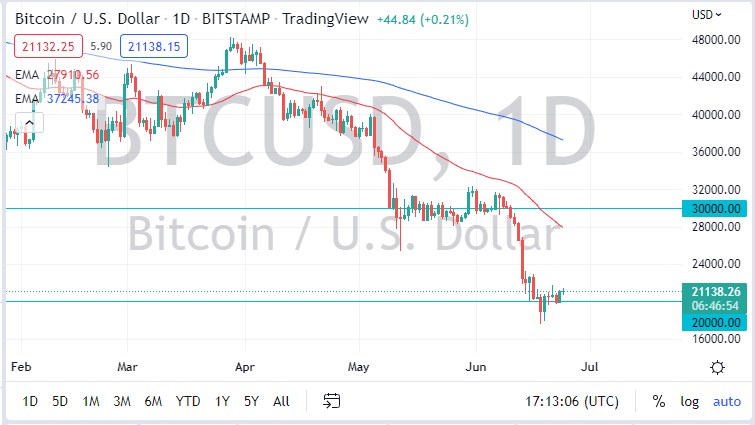

The Bitcoin market did very little on Friday, as we are hanging about the $21,000 level. The $21,000 level is the top of a short-term consolidation area, and I think it would not be surprised at all to see a little bit of a pullback. A pullback from here could open up the possibility of a move to the $20,000 level, maybe even down to the $18,000 level. It’s interesting to see that Bitcoin is underperforming Ethereum, but at this point both of them look rather weak.

Even if we break higher, I don’t see a situation where we would need to see a long position being put on, because I think at this point you could get a move all the way to the $30,000 level and still classify as a “bear market rally.” The 50-day EMA is sitting at the $28,000 level and sloping lower, so I think it offers a significant amount of area to start shorting from, and really, it’s not until we see a complete change in the overall attitude before we could get long of Bitcoin. The risk appetite out there is miserable, and although a lot of people who are long-term holders are looking at this as an opportunity to pick up value, the reality is that you are more likely than not going to have a lot of patience to see longer-term gains.

I do think that we probably have further to go to the downside, but the occasional bear market rally makes sense. What I’m hoping to see is some type of plateauing at a much lower level so that I can start to accumulate Bitcoin over the longer term. Ultimately, the market is one that has a long way to go in both directions, and I think it’s only a matter of time before we get an opportunity to pick up Bitcoin at lower levels. The markets will be very noisy, but there is a long way to go before people are comfortable buying Bitcoin for a bigger move. The market at this point in time is one that if you are talking about building up a position, you should do so slowly, because we could have a meltdown at any moment, or could turn around.