monday, gaining 15%. That being said, we still face a lot of resistance above, as the $180 level should continue to offer a bit of resistance. We did pull back from there, so it does suggest that perhaps this rally will be somewhat short-lived. After all, you need to keep in mind that Monero is a much smaller market than some of the others like Ethereum or Bitcoin, so a little bit of a volume surge could come into the picture.

Furthermore, you should also pay attention to the fact that the volume was lower than usual, meaning that the market was less liquid than usual. Ultimately, I think the market is one that you would continue to fade going forward on signs of exhaustion, with the $180 level being an obvious place where we have seen a lot of trouble. We have recently seen the 50-day EMA break below the 200-day EMA, forming the so-called “death cross.”

This is a market that will continue to follow the rest of crypto, although occasionally the lack of liquidity could make it change a bit. The candlestick is rather bullish, but it is probably only a matter of time before the massive selloff continues to attract resistance. The market had fallen apart quite drastically, and in a situation like this, it makes sense that we would see sellers come back in every time there is the slightest hint of trouble.

If the rest of crypto takes off, then it is possible that Monero might have an oversize move, but ultimately this is a situation where these altcoins will continue to be negative, at least until we see those bigger ones take off to the upside. The US dollar probably needs to stop as well, because as long as the US dollar continues to strengthen, it means that people are running away from risk, and you have to keep in mind that the price of Monero is quoted in those same US dollars, so the stronger that the greenback is, the less it will take to buy Monero. Fading rallies should continue to be the case.