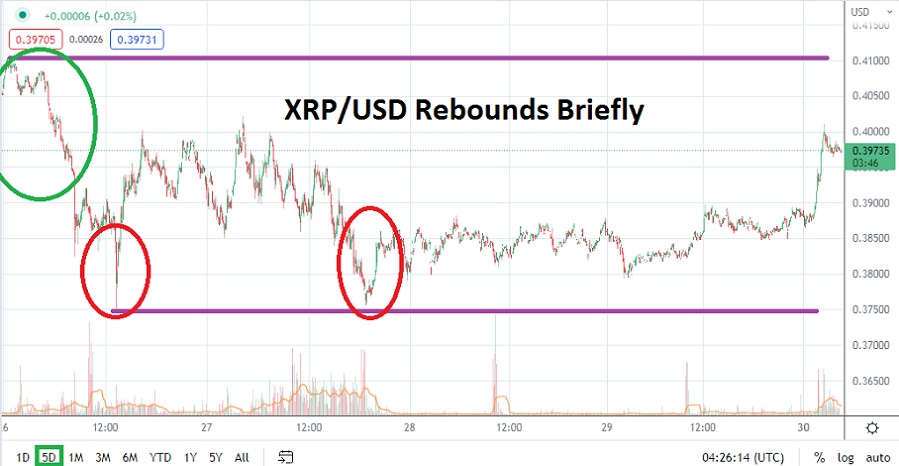

XRP/USD is trading slightly above the 39 and half cents mark as of this writing, having achieved a bounce higher since late last night. Early on Sunday morning, XRP/USD was trading below the 38 cents ratio. The move higher since yesterday may be encouraging for optimistic bullish speculators who continue to look for rays of hope in the cryptocurrency markets.

However, skeptics cannot be blamed for simply believing the movement higher that has been seen will see a return of gravity. Ripple did in fact climb over 40 cents briefly this morning, which tested highs not seen since the 27th, but the slight downturn since hitting the short term high has not proven long lasting. The broad cryptocurrency market has shown some resilient movement this morning as the major digital assets have fought off of lows.

The current resistance level of 40 cents may become important in the coming hours. If this level continues to act like a hurdle that is too hard to jump over and maintain value above, it could be considered a sign additional headwinds will start to blow again for XRP/USD. The bearish trend remains in full effect and while hopeful bullish traders cannot be blamed for wanting to see a strong reversal higher that is sustained, betting on this accomplishment could prove to be costly if choppy conditions persist.

Bullish traders who insist on looking for upside may want to use current support levels as a lynchpin to ignite their short term long positions while aiming for 40 cents. The 39 and a half, and perhaps the 39 and a quarter cents ratios could be a place to try and look for slights reversals. However if the 39 cents mark were to suddenly prove vulnerable it will likely mean another test of lower depths are about to be explored again. XRP/USD remains near rock bottom long term prices.

For traders who remain sellers and are looking for downside, short term wagers are encouraged too within the present trading landscape. Stop loss orders are urged and conservative leverage is recommended. If XRP/USD was to break the 39 cents mark below and starts to show price velocity, it is the 38 cents level which would need to be keenly watched. If prices are not able to be sustained above 38 cents in XRP/USD it would be a negative trading signal technically.

Ripple Short-Term Outlook

Current Resistance: 0.40150

Current Support: 0.39295

High Target: 0.40880

Low Target: 0.38140