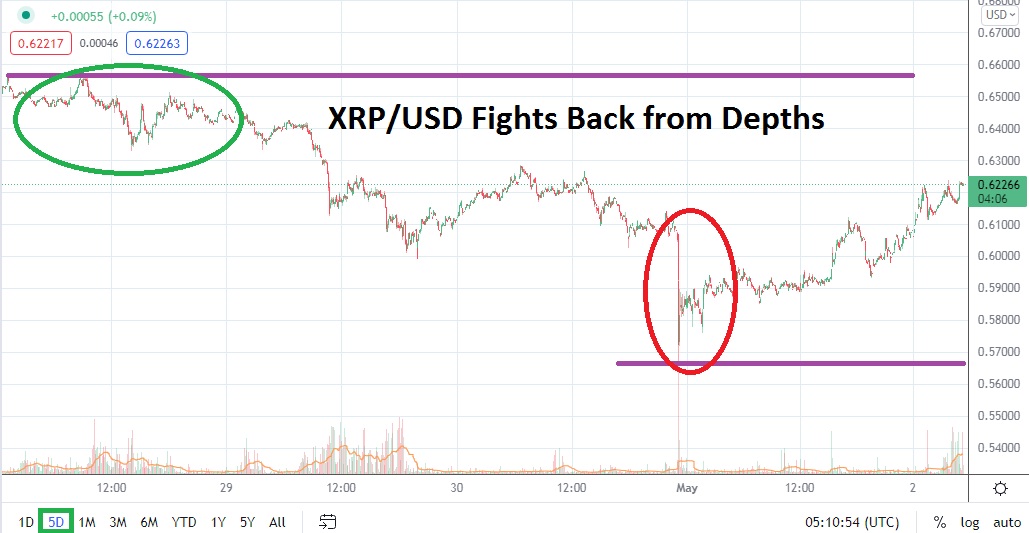

XRP/USD is trading near the 62 and a quarter cents ratio as of this writing. This past Saturday saw XRP/USD slip to a value below the 57 cents level, a mark that had not been seen since the last week of January. The broad cryptocurrency market remains in a bearish mode and Ripple has certainly been caught within the tide of negative sentiment.

XRP/USD traded near the 62 and half cents level on the 23rd and 24th of February. Traders need to understand the price range XRP/USD is now traversing hasn’t sincerely been fought over since the last week of January in a sustained manner. If XRP/USD is not able to climb higher near term and remains under the 62 and half cents juncture, this could create additional fragile behavioral sentiment among traders.

If support near the 62 cents mark proves vulnerable, traders cannot be blamed for targeting lower values with selling positions. XRP/USD proved this weekend that it is capable of moving fast and the spike lower on Saturday mirrored results seen in other major cryptocurrencies as fear grew. Some speculators may want to claim that profit taking was a cause for the sharp decline this weekend, but the downwards trend in XRP/USD and other major cryptocurrencies are testing vital support across the crypto landscape.

The notion that XRP/USD has now completely fallen through levels which were believed to be important support as the digital asset created a bullish trend from late February until late March is a poor indicator. The total reemergence of bearish momentum and failure of support levels to hold back selling, signals further declines could be demonstrated near term. If the 62 cents level is brushed aside, aiming for support near 61 and half cents seems almost reasonable. Volatility may continue to be exhibited in XRP/USD and traders need to use their risk management carefully.

Traders who want to pursue higher momentum and believe reversals will be demonstrated should not be overly ambitious regarding their targets. XRP/USD has seen a steady loss of value the past couple of weeks and its price velocity this weekend was fast. Some traders may believe the worst of the selling is over, but speculators who decide to wager on higher moves should remain cautious.

Ripple Short-Term Outlook

Current Resistance: 0.62820

Current Support: 0.61750

High Target: 0.64390

Low Target: 0.58550